The global electric vehicle aftermarket industry size was estimated at USD 67.74 billion in 2022 and is anticipated to reach USD 308.41 billion by 2030, registering a CAGR of 21.1% from 2023 to 2030. The growth of the global electric vehicle (EV) aftermarket can be attributed to the rising adoption of electric vehicles, increasing demand for battery replacements and upgrades, innovative charging solutions, customization trends, specialized maintenance and repair services, the conversion of conventional vehicles to electric, and supportive government policies and incentives.

As the electric vehicle market continues to expand and mature, the aftermarket industry is expected to play a critical role in fulfilling the evolving demands of EV owners. The ongoing shift toward electric mobility remains one of the primary growth drivers. With more consumers and businesses embracing EVs, the demand for aftermarket products and services will increase accordingly. For example, leading companies such as Tesla, Inc., Nissan Motor Co. Ltd., and Chevrolet have seen significant sales of their electric models, which, as they age, will create opportunities for replacement parts and maintenance services. According to the International Energy Agency (IEA), global electric car sales rose steadily, reaching 2 million in the first quarter of 2022—an increase of 75% compared to the same period in 2021.

Battery technology continues to advance, offering longer lifespans and higher efficiency. However, even with these improvements, EV batteries will eventually require replacement or refurbishment. This presents significant opportunities for the aftermarket, especially as the first generation of EVs approaches the end of their battery life. Companies specializing in battery refurbishment and advanced replacement technologies, such as higher capacity and faster charging solutions, are expected to benefit from this growing demand.

Government initiatives worldwide are further accelerating EV adoption. These include subsidies, tax credits, and regulations to phase out internal combustion engine vehicles. Such policies contribute to aftermarket growth by boosting the number of EVs on the road. For instance, Norway’s tax incentive program provides zero-emission vehicles (ZEVs) with exemptions from registration tax, VAT, and motor fuel taxes, along with reductions in tolls, ferry charges, and parking fees. The impact is evident—by 2021, over two-thirds of all new passenger cars sold in Norway were electric.

Key Market Highlights:

- Europe dominated the market with a revenue share of 30.3% in 2022.

- By replacement parts, the “other” segment accounted for the largest market share at 43.5% in 2022.

- By propulsion type, battery electric vehicles (BEVs) led the market with a share of 37.2% in 2022.

- By vehicle type, the passenger cars segment dominated with a revenue share of 71.0% in 2022.

- By distribution channel, the retailers segment held the largest share at 55.5% in 2022.

Download a free sample PDF of the Electric Vehicle Aftermarket Industry Intelligence Study from Grand View Research.

Market Performance:

- 2022 Market Size: USD 67.74 Billion

- 2030 Projected Market Size: USD 308.41 Billion

- CAGR (2023-2030): 21.1%

- Europe: Largest market in 2022

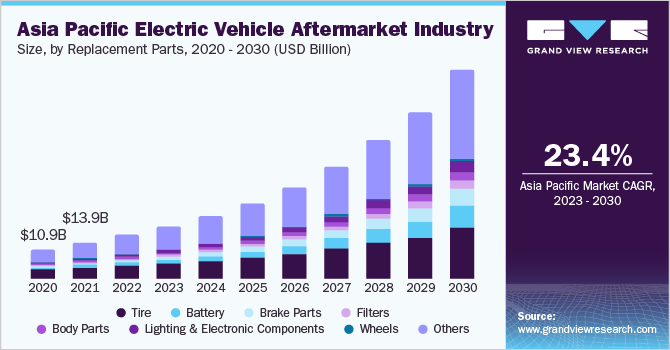

- Asia Pacific: Fastest growing market

Prominent Companies & Market Dynamics:

The electric vehicle aftermarket is highly competitive, with leading global players focusing on product innovation, strategic collaborations, and partnerships to strengthen their market presence.

Key Companies:

- Delphi Technologies

- Schneider Electric SE

- ClipperCreek, Inc.

- AeroVironment, Inc.

- Continental AG

- Denso Corporation

- Robert Bosch GmbH

Explore Horizon Databook – the world’s most comprehensive market intelligence platform by Grand View Research.

Conclusion

The electric vehicle aftermarket industry is poised for substantial growth, supported by the rapid adoption of EVs, rising demand for battery replacements, and ongoing technological advancements. Government incentives and favorable policies further reinforce this trend, driving consumer and business transitions to electric mobility. As the EV fleet expands globally, opportunities for aftermarket services, battery innovations, and specialized maintenance will continue to grow. With strong competition and strategic moves by key players, the industry is expected to evolve into a vital enabler of the electric mobility ecosystem, shaping the future of sustainable transportation.

No comments:

Post a Comment