The global rigid plastic packaging market was valued at USD 243.42 billion in 2024 and is projected to reach USD 295.52 billion by 2030, growing at a CAGR of 3.2% from 2025 to 2030. Market growth is supported by rising demand for packaged food, driven by the increasing preference for ready-to-eat products, along with the widespread use of plastic as a preferred material in rigid packaging solutions.

In the U.S., the rigid plastic packaging market is expected to witness steady growth, fueled by the food and beverage industry’s need for durable, tamper-proof, and lightweight packaging. The expansion of e-commerce and retail is further boosting demand for protective and shelf-ready rigid containers, particularly for personal care, pharmaceutical, and electronic products.

Key Market Insights:

- Asia Pacific dominated the rigid plastic packaging market, holding the largest revenue share of 43.93% in 2024.

- By material, the PET segment accounted for the largest revenue share of 30.61% in 2024.

- By production process, injection molding represented more than 35.0% of revenue share in 2024.

- By product, bottles & jars accounted for 51.45% of revenue share in 2024.

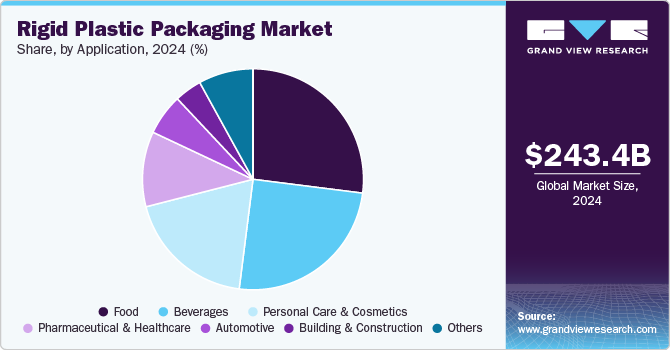

- By application, the food segment held the largest revenue share of 26.91% in 2024.

Order a free sample PDF of the Rigid Plastic Packaging Market Intelligence Study, published by Grand View Research.

Market Size & Forecast

- 2024 Market Size: USD 243.42 Billion

- 2030 Projected Market Size: USD 295.52 Billion

- CAGR (2025–2030): 3.2%

- Asia Pacific: Largest market in 2024

Key Companies & Market Share Insights

The rigid plastic packaging market is highly fragmented, with both global and local companies offering a diverse range of products. Industry players employ strategies such as mergers, acquisitions, geographic expansion, new product launches, and joint ventures to strengthen their competitive position.

- In March 2025, LyondellBasell introduced Pro-fax EP649U, a new polypropylene impact copolymer designed for the rigid packaging sector. Engineered for thin-walled injection molding, this material is ideal for food packaging applications. It offers excellent flow properties, rapid crystallization, smooth mold release, reduced static, and improved handling in high-speed filling lines—enhancing both productivity and product quality.

- In February 2025, Berry Global Group Inc. completed its acquisition of CMG Plastics, a rigid packaging manufacturer. This move comes as Berry approaches its acquisition by Amcor plc in a USD 8.4 billion all-stock agreement, unanimously approved by both companies’ boards. The merger, expected to close by mid-2025, is projected to yield USD 650 million in annual cost savings and additional synergies within three years.

Key Players

- Gerresheimer AG

- Manjushree Technopack Ltd

- Mold-Tek Packaging Ltd

- Greiner Packaging

- Takween Advanced Industries

- Ladain Alyamamah Plastic Factory

- Arabian Plastic Industrial Company Co

- Crown Packaging Int’l

- S.E.A. Global Pte. Ltd

- Dynapackasia

Explore Horizon Databook – the world’s most comprehensive market intelligence platform by Grand View Research.

Conclusion

The rigid plastic packaging market is set for steady growth, driven by rising demand for packaged and ready-to-eat foods, along with the versatility and durability of plastic materials. Increasing needs from the food and beverage, personal care, pharmaceutical, and electronics sectors are further boosting adoption. E-commerce expansion is creating additional demand for protective and shelf-ready packaging solutions. Industry players are focusing on innovation, product development, and strategic mergers to strengthen market presence. With continued advancements in materials and production processes, the market is expected to maintain its upward trajectory in the coming years.

No comments:

Post a Comment