Automotive Elastomers Industry Overview

The global automotive elastomers market size was valued at USD 32.9 billion in 2021 and is expected to expand at a compound annual growth rate (CAGR) of 5.4% from 2022 to 2030. The market is anticipated to be driven by the increasing demand for new vehicles and rising consumer disposable income. Moreover, the government's strict standards and policies to reduce pollution, increase vehicle efficiency, and ensure passenger safety have resulted in the widespread use of and demand for automotive elastomers. Rising awareness regarding various benefits of automotive elastomers like emissions reduction, noise reduction, performance improvement, and safety improvement is anticipated to boost the demand for several types of automotive elastomers.

The COVID-19 pandemic had a negative impact on the market. The pandemic forced governments to seal global borders and temporarily shut industries and markets in 2020. The closure of manufacturing plants in the regions has resulted in a significant loss of business and revenue for the regions under lockdown and fluctuation in raw material prices and supplies. The disruption in global supply chains negatively impacted the sales of products, delivery schedules, and manufacturing, which led to a notable drop in automotive sales, thereby leading to a reduction of automotive elastomer demand as it is dependent on the demand and sales of the automotive industry. However, the market is expected to recover quickly and reach pre-COVID levels over the forecast period.

Gather more insights about the market drivers, restraints, and growth of the Global Automotive Elastomers Market

The ongoing R&D and technological developments in the field of automotive elastomers and the widespread adoption of and need for elastomers in the automotive sector are expected to drive the market in the coming future. Additionally, an increasing need for lightweight, durable, flexible, high abrasion resistance and better low-temperature performance material is one of the factors driving the demand for automotive elastomers. The fluctuation of crude oil prices and their market substitutes impact the cost of automotive elastomer manufacturing, either directly or indirectly.

The capital cost of automotive elastomer manufacturing is high, and companies outsource manufacturing to nations with cheap labor and raw materials, such as India and China. Furthermore, the presence of a huge, domestic market in the Asia Pacific and the Middle East has posed a threat to major international firms because of the low-cost technology, the availability of raw materials at low prices, and cheap labor, resulting in a price disparity in the global market. In April 2022, Motherson announced the closing of the acquisition of Marelli, a car components manufacturer. The acquisition will lead the group to become India's largest vehicle component producer and rank among the world's top ten.

Browse through Grand View Research's Plastics, Polymers & Resins Industry Related Reports

Thermoplastic Elastomer Market - The global thermoplastic elastomer market size was valued at USD 21.45 billion in 2021 and is expected to expand at a compound annual growth rate (CAGR) of 7.2% from 2022 to 2030.

Medical Elastomers Market - The global medical elastomers market size was valued at USD 3.77 billion in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 12.74% from 2023 to 2030.

Automotive Elastomers Industry Segmentation

Grand View Research has segmented the global automotive elastomers market based on type, application, vehicle type, and region:

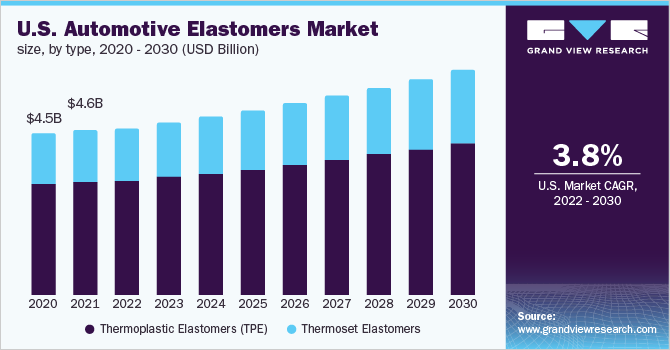

Automotive Elastomers Type Outlook (Volume, Kilotons, Revenue, USD Million, 2019 - 2030)

- Thermoset Elastomers

- Thermoplastic Elastomers (TEP)

Automotive Elastomers Application Outlook (Volume, Kilotons, Revenue, USD Million, 2019 - 2030)

- Tire

- Interior

- Exterior

- Under the Hood

Automotive Elastomers Vehicle Type Outlook (Volume, Kilotons, Revenue, USD Million, 2019 - 2030)

- Passenger Cars

- Light Commercial Vehicles

- Medium and Heavy Commercial Vehicles

Automotive Elastomers Regional Outlook (Volume, Kilotons, Revenue, USD Million, 2019 - 2030)

- North America

- Europe

- Asia Pacific

- Central & South America

- MEA (Middle East & Africa)

Market Share Insights:

December 2021: Pexco LLC declared that it acquired Performance Elastomers Corporation. Through this deal, Pexco is looking forward to expanding its thermoplastic and silicone elastomer products and expanding its abilities to incorporate other high-performance polymer solutions to provide even higher value to its customers.

December 2020: Ace Midwest LLC declared the acquisition of all functioning assets of RotaDyne's elastomer processing group rubber manufacturing business, strengthening the firm's product line and elastomers business.

Key Companies profiled:

Some prominent players in the global Automotive Elastomers Industry include

- BASF SE

- Exxon Mobil Corporation

- DuPont

- Dow

- Huntsman International LLC

- LANXESS

- SABIC

- Covestro AG

- Continental AG

- INEOS

- Mitsui Chemicals, Inc.

- Versalis S.p.A

- Kraton Corporation

- KRAIBURG TPE

- China Petroleum & Chemical Corporation (SINOPEC CORP.)

Order a free sample PDF of the Automotive Elastomers Market Intelligence Study, published by Grand View Research.

No comments:

Post a Comment