Women’s Health App Industry Overview

The global women’s health app market size was valued at USD 3.2 billion in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 19.6% from 2023 to 2030. The increasing incidence of diseases among women and the high penetration of smartphones is expected to drive the market growth. Dietary changes, stress, and alcohol intake are important factors that cause hormonal imbalances in women. Women are vulnerable to several postmenopausal diseases, such as Osteoarthritis (OA), anemia, obesity, irregular menstruation, depression, and fibromyalgia. As the aging population and incidence of obesity increase, the prevalence of OA is expected to increase.

According to the United Nations, about 10 to 15% of adults over the age of 60 have some degree of osteoarthritis, a condition that is common in women. Anemia continues to affect millions of women around the world. According to the WHO, the prevalence of anemia was 29.9% among females of reproductive age, which is equivalent to nearly half a billion females aged 15-49 years. In December 2020, Sanguina, Inc. announced the launch of AnemoCheck Mobile, a smartphone application that determines hemoglobin levels by the color of fingernails. Thus, the rising prevalence of anemia coupled with the launch of disease-specific solutions is expected to fuel the market growth.

Gather more insights about the market drivers, restraints, and growth of the Global Women’s Health App Market

The increasing prevalence of arthritis in females is expected to boost the market. Arthritis can be eased by developing healthy habits regularly and changing daily activities. For instance, The Arthritis Foundation recently launched Vim, an application that allows users to control and balance food intake, exercise, sleep, dosing, and mood. The software trackswhich user behavior heightens the pain of arthritis. Such innovations in the healthcare sector are expected to bode well with the market.Furthermore,rising government and private investmentsare contributing to the adoption of software for women’s welfare.

For instance, in May 2021, the Australian government announced an investment of USD 244.3 million over the next 4 years. The investment will be used to support women’s health including funding for breast and cervical cancer, reproductive health, and endometriosis. Increasing funding for startup businesses and the entry of new players are propelling market growth. For instance, in September 2021, the Flo application received USD 50 million in Series B funding, bringing the total capital raised to USD 65 million. The company is planning to use the funding to develop personalized solutions and give users advanced insights related to their menstrual cycle and symptom patterns to aid in proactive management and improvement of their general wellbeing.

Browse through Grand View Research's Healthcare IT Industry Related Reports

Femtech Market - The global femtech market size was valued at USD 5.1 billion in 2021 and is expected to expand at a compound annual growth rate (CAGR) of 11.1% from 2022 to 2030.

Healthcare Predictive Analytics Market - The global healthcare predictive analytics market size was valued at USD 9.3 billion in 2021 and is expected to grow at a compounded annual growth rate (CAGR) of 24.5% from 2022 to 2030.

Women’s Health App Industry Segmentation

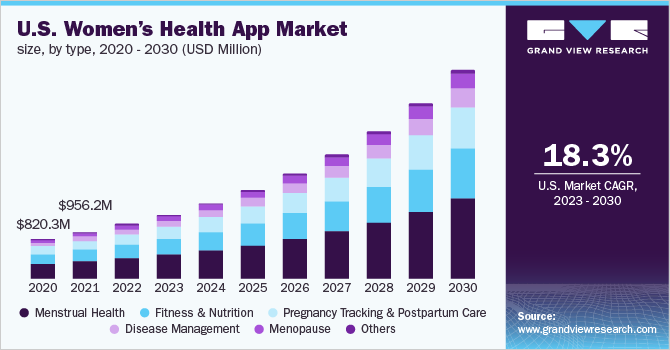

Grand View Research has segmented the global women’s health app market based on type, modality, age group, and region:

Women’s Health App Type Outlook (Revenue, USD Million, 2016 - 2030)

- Fitness & Nutrition

- Menstrual Health

- Pregnancy Tracking & Postpartum Care

- Menopause

- Disease Management

- Others

Women’s Health App Modality Outlook (Revenue, USD Million, 2016 - 2030)

- Smartphone

- Tablet

- Others

Women’s Health App Age Group Outlook (Revenue, USD Million, 2016 - 2030)

- Adolescent

- Adult

- Geriatric

Women’s Health App Regional Outlook (Revenue, USD Million, 2016 - 2030)

- North America

- Europe

- Asia Pacific

- Latin America

- MEA (Middle East & Africa)

Market Share Insights:

June 2022: Women’s hygiene brand, Sirona launched a menstrual tracker on WhatsApp. The WhatsApp time tracking tool helps users track their period by simply sending “Hello” to Sirona’s WhatsApp business account.

March 2021: Clue received FDA approval to launch ClueBirth Control, a digital contraceptive that statistically predicts ovulation and is used to prevent pregnancy.

Key Companies profiled:

Some prominent players in the global Women’s Health App Industry include

- Flo Health, Inc.

- Clue

- Glow, Inc.

- Withings

- Fitbit, Inc.

- Natural Cycles

- Apple Inc.

- Wildflower Health

- HelloBaby, Inc.

- Ovia Health

Order a free sample PDF of the Women’s Health App Market Intelligence Study, published by Grand View Research.

No comments:

Post a Comment