Neurothrombectomy Devices Industry Overview

The global neurothrombectomy devices market size was valued at USD 617.28 million in 2021 and is anticipated to expand at a compound annual growth rate (CAGR) of 6.7% during the forecast period. Increasing incidences of acute ischemic stroke on the global scale are majorly driving the market. Furthermore, increased adoption of unhealthy lifestyles and increasing awareness of the disorder among the population is fueling the market growth.

Neurothrombectomy devices are critical in treating ischemic stroke, a commonly occurring phenomenon of stroke among older adults. Modern lifestyle, stress, and dietary habits have been observed to result in the risk of stroke among adults older than 40 years. Stroke is the leading cause of disability among the elderly with around 65% of patients requiring physical assistance/support post an episode of stroke. According to WHO, approximately 15 million people worldwide are expected to suffer from stroke, each year. Since the neurothrombectomy procedure improves functional outcomes and lowers the mortality rate in patients, therefore, it is the most preferred treatment for acute ischemic stroke. Thereby, boosting the market growth during the forecast period.

Gather more insights about the market drivers, restraints, and growth of the Global Neurothrombectomy Devices market

The outbreak of COVID-19 has negatively impacted the market by directly affecting the demand & production, creating a disruption in the supply chain and increasing the financial burden on firms. The impact of the outbreak on the market varies as per the country, depending on the local state of health systems and the actions taken to combat the pandemic. Neurocare and neurosurgeons have been adversely impacted by the pandemic. To reduce the spread of the coronavirus, brain surgeries have frequently been postponed or even canceled during this timeframe. In worst-affected nations, such as the U.S., Russia, India, Brazil, France, U.K., Italy, and Spain, neurosurgical operations decreased by 55%.

However, according to a research study “COVID-19 and Hospital: A review” published in Elsevier journal (International Hemorrhagic Hospital Association) (Jan 2021), up to 36% of hospitalized COVID-19 patients might exhibit neurological symptoms and there were several cases related to ischemic & hemorrhagic infarction. These findings also suggest that COVID-19 might enhance sales in the neurology industry, especially for neurothrombectomy devices. Thus, these factors are expected to create lucrative opportunities for the market to grow in the near future, providing profitable opportunities for key players post COVID-19.

Browse through Grand View Research's Medical Devices Industry Research Reports.

Medical Suction Devices Market - The global medical suction devices market size was valued at USD 1.0 billion in 2021 and is expected to expand at a compound annual growth rate (CAGR) of 4.6% from 2022 to 2030.

Surgical Snares Market - The global surgical snares market size was valued at USD 920.6 million in 2020 and is expected to expand at a compound annual growth rate (CAGR) of 9.4% from 2021 to 2028.

Neurothrombectomy Devices Market Segmentation

Grand View Research has segmented the global neurothrombectomy devices market, based on product, end-use, and region:

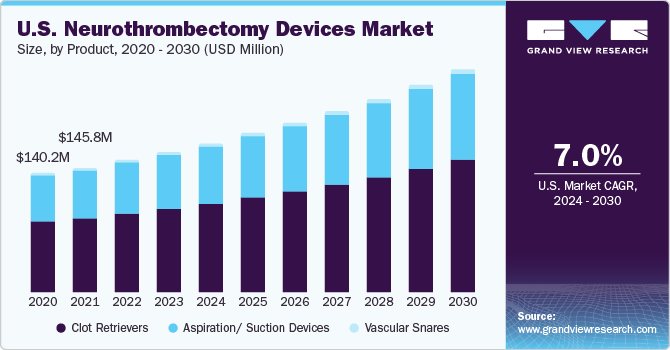

Neurothrombectomy Devices Product Outlook (Revenue, USD Million, 2018 - 2030)

- Clot Retrievers

- Aspiration/Suction Devices

- Vascular snares

Neurothrombectomy Devices End-use Outlook (Revenue, USD Million, 2018 - 2030)

- Hospitals

- Emergency Clinics

- Ambulatory Surgical Centers

Neurothrombectomy Devices Regional Outlook (Revenue, USD Million, 2018 - 2030)

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa (MEA)

Market Share Insights

April 2021: The Society of Neurointerventional Surgery (SNIS) and NeuroPoint Alliance (NPA) collaborate with the Society of Vascular and Interventional Neurology (SVIN) to the NeuroVascular Quality Initiative-Quality Outcomes Database (NVQI-QOD).

April 2019: Stryker launched the Sonopet iQ Ultrasonic Aspirator System at the American Association of Neurological Surgeons annual meeting in San Diego.

Key Companies profiled:

Some of the prominent players in the global neurothrombectomy devices market include:

- Medtronic

- Stryker Corporation

- Acandis GmbH

- Stryker

- Phenox GmbH

- Penumbra Inc.

- Vesalio

Order a free sample PDF of the Neurothrombectomy Devices Market Intelligence Study, published by Grand View Research.

No comments:

Post a Comment