North America Breast Reconstruction Industry Overview

The North America breast reconstruction market size was valued at USD 206.10 million in 2021 and is projected to expand at a compound annual growth rate (CAGR) of 6.69% from 2022 to 2030. Rising breast cancer patients and an increase in the number of breast reconstruction surgeries are the major factors driving the market. Moreover, the availability of reimbursement policies with respect to breast reconstruction is further boosting the North America breast reconstruction market.

The incidence rate of breast cancer has increased considerably in the past two decades. For instance, as per Cancer.net, from the mid-2000s, invasive breast cancer in women has increased approximately by half a percent every year. Moreover, as per a similar source, it is estimated that 287,850 women in the U.S. are expected to be diagnosed with invasive breast cancer in 2022.

Gather more insights about the market drivers, restraints, and growth of the North America Breast Reconstruction market

Additionally, as per the Canadian Cancer Society, breast cancer is the most common cancer among Canadian women. For instance, according to a similar source, it is estimated that 27,700 Canadian women were expected to be diagnosed with breast cancer. Moreover, 13.0% of the women were expected to die from breast cancer. To minimize the risk of breast cancer, many women opt for mastectomy & lumpectomy procedures; as a result, the demand for breast reconstruction products is anticipated to increase throughout the forecast period.

The growing adoption of breast reconstruction procedures is another factor responsible to drive the North America breast reconstruction market. For instance, American Society of Plastic Surgeons, the overall breast reconstruction procedures were calculated to be 137,808in 2020, which is 75.0% more than the breast reconstruction surgeries, held in 2000. Thus, the growing demand for breast reconstruction procedures may boost the North America breast reconstruction market, during the forecast period.

The COVID-19 pandemic was anticipated to have a negative impact on the North America breast reconstruction market. This can be attributed to the termination & delay of elective treatments including breast reconstruction. However, as the cases of COVID-19 have reduced, and vaccination has started globally, elective surgery for breast reconstruction is expected to take place. This may push the market growth during the forecast period. Moreover, to cope with the demand, and have a larger patient reach, many companies adopted strategies such as raising awareness campaigns, partnerships, and product approvals.

Besides, some companies opted for clinical trials during the post-pandemic period, which was expected to boost the North America breast reconstruction market growth. For instance, in March 2021, Surgical Innovation Associates initiated a clinical trial under an Investigational Device Exemption from the U.S. FDA, which accessed the durability & effectiveness of their product Dura Sorb. This was expected to drive the company’s market growth.

Browse through Grand View Research's Healthcare IT Industry Research Reports.

Breast Imaging Market - The global breast imaging market size was valued at USD 4.7 billion in 2022 and is projected to expand at a compound annual growth rate (CAGR) of 8.6% from 2023 to 2030.

Breast Implants Market - The global breast implants market size was valued at USD 2.17 billion in 2021 and is expected to witness a compound annual growth rate (CAGR) of 7.4% during the forecast period.

North America Breast Reconstruction Market Segmentation

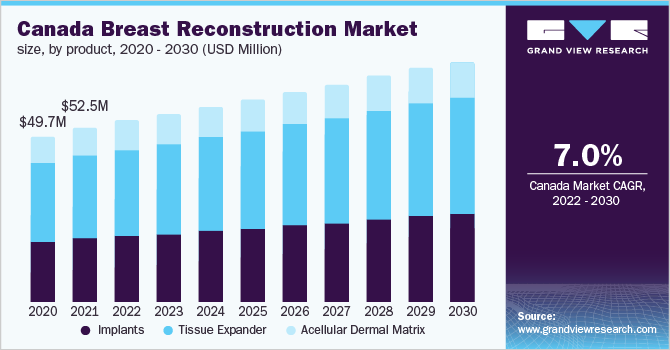

Grand View Research has segmented the North America breast reconstruction market report based on the product, shape, end-use, and region:

North America Breast Reconstruction Product Outlook (Revenue, USD Million, 2018 - 2030)

- Implants

- Tissue Expander

- Acellular Dermal Matrix

North America Breast Reconstruction Shape Outlook (Revenue, USD Million, 2018 - 2030)

- Round Shape

- Anatomical Shape

North America Breast Reconstruction End-use Outlook (Revenue, USD Million, 2018 - 2030)

- Hospitals

- Cosmetology Clinics

- Ambulatory Surgical Centers

Market Share Insights

October 2021: Sientra, Inc. and Mission Plasticos launched a nationwide Reshaping Lives: Full Circle program, to provide reconstructive breast surgery for women living in poverty.

April 2021: Sientra, Inc. and the Butterfly Network announced a strategic partnership to improve diagnostic surveillance of breast implant patients. This was expected to help the company to strengthen its safety profile, which was backed by the Platinum20 warranty program.

Key Companies profiled:

Some of the key players in the North America breast reconstruction market include:

- Mentor Medical Systems B.V. (Johnson & Johnson)

- Abbvie (Allergan Inc.)

- Integra Life sciences Corporation

- Sientra, Inc.

- Ideal Implant Incorporated

- Stryker Corporation

- Establishment Labs Holding, Inc. (Motiva USA LLC)

- RTI Surgical

- MTF Biologics

- SIA (Surgical Innovation Associates)

- Tela Bio, Inc.

Order a free sample PDF of the North America Breast Reconstruction Market Intelligence Study, published by Grand View Research.

No comments:

Post a Comment