The global wood and timber products market was valued at $992.43 billion in 2024. Projections indicate this market will expand to $1,251.26 billion by 2030, with a compound annual growth rate (CAGR) of 4.7% from 2025 to 2030. A key factor driving this growth is the rapid urbanization occurring globally, particularly in populous developing nations like China, India, and various African countries. As the need for residential and commercial construction, along with infrastructure, increases, timber is becoming a preferred material due to its cost-effectiveness, durability, and sustainability when compared to traditional alternatives like steel and concrete.

The rise of engineered wood products, such as cross-laminated timber (CLT) and glulam, has also positioned wood as a competitive building material for high-rise structures, further boosting its demand. Beyond construction, the furniture industry is a major consumer of wood, utilizing both solid wood and engineered products. The market is benefiting from rising disposable incomes in emerging economies, which is leading consumers to invest in premium furniture and wooden interior elements like flooring and wall panels. The expansion of e-commerce and the popularity of modular furniture have also spurred demand for cost-effective materials like plywood and medium-density fiberboard (MDF).

Key Market Highlights:

- In 2024, the Asia Pacific region accounted for the largest portion of the global wood and timber products market, holding a 31.8% share.

- China is the world's leading consumer and importer of wood and timber products, relying on international sources to meet its significant demand for raw materials.

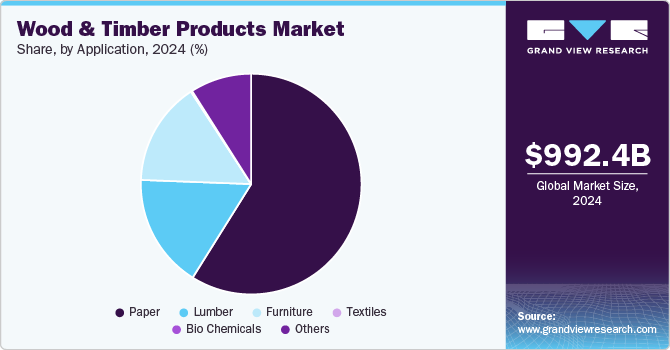

- By application, the paper segment was the dominant force in 2024, representing 58.9% of the total market revenue. This segment is expected to continue its strong growth from 2025 to 2030.

Order a free sample PDF of the Wood and Timber Products Market Intelligence Study, published by Grand View Research.

Market Size & Forecast

- 2024 Market Size: USD 992.43 Billion

- 2030 Projected Market Size: USD 1,251.26 Billion

- CAGR (2025-2030): 4.7%

- Asia-Pacific: Largest Market in 2024

Key Companies & Market Share Insights

Vendors in the wood and timber products market are actively working to expand their customer base in order to strengthen their competitive positioning. As part of this effort, leading players are pursuing strategic initiatives such as mergers, acquisitions, and partnerships with other prominent companies to enhance their market reach and capabilities.

Stora Enso Oyj, established in 1998 and headquartered in Finland, Europe, is a key player in the industry, specializing in the development and production of wood- and biomass-based products. The company operates through six business divisions: wood products & services, packaging materials, packaging solutions, biomaterials, forest, and paper. Its diverse product portfolio includes formed fiber, bio-composites, wooden construction products, bio-based chemicals and materials, intelligent packaging, and corrugated packaging, among others.

Sterling Solutions LLC, also founded in 1998, is based in Illinois, U.S., and offers matting and site access solutions tailored for the construction and industrial sectors. The company’s product lineup includes TeraLam mats, Terra Cross bridges, Clean Exit mats, composite mats, timber mats, crane mats, and marine-barge floating mats, providing durable and reliable solutions for a wide range of worksite conditions.

Key Players

- Southern Pine Timber Products, Inc.

- Stora Enso Oyj

- Timbeck Architecture

- Timber Products Co. Limited Partnership

- Georgia-Pacific LLC

- West Fraser Timber Co. Ltd.,

- Sterling Solutions LLC

- Weyerhaeuser Company

Explore Horizon Databook – The world's most expansive market intelligence platform developed by Grand View Research.

Conclusion

The global wood and timber products market is witnessing steady growth, supported by rapid urbanization, rising construction needs, and increasing demand for sustainable building materials. Technological advancements in engineered wood are making timber a viable option for large-scale and high-rise projects. Additionally, expanding furniture markets and interior design trends are contributing to higher wood consumption across emerging economies. E-commerce and modular furniture innovations further amplify demand for affordable wood-based alternatives like plywood and MDF. As sustainability and cost-efficiency gain traction, the market is poised for continued momentum driven by both innovation and infrastructure development.

No comments:

Post a Comment