Automotive Axle Industry Overview

The global automotive axle market size was valued at USD 61.19 billion in 2021 and is projected to register a compound annual growth rate (CAGR) of 1.5% from 2022 to 2030. Factors such as growing demand for heavy duty commercial vehicles such as long trailers used to carry oversize loads and increase in the sales of passenger vehicles in developing economies like Mexico, China, and India are expected to propel the growth of the market. The rising sales of luxury vehicles that demand higher torque and performance are further encouraging market growth. The growing concerns over growing carbon emissions and their environmental repercussions have caused a shift in the consumer’s preference for hybrid and electric vehicles over conventional vehicles.

Governments worldwide are strongly advocating for the adoption of EVs and hybrid vehicles. Thus, a growing inclination towards EV and hybrid vehicles is anticipated to propel market growth. Moreover, the automotive industry is developing technically advanced axle which is lightweight, smaller yet more fuel and performance efficient. The implementation of technological advancement has led to a surge in the adoption of lightweight axles, which provide improved efficiency and contribute to lowering the overall weight of hybrid, EV, and commercial vehicles favoring the market growth. The aftermarket services for replacing and maintaining axles in powertrains are also creating new market opportunities.

Gather more insights about the market drivers, restraints, and growth of the Global Automotive Axle Market

COVID-19 has adversely affected industries throughout the globe as the federal authorities imposed strict quarantine measures to curb the spread of the virus. Hospitality, aviation, and automotive were the worst hit among all the industries. The automotive industry suffered a sharp decline in demand due to travel restrictions, disruption in the production and manufacturing of automotive components, and bottlenecks in the supply chain worldwide. Thus, impacting the automotive market negatively. The production and demand for the axle directly depend on the demand for automobiles. However, in 2021 as the lockdowns were being lifted in a phased manner, the demand for automobiles saw a surge which was met with a still disrupted raw material supply chain. Still, the automotive market started showing signs of recovery which also induced recovery in demand for axles used in the applications powertrains.

With the ongoing development, the latest axle innovation for heavy-duty commercial vehicles aims to improve maintenance and performance. The growing trend of vehicle electrification and innovation continues for drive axle coupled with electric powertrain. The trend has led to changes in designing to regenerate torque load needs and including the appropriate axle for the electric application. To meet the greenhouse emission regulations, downsizing, weight reduction, and torque-carrying qualities have been prioritized in drive and steer axle development. Drive axles are developed to have faster ratios to handle bigger axle input torques caused by lowering engine revolutions per minute at highway speeds to aid engine down speeding for line-haul logistics vehicles by road transportation. Also, the increasing use of 612 configurations can be applied for building single drive axles to support engine down speeding and quicker ratios. For instance, steer axle system has improved kinematics with less bump and roll steer being transmitted to the driver through the seat or the steering wheel, which can help reduce driver fatigue.

Browse through Grand View Research's Automotive & Transportation Industry Related Reports

Light Car Trailer Market - The global light car trailer market size was valued at USD 1.55 billion in 2021 and is expected to expand at a compound annual growth rate (CAGR) of 3.7% from 2022 to 2030.

Electric Forklift Market - The global electric forklift market size is expected to reach USD 39.15 billion by 2022 and is expected to grow at a compound annual growth rate (CAGR) of 14.9% from 2023 to 2030, according to a study conducted by Grand View Research, Inc.

Automotive Axle Industry Segmentation

Grand View Research has segmented the global automotive axle market based on type, application, vehicle type, and region:

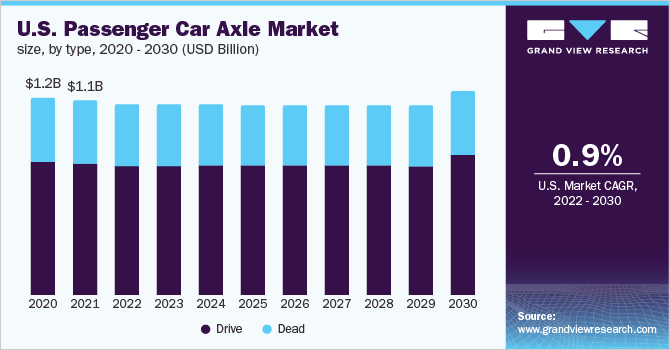

Automotive Axle Type Outlook (Volume, Thousand Units, Revenue, USD Million, 2018 - 2030)

- Drive

- Dead

- Lift

Automotive Axle Application Outlook (Volume, Thousand Units, Revenue, USD Million, 2018 - 2030)

- Front

- Rear

Automotive Axle Vehicle Type Outlook (Volume, Thousand Units, Revenue, USD Million, 2018 - 2030)

- Passenger Cars

- Light Commercial Vehicle (LCV)

- Heavy Commercial Vehicle (HCV)

Automotive Axle Regional Outlook (Volume, Thousand Units, Revenue, USD Million, 2018 - 2030)

- North America

- Europe

- Asia Pacific

- Rest of the World

Key Companies profiled:

Some prominent players in the global Automotive Axle Industry include

- American Axle & Manufacturing, Inc.

- Dana Incorporated

- Daimler AG

- GNA Group

- Meritor Inc.

- ZF Friedrichshafen AG

- Melrose Industries PLC

- Talbros Engineering Limited

Order a free sample PDF of the Automotive Axle Market Intelligence Study, published by Grand View Research.

No comments:

Post a Comment