The global electric off-highway equipment industry size will observe an upward growth trajectory on the back of agriculture equipment electrification and urbanization, according to the "Electric Off-Highway Equipment Industry Data Book, 2023 – 2030," published by Grand View Research. Original Equipment Manufacturers (OEMs) have witnessed an influx of funds into state-of-the-art technologies, including advanced analytics, connectivity, ADAS, cloud, telematics and machine vision. Advanced technologies have become sought-after across construction, agriculture and mining sectors to curb carbon emissions and bolster sustainability.

Heightened demand for electric equipment, including electric dump trucks, mining trucks, dozers, motor graders, excavators and loaders, has reinforced the industry growth. Amidst surging noise pollution, end-users have shown a notable inclination for low-noise equipment and zero-exhaust emissions. Customers are also likely to seek tools that are in line with environmental regulations, requiring lower maintenance and vibrations. To illustrate, in May 2022, Bobcat Company unleashed the expertise of the zero-emission, off-road construction equipment in California. The company asserts it will help keep up the state's climate goals, boost a low-carbon future and enhance air quality.

Order your copy of the Free Sample of " Electric Off-Highway Equipment Industry Data Book - Electric Agriculture Equipment, Construction Equipment, and Mining Equipment Market Size, Share, Trends Analysis, And Segment Forecasts, 2023 - 2030 " Data Book, published by Grand View Research

Soaring noise pollution has furthered the footprint of electric construction equipment, prompting OEMs to inject funds into the landscape. Since governments and other watchdogs have implemented rigorous emission standards, battery-powered construction equipment has garnered immense traction globally. According to a House of Commons Committee report 2022-2023, the built environment accounts for 25% of the U.K.'s total greenhouse gas emissions. Besides, the U.K.'s 6th Carbon Budget warrants carbon emissions to be minimized by 78% by 2035.

Prominently, 62% of the total waste in the U.K. is attributed to the construction, demolition and excavation sector. Carbon regulations are likely to propel the use of electric equipment. For instance, the "Buy Clean California Act" lays Carbon Intensity Limits on specific construction materials for infrastructure projects and public buildings. The electric construction equipment market size stood at USD 1.24 billion in 2022 and will depict a robust CAGR of 14.8% from 2023 to 2030.

The foray of innovations and digitization into the mining sector has brought a paradigm shift in the electrification of off-highway equipment. Electric machines are touted to boost sustainability, working conditions, productivity and RoI. Concerted efforts to enhance environmental, social and governance (ESG) performance will leverage miners to foster their sustainability profile.

The growing applications of electric & hybrid-electric tools, digital twinning and advancements in maintenance and monitoring will provide opportunities, both locally and globally. The electric mining equipment market size was valued at USD 94.49 billion in 2022 and could observe around 11.5% CAGR over the forecast period. The environmental and economic upsides will gain momentum with AI's introduction in the mining industry. It will leverage digital miners to use sensor network technologies for real-time surveillance and reduce asset idle time.

Industry leaders are poised to emphasize the following dynamics to tap into the global market:

- Electric agriculture equipment will observe prominent growth with the rising penetration of commercial farming and farm mechanization.

- Off-road construction equipment could be the next frontier with soaring subsidies and incentives for a cost-effective and efficient solution.

- Europe could account for a notable share of the global market with buoyant investments in the electrification of off-road mining vehicles. For instance, in October 2022, Shell announced the formation of a nine-member consortium to expedite the electrification of off-road mining vehicles.

Incumbents envisage North America electric off-highway equipment industry share to be pronounced following the prevalence of comprehensive infrastructure plans. In March 2021, U.S. President Joe Biden revealed a USD 2.25 trillion plan to boost the nation's infrastructure and address climate change. In February 2023, President Biden's Bipartisan Infrastructure Law announced the pouring of more than USD 7 billion in EV battery components, critical minerals and materials and USD 10 billion in clean transportation.

A notable uptick in the farm economy in the U.S. will accentuate regional growth. Equipment manufacturers expect infrastructure modernization, including bridges, roads, waterways, ports, locks and broadband, to augment economic competitiveness. For instance, in November 2021, Gridtractor announced the rollout of fleet electrification services to propel zero-emission agriculture. The company will use on-farm electrical services with new technology (charging and monitoring) to streamline electric tractor operations.

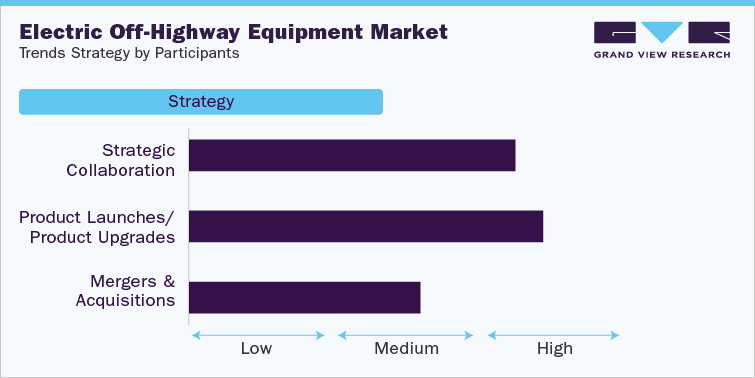

The competitive landscape alludes to an increased emphasis on organic and inorganic strategies, including product offerings, technological advancements, innovation, geographical expansion, R&D activities, collaboration and mergers & acquisitions. To illustrate, in July 2022, Sandvik sealed a USD 32 million order for battery electric mining equipment. Meanwhile, in February 2023, Volvo Construction Equipment announced an infusion of SEK 80 million (USD 7.8 million) in battery pack production in South Korea. The company suggested 35% of machine sales would be electric by 2030. The current trend is poised to encourage equipment manufacturers to expand their footprint globally.

Check out more Industry Data Books, published by Grand View Research

About Grand View Research

Grand View Research, U.S.-based market research and consulting company, provides syndicated as well as customized research reports and consulting services. Registered in California and headquartered in San Francisco, the company comprises over 425 analysts and consultants, adding more than 1200 market research reports to its vast database each year. These reports offer in-depth analysis on 46 industries across 25 major countries worldwide. With the help of an interactive market intelligence platform, Grand View Research Helps Fortune 500 companies and renowned academic institutes understand the global and regional business environment and gauge the opportunities that lie ahead.

Contact:

Sherry James

Corporate Sales Specialist, USA

Grand View Research, Inc.

Phone: 1-415-349-0058

Toll Free: 1-888-202-9519

Email: sales@grandviewresearch.com

Web: https://www.grandviewresearch.com/sector-reports-list

Follow Us: LinkedIn | Twitter

No comments:

Post a Comment