Cladding Industry Overview

The global cladding market size is expected to reach USD 386.04 billion by 2030, as per a new report by Grand View Research Inc. The market is expected to register a CAGR of 7.0% from 2022 to 2030. Increasing construction spending, particularly for non-residential applications such as office and commercial sectors, is expected to drive the adoption of claddings, thereby driving market growth.

Rising consumer demand for aesthetically attractive residences, along with significant growth in single and multi-family building units due to population growth is expected to drive industry growth. Furthermore, the increasing use of lightweight materials to promote energy savings in households and workplaces is expected to drive market expansion throughout the forecast period.

Cladding Market Segmentation

Grand View Research has segmented the cladding market report based on product, application, and region:

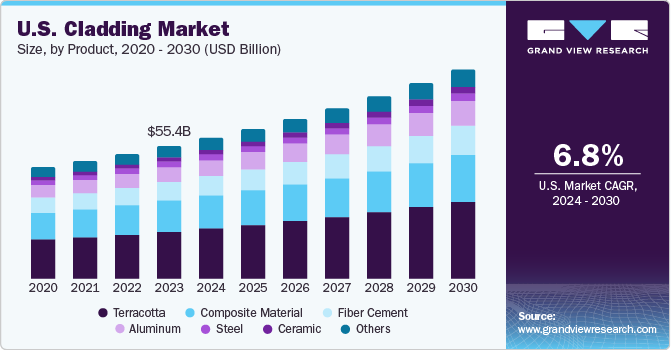

Based on the Product Insights, the market is segmented into Steel, Aluminum, Composite Materials, Fiber Cement, Terracotta, Ceramic, and Others

- Terracotta product segment led the market and accounted for more than 35% share of the global revenue in 2021. The growth can be attributed to its durability, recyclability, resistance to ultraviolet radiation, weatherproof & fireproof, and fast & easy installation properties.

- The demand for fiber cement-based cladding is likely to witness a high growth on account of its high durability, cost-effectiveness, and low maintenance cost. It is manufactured using cement, water, cellulose fiber, and pulverized limestone.

- There is an increasing demand for aluminum cladding in the construction industry, owing to its beneficial properties such as lightweight, recyclability, resistance to fungi & algae, and easy installation.

- The demand for ceramic cladding is likely to witness growth on account of its maintenance-free and pollution resistance properties as well as the ability to enhance the aesthetic appeal.

Based on the Application Insights, the market is segmented into Residential, Industrial, Commercial, Offices, and Institutional

- The office construction segment led the market and accounted for more than 33.8% of the global revenue share in 2021. The segment is inclusive of working spaces including government and private offices.

- Cladding demand is predicted to increase significantly in the residential construction sector as a result of rising consciousness about energy-efficient structures, the need for rehabilitation of old buildings, increasing over-cladding operations, and government mandates for green buildings.

- Rapid industrial expansion and increased government and private sector investment are projected to promote the growth of the industrial construction industry.

- Increasing urbanization and investments from the government in tourism and commercial construction are expected to drive the demand for claddings.

Cladding Regional Outlook

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa (MEA)

Key Companies Profile & Market Share Insights

The key players in the cladding market are manufacturers, distributors, and installers dealing in various components of the entire cladding structure. The market players are engaged in the procurement and distribution of metal frameworks, panels or facades, and insulation sheets in order to cater to the demand from the construction sector.

Some prominent players in the global Cladding market include:

- Kingspan Group

- Carea Group

- GB Architectural Cladding Products Ltd

- Rieger Architectural Products

- OmniMax International, Inc.

- CGL Systems Ltd.

- SFS Group

- Cladding Corp

- Centria

- Trespa International B.V.

- Middle East Insulation LLC

- Shildan, Inc.

- Avenere Cladding LLC

Order a free sample PDF of the Cladding Market Intelligence Study, published by Grand View Research.

No comments:

Post a Comment