Implantable Cardiac Rhythm Management Device Industry Overview

The global implantable cardiac rhythm management device market size was valued at USD 17.04 billion in 2021 and is expected to expand at a compound annual growth rate (CAGR) of 6.2% from 2022 to 2030. The increasing prevalence of cardiac disorders, growing geriatric population base, and technological advancements are the major factors leading to the market growth. Furthermore, supportive legislative regulations, favorable reimbursement policies, and technological advancements are anticipated to drive the market globally over the forecast period.

The COVID-19 pandemic has impacted all industries, including the market for implantable cardiac rhythm management (CRM) devices. Market players have experienced significant losses in their CRM segments due to the postponement of cardiovascular procedures. For instance, Medtronic experienced a 12% decrease in its CRM devices segment in 2020, as compared to 2019. The decline was majorly experienced in ICDs, CRT-Ds, and the pacemakers segment. In 2021, Medtronic is recovering in terms of its annual revenue as well as cardiac rhythm and heart failure segment revenue. The company experienced a rise of 4.16% in its total revenue from 2020 to 2021.

Gather more insights about the market drivers, restraints, and growth of the Global Implantable Cardiac Rhythm Management Device market

According to the Center for Diseases Control and Prevention (CDC), as of February 2022, Cardiovascular diseases (CVDs) are a major cause of mortality in the U.S. One-fourth of all deaths are likely to be caused by CVDs. Stroke and ischemic heart disease are the major causes of more than 80% of all CVD-related deaths. According to a report published by the CDC in 2017, CVDs accounted for about 800,000 lives lost in the U.S. In addition, Coronary Heart Disease (CHD) accounted for the majority of CVD deaths, followed by heart failure and stroke with the economic burden of CVDs likely to be around USD 1,044 billion by 2030.

Favorable reimbursement policies, such as the U.S. Medicare system, are among the major factors driving the implantable cardiac rhythm management device market. For instance, Medicare Physician Fee Schedule Final Rule 2019 is expected to provide reimbursement for implantation and removal of a pacemaker, reducing the overall cost of surgery for the patients. Reimbursement can be availed for devices such as single-chamber, dual-chamber, and biventricular pacemakers.

Increasing demand to enhance patients' lives and improve outcomes of various cardiac procedures with the most advanced and minimally invasive technologies is the major factor fueling the growth of the market for cardiac monitoring and cardiac rhythm management. Moreover, favorable reimbursement policies, such as those introduced by the U.S. Medicare system, are among the major factors driving the market for cardiac monitoring and cardiac rhythm management.

Browse through Grand View Research's Medical Devices Industry Research Reports.

Pacemakers Market - The global pacemakers market size was valued at USD 4.4 billion in 2021 and is estimated to expand at a compound annual growth rate (CAGR) of 3.4% from 2022 to 2030.

Cardiac Rhythm Management Devices Market - The global cardiac rhythm management devices market size was valued at USD 18.8 billion in 2022 and is estimated to expand at a compound annual growth rate (CAGR) of 5.50% from 2023 to 2030.

Implantable Cardiac Rhythm Management Devices Market Segmentation

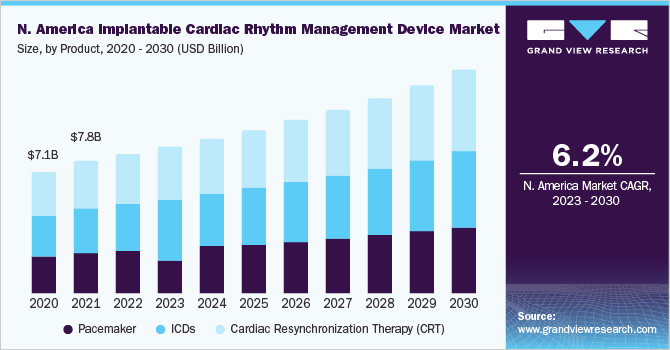

Grand View Research has segmented the global implantable cardiac rhythm management devices market on the basis of product, end use, and region:

Implantable CRM Devices Product Outlook (Revenue, USD Million, 2017 - 2030)

- Pacemaker

- ICDs

- CRT

Implantable CRM Devices End-use Outlook (Revenue, USD Million, 2017 - 2030)

- Hospitals

- Specialty Cardiac Centers

- Others

Implantable CRM Devices Regional Outlook (Revenue, USD Million, 2017 - 2030)

- North America

- Europe

- Asia Pacific

- Latin America

- MEA

Market Share Insights

October 2020: Abbott launched its new ICD and CRT-D in India, hence expanding its product portfolio in the country.

Key Companies profiled:

Some prominent players in the global implantable cardiac rhythm management device market include

- Stryker

- Schiller AG

- Medtronic

- Abbott

- Boston Scientific Corporation

- Koninklijke Philips N.V.

- Zoll Medical Corporation

- BIOTRONIK

- Nihon Kohden Corporation

- Microport Scientific Corporation

Order a free sample PDF of the Implantable Cardiac Rhythm Management Device Market Intelligence Study, published by Grand View Research.

No comments:

Post a Comment