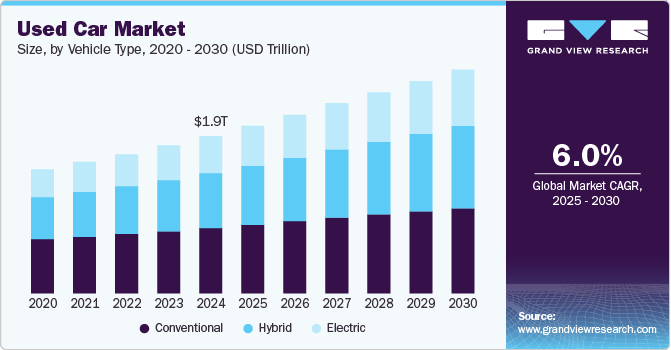

The global used car market was valued at approximately $1.90 trillion in 2024. Projections indicate it will grow to around $2.70 trillion by 2030, with a Compound Annual Growth Rate (CAGR) of 6.0% between 2025 and 2030. This growth is being fueled by a confluence of economic shifts, evolving consumer preferences, and technological advancements.

As the prices of new cars continue to climb, a growing number of consumers are opting for used cars as a more affordable alternative. This trend has been particularly notable since the COVID-19 pandemic, which caused disruptions in new car supply chains and led to inventory shortages. Consequently, the demand for pre-owned vehicles has surged, as consumers seek reliable and budget-friendly options. The increasing prevalence of remote work and other lifestyle changes has also influenced purchasing decisions, with people seeking vehicles that align with their new routines. Furthermore, the rise of online platforms for buying and selling used cars has made the process more convenient and transparent, providing consumers with a wider selection of vehicles.

Key Market Insights:

- Regional Dominance: North America held the largest market share, accounting for 32.8% of the global used car market.

- Vehicle Type: The conventional vehicle segment, which includes internal combustion engine (ICE) cars, accounted for the dominant share of 41.7%.

- Fuel Type: The petrol segment dominated the market.

- Vehicle Size: The SUV segment held the largest market share.

Order a free sample PDF of the Used Car Market Intelligence Study, published by Grand View Research.

Market Size & Forecast

- 2024 Market Size: USD 1.90 Trillion

- 2030 Projected Market Size: USD 2.70 Trillion

- CAGR (2025-2030): 6.0%

- North America: Largest market in 2024

Key Companies & Market Share Insights

Leading companies in the used car market, such as CarMax, Enterprise Services, LLC, Asbury Automotive Group, and Alibaba.com, are actively pursuing strategies to expand their customer base and gain a competitive advantage. These efforts often involve a combination of mergers and acquisitions, strategic partnerships, and the adoption of new technologies.

Asbury Automotive Group, a major player in the U.S. market, is also prioritizing strategic growth. The company has a history of expanding its network of dealerships through acquisitions. Recent initiatives include the acquisition of The Herb Chambers Automotive Group to rebalance its brand portfolio and further its presence in key regions. Asbury has also made significant investments in digital platforms and services like virtual consultations to enhance its online sales capabilities.

Meanwhile, Alibaba has entered the used car market by leveraging its existing e-commerce platform. The company connects buyers and sellers with a wide range of vehicles and uses its established logistics and payment systems to facilitate transactions. Alibaba.com has also integrated AI-driven solutions to improve the buyer experience, offering features such as virtual tours and pricing comparisons.

Key Players

- Alibaba

- CarMax Enterprise Services, LLC

- Asbury Automotive Group

- TrueCar, Inc.

- Scout24 SE

- Lithia Motor Inc.

- Group 1 Automotive, Inc.

- eBay.com

- Hendrick Automotive Group

- AutoNation

Explore Horizon Databook – The world's most expansive market intelligence platform developed by Grand View Research.

Conclusion

The global used car market is undergoing a steady transformation, driven by shifting economic factors, evolving consumer behaviors, and digital innovation. Rising prices of new vehicles have led to greater consumer interest in pre-owned cars, particularly in the aftermath of pandemic-related supply chain disruptions. Technological advancements, especially the rise of online marketplaces, have significantly simplified the car-buying process, making it more accessible and transparent. Lifestyle changes, such as remote work, continue to reshape mobility needs and influence buying decisions. As key players embrace digital strategies and expand their networks, the market is expected to maintain its growth trajectory.

No comments:

Post a Comment