Indian Clinical Trials Industry Overview

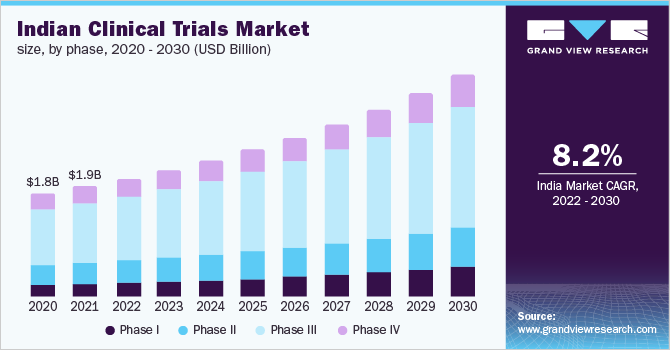

The Indian clinical trials market size was valued at USD 1.93 billion in 2021 and is expected to expand at a compound annual growth rate (CAGR) of 8.2% from 2022 to 2030. The globalization of clinical trials, adoption of new technology in clinical research, growing disease variation and prevalence, and increasing research and development promoting outsourcing are the key factors estimated to drive the market.

The government in this country is taking active initiatives to improve the R&D activities, which is expected to promote the growth of the market. Apart from this, in October 2021, the Department of Pharmaceuticals (India) proposed a new policy to reduce the time required for the approval of innovative products by at least 50% within the next two years, to improve the R&D activities in the country. Such initiatives are anticipated to further propel the growth of the market.

Gather more insights about the market drivers, restraints, and growth of the Indian Clinical Trials market

The digitalization of clinical trials is expected to have a positive impact on market growth. Digitalization has enabled streamlining of several trial processes such as data capture, regulatory compliance, logistics and supplies management, and others. Furthermore, with the introduction of digital therapeutics, real-time data acquisition related to safety and toxicity is becoming increasingly easy, thereby promoting timely rectification in trial design and facilitating market growth. The cost of clinical trials in India is nearly half of that incurred in the U.S. and Europe. Thus, the cost efficiency and a large treatment-naïve patient pool offered by the county are anticipated to drive the market.

The outbreak of the COVID-19 pandemic has created a catastrophic situation across the world and India faced no different scenario. The initial period of the pandemic has created a halt in research and development activities across the country due to factors such as disruption in the supply chain and the shutdown of manufacturing plants for a certain timeframe, thereby creating obstacles in the path of clinical research being conducted. Moreover, the implemented lockdown has created a reduction in the number of patient trials conducted across the country.

However, the COVID-19 pandemic had created an urgent need for treatments and vaccines, owing to which a significant number of clinical trials were performed in the country post-2021, thus reflecting a rebound in the total number of trials conducted across India. For instance, in November 2021, U.S.-based Akston Biosciences announced that it is about to start the clinical trial for its second-generation COVID-19 vaccine ‘AKS-452’ in India. Similarly, in April 2021, the Ministry of Ayush and Council of Scientific & Industrial Research in India announced that it completed a multi-center clinical trial of AYUSH 64 drug used for the treatment of mild-to-moderate COVID-19 infections in the country. The rise in the number of clinical trials for COVID-19 post-2020 is likely to have a positive impact on the market growth from 2021.

Browse through Grand View Research's Medical Devices Industry Research Reports.

Rare Disease Clinical Trials Market - The global rare disease clinical trials market size was valued at USD 11,455.0 million in 2022 and is expected to expand at a compound annual growth rate (CAGR) of 9.7% from 2023 to 2030.

Neurology Clinical Trials Market - The global neurology clinical trials market size was valued at USD 5,235.8 million in 2022 and is expected to expand at a compound annual growth rate (CAGR) of 5.6% from 2023 to 2030.

Indian Clinical Trials Market Segmentation

Grand View Research has segmented the Indian clinical trials market on the basis of phase, study design, indication and end user:

Indian Clinical Trials Phase Outlook (Revenue, USD Million, 2018 - 2030)

- Phase I

- Phase II

- Phase III

- Phase IV

Indian Clinical Trials Study Design Outlook (Revenue, USD Million, 2018 - 2030)

- Interventional Trails

- Observational Trails

- Expanded Access Trails

Indian Clinical Trials Indication Outlook (Revenue, USD Million, 2018 - 2030)

- Autoimmune/Inflammation

- Pain Management

- Oncology

- CNS Condition

- Diabetes

- Obesity

- Cardiovascular

- Others

India Clinical Trials End User Outlook (Revenue, USD Million, 2018 - 2030)

- Pharmaceutical & Biopharmaceutical Companies

- Medical Device Companies

- Others

Market Share Insights

December 2021: Aragen Life Sciences, an India-based CRO, acquired Intox Pvt. Ltd. in Maharashtra, India to expand Aragen’s end-to-end integrated discovery and development platform for biotechnology, pharmaceuticals, and other industries.

February 2020: India-based clinical stage company, Aurigene collaborated with a biotechnology companyCuris, Inc. As per the terms of the collaboration, Aurigene provided funding for conducting Phase 2b/3 randomized study on evaluating the effect of CA-170 in patients with non-squamous non-small cell lung cancer (nsNSCLC).

Key Companies profiled:

Some prominent players in the Indian clinical trials market include:

- IQVIA HOLDINGS INC.

- PAREXEL International Corporation

- Pharmaceutical Product Development (PPD) LLC

- Charles River Laboratory

- ICON PLC

- PRA Health Inc.

- Chiltern International LTD.

- Syneos Health Inc.

- SGS SA

- Syngene International Limited

- Aurigene Discovery Technologies Limited

- Aragen Life Sciences

- Abiogenesis Clinpharm Pvt Ltd

- Accelsiors

- Accutest Global.

- Clario

- Cliantha Research

- Cliniminds

- CliniRx

- JSS Medical Research

Order a free sample PDF of the Indian Clinical Trials Market Intelligence Study, published by Grand View Research.

No comments:

Post a Comment