Veterinary Diagnostics Industry Overview

The global veterinary diagnostics market size was valued at USD 6.63 billion in 2021 and is expected to grow at a compound annual growth rate (CAGR) of 11.2% from 2022 to 2030. The growth in this market is attributed to factors, such as increased expenditure on animal health, rising incidence of zoonotic diseases & number of veterinary practitioners, technological advancement in point of care diagnostics, and increasing disposable income levels in developing regions. The growing incidence of infectious animal ailments is further poised to augment the demand for veterinary diagnostics. Moreover, advancements in diagnostics together with the growing acceptance of innovative techniques in most of the laboratories are driving the market growth.

For instance, in August 2021, FORCE Technology established a new subsidiary called AeroCollect A/S. AeroCollect technology with simple air samples offers a picture of the diseases in a herd. This is a revolution in animal diagnostics developed in Denmark by the GTS institute FORCE Technology. AeroCollect technology is presently used in the swine, poultry, and mink industries. The global COVID-19 pandemic has impacted all industries. OIE has confirmed that no animals can spread this virus. However, human-to-animal transmission has been reported in a few countries. During the COVID-19 pandemic, limited operation of veterinary clinics due to stringent lockdown norms consequently resulted in a decline in veterinary visits, thus impacting the market.

Gather more insights about the market drivers, restraints, and growth of the Global Veterinary Diagnostics market

However, the market has shown a V-shaped recovery during the 3rd quarter of 2020 due to the resumption of pet clinic visits and ease of norms. According to IDEXX, U.S. clinic visits increased by 6% in Q4 2020 from the last quarter, which is expected to drive the market growth over the forecast period. An increase in pet adoption will also support the market growth. For instance, shelters, nonprofit rescues, and private breeders all reported high consumer demand post-COVID-19 in the U.S. Strong product pipeline By IDEXX, Zoetis, and Heska Corp. is expected to propel the growth over the forecast period. For instance, Zoetis acquired Scandinavian Micro Biodevices in August 2020 to expand its revenue in veterinary diagnostics.

Moreover, veterinarians have been gradually increasing the frequency of diagnostic testing. This trend was highlighted during the COVID-19 pandemic when hospitals had to focus on essential pet services. Continued growth in the population of pets and the increased penetration of veterinary diagnostic products at veterinary clinics further promote market growth. For instance, IDEXX showed improved utilization of diagnostics supported a 21% surge in same-store diagnostic revenue per practice, and a 15% surge in same-store veterinary clinic revenue in its Q1 2021 earning call.

Increasing demand for point-of-care diagnostics is expected to further propel market growth. It provides fast results for clinical tests and can be directly assessed to save time. According to AVMA, there were around 26,000 veterinary hospitals & clinics in the U.S. in 2019 and more than 80% of them provided point-of-care testing. In June 2021, DCN Dx acquired PortaScience, Inc., a point-of-care diagnostics development corporation. With this acquisition, DCN Dx expanded its capabilities for veterinary, healthcare, and consumer markets. The aforementioned factors are expected to propel the market growth over the forecast period.

Browse through Grand View Research's Animal Health Industry Research Reports.

Pet Dental Health Market - The global pet dental health market size was valued at USD 5.9 billion in 2021 and is expected to expand at a compound annual growth rate (CAGR) of 6.18% from 2022 to 2030.

Pet Grooming Services Market - The global pet grooming services market size was estimated at USD 5.38 billion in 2021 and is anticipated to grow at a compound annual growth rate (CAGR) of 7.09% from 2022 to 2030.

Veterinary Diagnostics Market Segmentation

Grand View Research has segmented the global veterinary diagnostics market on the basis of product, species, testing type, disease type, end-use, and region:

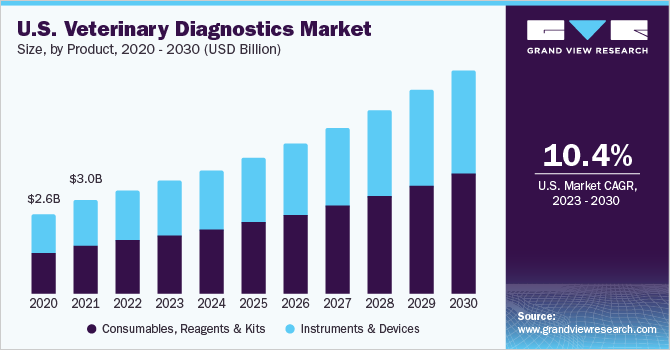

Veterinary Diagnostics Product Outlook (Revenue, USD Million, 2017 - 2030)

- Consumables, Reagents & Kits

- Instruments & Devices

Veterinary Diagnostics Species Outlook (Revenue, USD Million, 2017 - 2030)

- Cattle

- Canine

- Feline

- Caprine

- Equine

- Ovine

- Porcine

- Avian

- Others

Veterinary Diagnostics Testing Type Outlook (Revenue, USD Million, 2017 - 2030)

- Analytical Services

- Diagnostic Imaging

- Bacteriology

- Pathology

- Molecular Diagnostics

- Immunoassays

- Parasitology

- Serology

- Virology

Veterinary Diagnostics Disease Type Outlook (Revenue, USD Million, 2017 - 2030)

- Infectious Diseases

- Non-Infectious Diseases

- Hereditary, Congenital & Acquired Diseases

- General Ailments

- Structural & Functional Diseases

Veterinary Diagnostics End-use Outlook (Revenue, USD Million, 2017 - 2030)

- Laboratories

- Veterinary Hospitals & Clinics

- Point-Of-Care/In-House Testing

- Research Institutes & Universities

Veterinary Diagnostics Regional Outlook (Revenue, USD Million, 2017 - 2030)

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

Market Share Insights

November 2021: FUJIFILM Europe aims to expand its veterinary diagnostic customer portfolio with products and services with the purchase of DMV Imaging. DMV Imaging, headquartered in Lyon, France, has specialized in offering veterinary POC laboratory diagnostics.

March 2021: Zomedica Corp., a veterinary health corporation producing point-of-care diagnostics products for cats and dogs, recorded the first veterinarian sale of TRUFORMA and officially entered commercialization.

Key Companies profiled:

Some of the prominent players in the global veterinary diagnostics market include:

- Zoetis

- Heska Corp.

- IDEXX Laboratories Inc.

- Agrolabo S.p.A.

- IDvet

- Virbac

- Thermo Fisher Scientific Inc.

- Neogen Corp.

- Covetrus

- iM3Vet Pty Ltd.

Order a free sample PDF of the Veterinary Diagnostics Market Intelligence Study, published by Grand View Research.

No comments:

Post a Comment