The global wine market size was valued at USD 515.1 billion in 2024 and is projected to grow to USD 812.78 billion by 2030, registering a CAGR of 8.1% from 2025 to 2030. This growth is largely fueled by the rising demand for premium and super-premium wines, especially among younger consumers in emerging economies.

These consumers are showing a preference for high-quality, refined wines and are increasingly willing to pay more for superior products. A notable trend driving market expansion is the surge in demand for sustainably and organically produced wines, which aligns with growing consumer awareness around environmental impact and personal wellness. Rosé wine continues to gain popularity due to its refreshing profile and adaptability across different settings and occasions. Additionally, the rise of e-commerce and online wine subscription services is reshaping the industry by enabling producers to directly engage with customers and offer personalized experiences.

Emerging markets in the Asia Pacific region are playing a pivotal role in the market’s expansion. Countries such as China, India, and South Korea are witnessing increased wine consumption, driven by higher disposable incomes, urbanization, and growing familiarity with Western lifestyle and drinking culture. At the same time, sustainability trends are influencing consumer behavior, leading to increased interest in organic, natural, and environmentally responsible wines. Producers that implement eco-conscious practices—such as organic farming, recyclable packaging, and the use of renewable energy—are seeing rising support from environmentally aware buyers.

Key Market Insights:

- The Europe wine industry captured the largest global revenue share of 44.9% in 2024.

- France is projected to grow at the fastest CAGR of 7.9% during the forecast period.

- By product type, the table wine segment dominated the market with a share of over 81.8% in 2024.

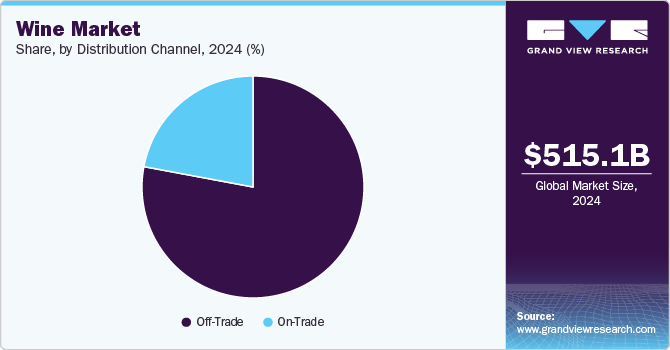

- By distribution channel, the off-trade segment led in 2024, accounting for the largest revenue share of 77.9%.

Order a free sample PDF of the Wine Market Intelligence Study, published by Grand View Research.

Market Size & Forecast

- 2024 Market Size: USD 515.1 Billion

- 2030 Projected Market Size: USD 812.78 Billion

- CAGR (2025-2030): 8.1%

- Europe: Largest market in 2024

Key Companies & Market Share Insights

The wine market remains highly fragmented, with a mix of global and regional players competing for market share. These companies are making strategic investments in acquisitions and promotional activities to expand their customer base and foster brand loyalty. In parallel, they are embracing emerging technologies such as blockchain and artificial intelligence to elevate customer engagement and enhance the efficiency of supply chain operations.

In January 2025, Alliance Wine launched its first full-scale Burgundy En Primeur campaign, incorporating wines from its newly acquired H2Vin portfolio. The campaign featured nearly 350 wines from more than 30 leading Burgundy producers, highlighting the enhanced portfolio strength created through this merger. This launch reflects a wider trend in the wine industry, with other key players like Thorman Hunt and Flint Wines unveiling similar en primeur campaigns around the same period.

In June 2024, Searcys, the oldest catering company in Great Britain, introduced a new English Sparkling Wine. The vintage, harvested in 2016, bottled in 2017, and aged on lees for over six and a half years, was crafted at Greyfriars vineyard in Surrey. It offers vibrant apple and citrus notes, complemented by toasty aromas, reflecting the rising popularity of premium local sparkling wines.

In May 2023, Sixty Vines, a U.S.-based restaurant chain celebrated for its wine-on-tap model, entered into a partnership with Ridge Vineyards. This collaboration brought Ridge’s prestigious wines to taps across the country, marking the winery’s first foray into tap service. The initiative supports both sustainability goals—by minimizing glass bottle waste—and the growing consumer preference for eco-friendly and accessible wine experiences, reinforcing Sixty Vines' innovative approach.

In June 2023, NICE, a female-founded wine startup based in London, introduced its first canned sparkling white wine. Made from Spanish Airén grapes from La Mancha, this 10% ABV wine is dry, crisp, and sparkling, available in a 200ml can. It joins the brand’s expanding canned wine lineup, which includes Sauvignon Blanc, Pale Rosé, and Malbec. The launch responds to the surging interest in portable, premium wine formats, with miniature cans experiencing 17% year-over-year growth, compared to 8% for miniature bottles.

Key Players

- E. & J. Gallo Winery

- Constellation Brands, Inc.

- The Wine Group

- Treasury Wine Estates

- Concha Y Toro

- Castel Freres

- Accolade Wines

- Pernod Ricard

Explore Horizon Databook – The world's most expansive market intelligence platform developed by Grand View Research.

Conclusion

The global wine market is on a robust growth trajectory, propelled by the increasing demand for premium and super-premium wines, particularly among a new generation of consumers in developing economies. The industry is also being reshaped by a significant focus on sustainability and organic production, reflecting growing consumer environmental and health consciousness. With the rise of e-commerce and innovative distribution channels like online subscriptions and canned wines, producers are finding new ways to connect with consumers. This dynamic market is seeing key players adopt strategic initiatives like mergers and new product launches to stay competitive and meet evolving consumer preferences.

No comments:

Post a Comment