Hydraulic Fluids Industry Overview

The global hydraulic fluids market size was estimated at USD 7.6 billion in 2021 and is anticipated to expand at a compound annual growth rate (CAGR) of 5.2% from 2022 to 2030. The growth of the market can be attributed to the increasing infrastructure and construction activities across the globe. Governments across developing nations are focusing on infrastructure development. Factors such as availability of finance, focus on operational resilience, deployment of new technologies, and the affordability of infrastructure are helping the rise in infrastructure activities. In 2020, due to the spread of Coronavirus, the market was affected in terms of production, distribution, and supply.

The prices of the base oils dropped severely due to the lack of supply and demand from the end-use industries such as automotive, construction, oil and gas, manufacturing, aerospace and defense, power, marine, etc. Restriction on material and people movement during the pandemic led to an abrupt halt in the functioning of the above industries. In 2022, the Russia-Ukraine war has further disrupted the supply chain of the hydraulic fluids market. Russia is one of the significant producers of base oil in the world. The cut down of base oil import from Russia by various countries has impacted the prices of hydraulic fluid drastically. Numerous companies have increased the prices of base oils by 15% compared to the previous years.

Gather more insights about the market drivers, restraints, and growth of the Global Hydraulic Fluids Market

The hydraulic equipment market is changing at a rapid pace. In line with this, the lubricant industry has been changing to satisfy the reliability needs of hydraulic equipment as new technologies enable more efficient operation. The following are the important trends: Finer Filtration: Hydraulic pumps are susceptible to contamination because of the surroundings they work in. Thus, the fluids applied to lubricate them should be ultraclean. Original equipment manufacturers (OEMs) are responding by selecting improved filters that comply with ISO 4406 specifications. Minimizing Power Loss: today Hydraulic equipment places greater importance on reducing power losses and improving overall machine efficiency by lowering the number of joints, bends, and filter pressure differentials. Furthermore, OEMs are focusing on conserving as much energy as possible, and they are turning to energy-efficient hydraulic fluids to do so.

Browse through Grand View Research's Petrochemicals Industry Related Reports

Heat Transfer Fluids Market - The global heat transfer fluids market size was estimated at USD 10.7 billion in 2022 and is anticipated to grow at a compound annual growth rate (CAGR) of 3.2% from 2023 to 2030.

Automotive Lubricants Market - The global automotive lubricants market size was estimated at USD 72.05 billion in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 3.5% from 2023 to 2030.

Hydraulic Fluids Industry Segmentation

Grand View Research has segmented the global hydraulic fluids market based on base oil, end-use, and region:

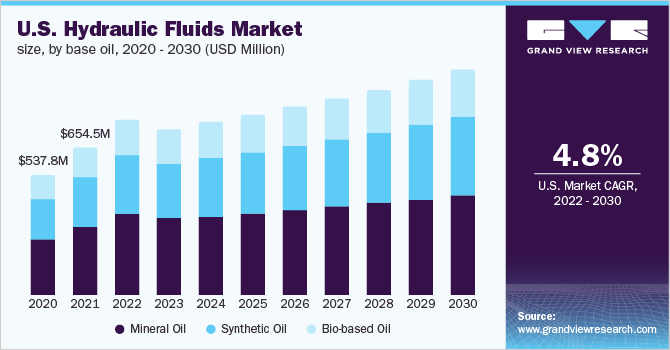

Hydraulic Fluids Base Oil Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

- Mineral Oil

- Synthetic Oil

- Bio-based Oil

Hydraulic Fluids End-use Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

- Construction

- Metal & Mining

- Oil & Gas

- Agriculture

- Automotive

- Aerospace & Defense

- Others

Hydraulic Fluids Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

- North America

- Europe

- Asia Pacific

- Central & South America

- MEA (Middle East & Africa)

Market Share Insights:

February 2022: South Korea’s hydraulic brake fluid exports were USD 791 thousand, while imports totaled USD 618 thousand, creating a USD 173 thousand positive trade balance.

March 2021: TotalEnergies launched fire-resistant HYDRANSAFE HFC_E hydraulic fluid in Australia. The fluid improves machine reliability while simultaneously reducing fire threats in subterranean mines.

Key Companies profiled:

Some prominent players in the global Hydraulic Fluids Industry include

- Shell plc

- Exxon Mobil Corporation

- Chevron Corporation

- BP p.l.c.

- TotalEnergies

- PetroChina Company Limited

- China Petrochemical Corporation (SINOPEC)

- FUCHS

- Valvoline

- NYCO

- Idemitsu Kosan Co., Ltd.

- Dow

- Eastman Chemical Company

- LUKOIL

- Gazprommeft - Lubricants Ltd.

Order a free sample PDF of the Hydraulic Fluids Market Intelligence Study, published by Grand View Research.

No comments:

Post a Comment