The global active pharmaceutical ingredients and high potency API industry size stood at USD 233.31 billion in 2021 and is poised to observe a CAGR of 6% from 2022 to 2030, according to the "Active Pharmaceutical Ingredients and High Potency API Industry Data Book, 2023 – 2030," published by Grand View Research. Demand for the medicine that produces the intended therapeutic effects has witnessed an upward trajectory among pharmaceutical drug companies. The notable penetration of oncology drugs and precision medicine will favor the growth of API and HPAPI technologies.

API has become a lucrative option for venture capitalists, investors, pharma majors and other stakeholders. Of late, innovative APIs have garnered traction in the wake of bullish regulation on R&D activities and novel drug development. Besides, the adoption of a sedentary lifestyle and soaring cancer cases have propelled the development of API. The global API market size was valued at USD 209.71 billion in 2021 and will exhibit a 5.9% CAGR between 2022 and 2030. Robust projection is partly due to R&D efforts to produce generic APIs. Moreover, personalized medicine has gained an uptick from the surging demand for targeted therapies, a trend likely to foster industry growth.

CMOs and CDMOs have furthered their focus on HPAPI manufacturing and development to keep up with the drug demand for antibody drug conjugates and oncology. To illustrate, in March 2022, Lonza announced laboratory expansion at its API manufacturing site in China. It will underpin the early-phase highly-potent API manufacturing capabilities and help the company boost clinical trials in oncology. The global high potency API market size stood at USD 23.60 billion in 2021 and is slated to depict a CAGR of 6.2% through 2030.

Order your copy of the Free Sample of "Active Pharmaceutical Ingredients and High Potency API Industry Data Book - Active Pharmaceutical Ingredients and High Potency Active Pharmaceutical Ingredients Market Size, Share, Trends Analysis, And Segment Forecasts, 2023 - 2030" Data Book, published by Grand View Research

Industry leaders are counting on the high efficiency of HPAPI molecules to solidify their position in the global landscape. In March 2022, Novasep announced an infusion of €5.1 million (approximately USD 5.5 million) to bolster the production capacity for HPAPIs in France. The company expects it to propel its position in manufacturing innovative and targeted molecules for cancer treatment and undergird its footprint in the antibody drug conjugates space.

Incumbents across North America, Europe, Asia Pacific, Latin America and Middle East & Africa will potentially bolster their API and HPAPI portfolios. In doing so, the following dynamics are expected to hold prominence:

- Synthetic APIs and HPAPIs will hold prominence in the wake of increased raw material availability and higher effectiveness in treatment.

- Laboratories expansion will redefine the global landscape. Polpharma is anticipating opening a new R&D & Production facility in the first quarter of 2024, which will include analytical laboratories (ADL) for Quality Control analyses and separate process laboratories (PDL), among others.

- The North America market will witness bullish investments on the back of growing cancer-related morbidity, mortality and cases. A study published in the American Cancer Society journal noted that 1,958,310 new cancer cases and 609,820 cancer deaths would be witnessed in the U.S. in 2023.

Forward-looking companies envisage Asia Pacific to provide compelling growth opportunities, relying on the advanced chemical sector, rigorous manufacturing and quality standards, skilled manpower and reduced costs. Furthermore, governments have ramped up initiatives and schemes to provide a favorable platform for stakeholders. For instance, in March 2022, India started local manufacturing of 35 APIs under the Production Linked Incentive (PLI) Scheme.

Key players have propelled their API portfolio to tap into the global market. In June 2022, WuXi announced the opening of an HPAPI production facility in China with milling technology and flow chemistry. With the pharmaceutical industry brimming with growth and innovations, Asia Pacific is touted to witness investment abound. In April 2023, the U.S. FDA gave the nod to Ajinomoto Bio-Pharma Services' HPAPI fill line to manufacture a commercial product.

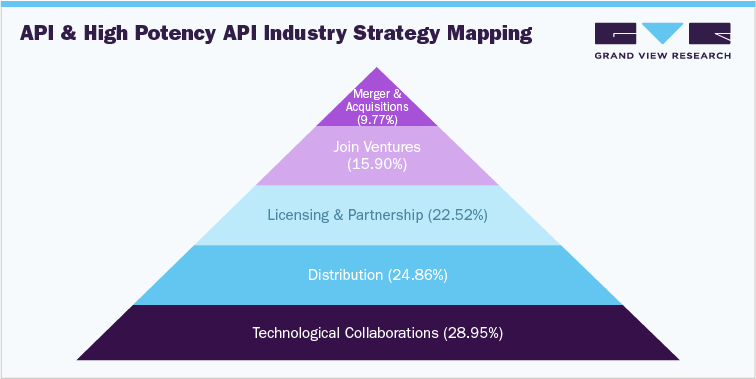

The competitive scenario indicates that well-established players and startups could inject funds into product offerings, technological advancements, innovations, geographical expansion, partnerships and mergers & acquisitions. To illustrate, in January 2023, Sterling Pharma announced the completion of the acquisition of Novartis' API manufacturing facility in Ireland, a significant step to bolster its position in the Europe market.

Check out more Industry Data Books, published by Grand View Research

About Grand View Research

Grand View Research, U.S.-based market research and consulting company, provides syndicated as well as customized research reports and consulting services. Registered in California and headquartered in San Francisco, the company comprises over 425 analysts and consultants, adding more than 1200 market research reports to its vast database each year. These reports offer in-depth analysis on 46 industries across 25 major countries worldwide. With the help of an interactive market intelligence platform, Grand View Research Helps Fortune 500 companies and renowned academic institutes understand the global and regional business environment and gauge the opportunities that lie ahead.

Contact:

Sherry James

Corporate Sales Specialist, USA

Grand View Research, Inc.

Phone: 1-415-349-0058

Toll Free: 1-888-202-9519

Email: sales@grandviewresearch.com

Web: https://www.grandviewresearch.com/sector-reports-list

Follow Us: LinkedIn | Twitter

No comments:

Post a Comment