High Performance Fibers Industry Overview

The global high performance fibers market size is expected to reach USD 25.32 billion by 2030, according to a new report by Grand View Research, Inc. High strength to weight ratio coupled with rigidity offered to the aerospace and automotive components by these fibers is projected to drive the market. Technologically, the key factor is the level of fiber properties that can be controlled in this product through modifications in polymer composition, the molecular weight of the polymer, ingredients choice, and method of fiber formation.

However, from the business point of view, the critical factors are high manufacturing costs, initial investment, and limited monomer supply. The drive to increase fuel efficiency and aerodynamics performance of aircraft is encouraging the manufacturers to replace traditional metal alloys with composite materials in the manufacturing of primary and secondary parts of aircraft.

High Performance Fibers Market Segmentation

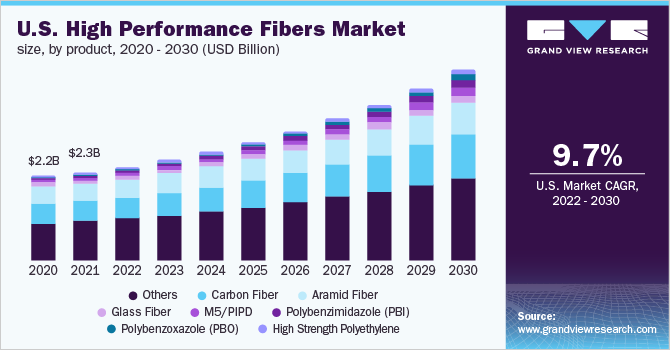

Grand View Research has segmented the global high performance fibers market based on product, application, and region:

Based on the Product Insights, the market is segmented into Carbon Fiber, Polybenzimidazole (PBI), Aramid Fiber, M5/PIPD, Polybenzoxazole (PBO), Glass Fiber, High-strength Polyethylene, and Others

- The Polybenzimidazole (PBI) fibers segment is expected to register the fastest CAGR of more than 14.00% from 2022 to 2030 owing to superior properties offered by the product, such as high glass transition temperature, no melting point, and extremely high heat deflection temperature.

- Carbon fiber was the second-largest product segment and accounted for over 22% share of the global market revenue in 2021 owing to a wide range of applications in the aerospace industry including aircraft, rockets, satellites, and missiles.

- In addition, the rising penetration of CFRCs in aircraft components, owing to their lightweight and rigidity properties, is expected to drive the demand.

Based on the Application Insights, the market is segmented into Electronics & Telecommunication, Textile, Aerospace & Defense, Construction & Building, Automotive, Sporting Goods, and Others

- The aerospace and defense application segment led the market and accounted for over 44% share of the global revenue in 2021.

- It is expected to register a steady CAGR from 2022 to 2030as the industry is moving towards lightweight materials in an attempt to improve the cost-efficiency and environmental performance of the aircraft.

- Increasing carbon fiber demand in the automotive industry is expected to drive market growth over the forecast

- The automotive application segment is projected to register a significant CAGR over the forecast period on account of the rising use of fiber-reinforced composite materials in the industry due to curb weight reduction trends.

High Performance Fibers Regional Outlook

- North America

- Europe

- Asia Pacific

- Central & South America

- Middle East & Africa (MEA)

Key Companies Profile & Market Share Insights

The competitive rivalry among manufacturers is high as the market is characterized by the presence of a large number of global and regional players. Raw material suppliers play a crucial role in the value chain as they provide basic raw materials required to initiate the manufacturing process of various fibers. The high production cost of PBO, PBI, M5/PIPD, and aramid fibers is challenging the growth and profitability of the market across the world. Other than high production cost, initial capital investment and monomer supply is further anticipated to pose a challenge to the capacity expansion of the aforementioned fibers over the forecast period.

Some prominent players in the global High Performance Fibers market include:

- Toray Industries, Inc.

- Dupont

- Teijin Limited

- Toyobo Co. Ltd

- DSM

- Kermel S.A.

- Kolon Industries, Inc.

- Huvis Corp.

Order a free sample PDF of the High Performance Fibers Market Intelligence Study, published by Grand View Research.

No comments:

Post a Comment