The global holter monitors market size was estimated at USD 1.45 billion in 2022 and is projected to reach USD 3.05 billion by 2030, growing at a CAGR of 9.7% from 2023 to 2030. The market growth is driven by the increasing prevalence of atrial fibrillation (AFib), an aging population, and a rising incidence of cardiovascular diseases (CVD). Additionally, a growing preference for ambulatory monitoring, technological innovations, enhanced arrhythmia detection capabilities, and supportive regulatory policies are further propelling market expansion.

AFib, a common and often underdiagnosed heart rhythm disorder, requires continuous monitoring for accurate diagnosis and management. The European Society of Cardiology (ESC), in its 2023 guidelines, recommended 24–48-hour Holter monitoring for identifying AFib and non-sustained ventricular tachycardia (NSVT) in hypertrophic cardiomyopathy (HCM) patients, fueling demand. Moreover, extended ECG monitoring has proven effective in detecting AFib in individuals with cryptogenic stroke or post-pulmonary vein isolation, strengthening market momentum.

According to the Centers for Disease Control and Prevention (CDC), in 2021, coronary artery disease (CAD) accounted for 375,476 deaths, with about 5% of adults aged 20 and above suffering from CAD. Nearly 20% of CAD-related deaths occurred in individuals under 65, underscoring the need for continuous heart monitoring. Similarly, the American Heart Association (AHA) reported in 2023 that 70% of the elderly population is at risk of CVD, creating demand for pacemakers and complementary monitoring devices such as Holter monitors. These devices also play a vital role in evaluating the performance of leadless pacemakers and detecting irregularities during daily activities.

Key Market Trends & Insights

- North America dominated the market with the largest share of 42.8% in 2022.

- By component, the wired segment led with a 63.54% revenue share in 2022.

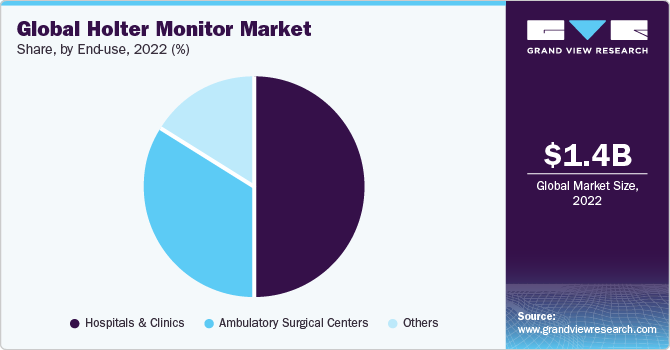

- By end-use, hospitals & clinics held the largest share at 50.42% in 2022.

Download a free sample PDF of the Holter Monitor Market Intelligence Study, published by Grand View Research.

Download a free sample PDF of the Holter Monitor Market Intelligence Study, published by Grand View Research.

Market Performance

- 2022 Market Size: USD 1.45 Billion

- 2030 Projected Market Size: USD 3.05 Billion

- CAGR (2023–2030): 9.7%

- North America: Largest market in 2022

- Asia Pacific: Fastest growing market

Competitive Landscape

Key players are pursuing strategies such as new product launches, expansions, acquisitions, collaborations, and product upgrades. In March 2023, Koninklijke Philips N.V. presented research findings at the World Congress of Cardiology demonstrating that extending monitoring duration using its ePatch Holter device increased clinically actionable findings by two times after 7 days and 2.5 times after 14 days. This underscores the strong growth potential of extended monitoring technologies, prompting further investigation into their diagnostic impact.

Key Companies

- Koninklijke Philips N.V.

- GE HealthCare

- Hill-Rom Holdings, Inc.

- Spacelabs Healthcare (OSI Systems, Inc.)

- SCHILLER AG

- Bittium

- Lepu Medical Technology (Beijing) Co., Ltd.

- BPL Medical Technologies

- Biotricity

- Nitto Denko Corporation

Explore Horizon Databook – the world’s most comprehensive market intelligence platform by Grand View Research.

Conclusion

The holter monitors market is witnessing strong momentum due to the growing global burden of heart-related disorders and the need for real-time cardiac monitoring. Continuous advancements in wearable and wireless monitoring technologies are enhancing diagnostic accuracy and patient comfort. Supportive healthcare policies, expanding geriatric populations, and increased awareness of preventive cardiac care further strengthen market potential. Moreover, ongoing research and product innovation by leading players are set to make Holter monitoring an indispensable tool in modern cardiovascular diagnostics.

No comments:

Post a Comment