The U.S. semi-trailer dealership market size was valued at USD 8.25 billion in 2021 and is projected to reach USD 13.85 billion by 2030, growing at a Compound Annual Growth Rate (CAGR) of 5.6% from 2022 to 2030. The market is primarily driven by the expansion of the logistics industry, rising disposable incomes, and increasing travel interest among consumers. Growth in the automotive and manufacturing sectors further supports market expansion. Improved road networks have boosted adoption of road transport, while rising demand for semi-trailers for transporting construction & mining equipment, automotive & healthcare products, and chemicals is fueling market growth.

Rising investments in road infrastructure have also increased the demand for transportation vehicles. Semi-trailers are preferred for their ability to carry heavy loads over long distances, low maintenance requirements, and ease of operation. The market experienced strong demand in 2018; however, growth was negatively impacted by the COVID-19 pandemic in 2019. Global lockdowns caused supply chain disruptions, resulting in production losses. The market recorded a year-on-year decline of approximately 1.7% in 2019 compared to 2018. A similar trend continued into the first half of 2020, but manufacturing resumed in the last quarter, driving sales momentum in 2021. Dealers witnessed increased orders from sectors such as agriculture & food, construction & mining, logistics, and chemicals.

Semi-trailer manufacturers are expanding business offerings by providing advantages such as website hosting, streaming videos, dealer mobile applications, and consumer portals, helping dealers grow their customer base and gain a competitive edge. To overcome financing challenges, manufacturers are also offering various financing options. For instance, Novae LLC provides wholesale floorplan financing and retail financing to its dealers.

Key Market Insights:

- The West U.S. held the largest revenue share of 24.58% in 2021, due to the presence of e-commerce industries, developed road infrastructure, and key dealers.

- By end-use, the food & beverages/FMCG segment held the highest market share of 34.01% in 2021, driven by the high demand for perishable goods like dry products, fruits & vegetables, and dairy products.

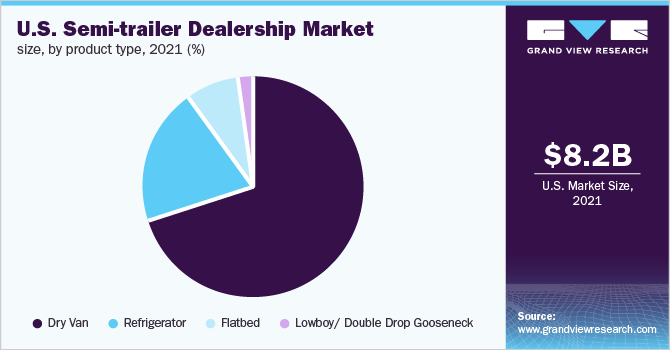

- By product type, dry vans accounted for the largest share at 67.07% in 2021, owing to their versatility in accommodating various types of cargo requiring minimal protection from the external environment.

Order a free sample PDF of the U.S. Semi-Trailer Dealership Market Intelligence Study, published by Grand View Research.

Market Size & Forecast:

- 2021 Market Size: USD 8.25 Billion

- 2030 Projected Market Size: USD 13.85 Billion

- CAGR (2022-2030): 5.6%

Key Companies & Market Share Insights:

Major players in the market include Great Western Leasing and Sales, Superior Trailer Sales, Crossroad Trailers Sales and Service Inc., and Young Truck and Trailers, among others. These companies invest in R&D to develop innovative trailer technologies. Dealers focus on marketing strategies and branding activities to boost sales, while manufacturers provide tools and insights to optimize inventory and increase sales.

To expand market presence and revenues, dealers also pursue alliances, mergers, and acquisitions. For example, in June 2021, Royal Truck & Trailer acquired Arista Trucking System, a commercial truck equipment dealer, to expand geographic reach and diversify its product portfolio.

Key Players:

- Great Western Leasing and Sales

- Superior Trailer Sales

- Crossroad Trailers Sales and Service Inc.

- Larry's Trailer Sales & Service LLC

- Diamond T Truck & Trailer Inc.

- Northwest Truck & Trailer

- Royal Truck & Trailer Sales and Service, Inc.

- Semi-Truck and Trailer Sales

- Star Trailer Sales, Inc.

- Young Truck and Trailer

Explore Global Industry Herald for Insights that Drive Smarter Decisions

Conclusion:

The U.S. semi-trailer dealership market is poised for steady growth, supported by rising logistics demand, infrastructure development, and increasing adoption of semi-trailers across industries. Ongoing investments, dealer support programs, and strategic expansions are expected to further strengthen market presence and drive sustained revenue growth.

No comments:

Post a Comment