Nuclear Decommissioning Services Industry Overview

The global nuclear decommissioning services market size is expected to be valued at USD 9.42 billion by 2030, according to a new report by Grand View Research, Inc., exhibiting a 5.1% CAGR during the forecast period. Global nuclear phase-out and rising support from government’s post-nuclear accidents are among the major factors expected to fuel market growth in upcoming years.

The rise in public safety concerns due to hazardous consequences of nuclear accidents is set to actuate market demand in the coming years. In addition, increasing sustainability concerns are likely to positively impact market growth. The transitioning trend toward renewable energy, owing to various government initiatives and regulations is also projected to promote nuclear decommissioning services throughout the forecast period. Due to the Covid-19, the nuclear sector faced a few challenges such as unavailability of the workers, restrictions on the number of on-site workers, and disruption in supply chains.

Nuclear Decommissioning Services Market Segmentation

Grand View Research has segmented the global nuclear decommissioning services market based on the reactor type, strategy, and region:

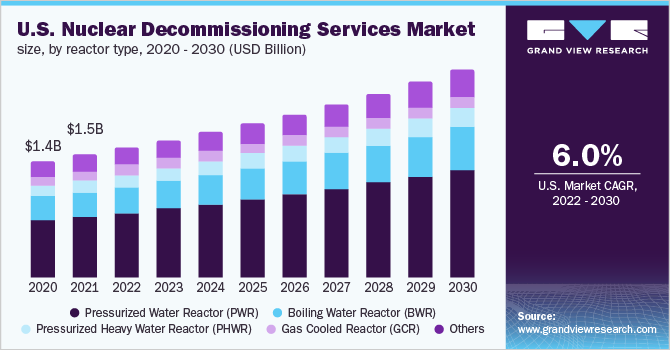

Based on the Reactor Type Insights, the market is segmented into Pressurized Water Reactor (PWR), Boiling Water Reactor (BWR), Pressurized Heavy Water Reactor (PHWR), Gas Cooled Reactor (GCR), and Others

- Pressurized water reactors held the maximum share in the global nuclear decommissioning services market in 2021.

- PWRs are highly preferred by industry operators due to the factors such as a high level of stability and ease of operation. This segment is also projected to exhibit the strongest growth rate during the forecast period due to its widespread use and installation.

Based on the Strategy Insights, the market is segmented into Immediate Dismantling, Deferred Dismantling, and Entombment

- Deferred dismantling is expected to be the fastest-growing segment during the forecast period due to reduced levels of radiation as compared to other methods.

- Rise in the global shutdown of nuclear reactors, especially in Europe, the immediate dismantling of reactors soon after the shutdown has dominated the market.

Nuclear Decommissioning Services Regional Outlook

- North America

- Europe

- Asia Pacific

- South & Central America

- Middle East & Africa (MEA)

Key Companies Profile & Market Share Insights

In June 2019, AECOM signed an alliance agreement with Japan-based Toshiba Corporation, a multinational conglomerate, to work on nuclear reactor decommissioning in Japan. It aims to offer decommissioning services for nuclear reactors and facilities of Japanese government organizations and commercial power utilities with this partnership.

Providers of nuclear decommissioning services continue to focus on innovation and technological advancements in dismantling techniques to deliver enhanced performance. Such developments, coupled with competitive pricing, are likely to assist them in increasing their market share during the forecast period. Companies are investing profoundly in research and development to overcome barriers faced while decommissioning nuclear facilities.

In April 2022, Westinghouse Electric Company LLC announced the signing of an agreement for the acquisition of U.S.-based BHI Energy, a company providing services in power generation and delivery. Westinghouse Electric Company LLC aims to expand its expertise and capabilities in nuclear plant modification and maintenance, and other such services with this acquisition.

Some prominent players in the global Nuclear Decommissioning Services market include:

- Babcock International Group PLC

- Orano Group

- Studsvik AB

- Westinghouse Electric Company LLC

- AECOM

- Bechtel Corporation

- Jacobs (CH2M Hill Company Ltd.)

- Magnox Ltd

- GE Hitachi Nuclear Energy

- Ansaldo Energia

Order a free sample PDF of the Nuclear Decommissioning Services Market Intelligence Study, published by Grand View Research.

No comments:

Post a Comment