The global reverse mortgage market was valued at USD 1.83 billion in 2023 and is projected to reach USD 2.71 billion by 2030, growing at a CAGR of 5.9% from 2024 to 2030. The market’s growth is primarily driven by an aging global population, rising retirement funding needs, and increasing home values and equity.

Growing awareness and education surrounding reverse mortgages are further boosting their adoption, as more retirees recognize the financial stability these products can provide. With better understanding, seniors are increasingly viewing reverse mortgages as a strategic tool for maintaining independence and securing supplemental income during retirement.

The global population is aging rapidly, with the number of individuals aged 65 years and above expected to double by 2050. This demographic shift is a key factor fueling demand for reverse mortgages, as retirees seek additional income sources to support daily living and cover escalating healthcare expenses. Given that home equity remains one of the largest financial assets for seniors, reverse mortgages offer a way to unlock this value without the need to sell or vacate their homes. As the need for alternative retirement funding solutions continues to rise, the market is expected to expand steadily over the forecast period.

Reverse mortgage providers are focusing on innovation and product diversification to better cater to the evolving needs of borrowers. The introduction of flexible loan options, such as adjustable-rate and jumbo reverse mortgages for high-value properties, has broadened the market’s reach. Additionally, simplified application procedures and enhanced consumer education initiatives have reduced the stigma surrounding reverse mortgages, making them more accessible to a wider demographic.

Technological advancements, including virtual consultations, automated underwriting, and digital document management, have streamlined the borrowing process, cutting processing times and increasing transparency. These innovations not only attract tech-savvy seniors but also make reverse mortgages more efficient and user-friendly, further driving market growth.

Key Market Trends & Insights

- North America accounted for the largest market share of 35.2% in 2023.

- By type, the Home Equity Conversion Mortgages (HECMs) segment dominated the market, holding an 81.8% share of global revenue in 2023.

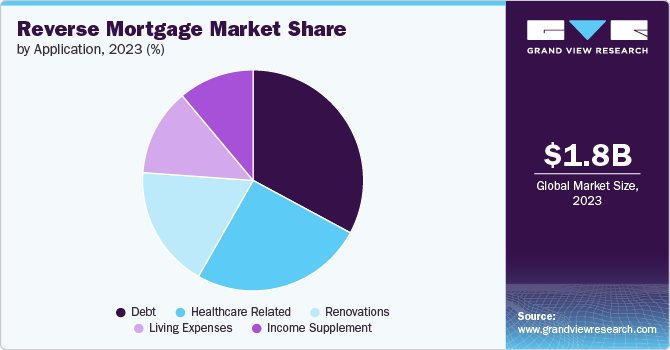

- By application, the debt segment led the market in 2023.

Download a free sample PDF of the Reverse Mortgage Market Intelligence Study, published by Grand View Research.

Market Performance

- 2023 Market Size: USD 1.83 Billion

- 2030 Projected Market Size: USD 2.71 Billion

- CAGR (2024–2030): 5.9%

- Leading Region (2023): North America

Competitive Landscape

Leading players in the reverse mortgage market are pursuing strategies such as product innovation, geographic expansion, and strategic partnerships to strengthen their market position and gain a competitive edge.

Recent Developments

- April 2024: Portfolio+ Inc., a Canadian financial technology provider, expanded its lending solutions by launching a new reverse mortgage product. This offering enables lenders to serve clients aged 55 and older, allowing them to access tax-free home equity as part of their retirement planning. The initiative enhances Portfolio+’s position as a comprehensive provider of financial services systems and technologies.

Key Companies

- American Advisors Group

- Finance of America Reverse

- Reverse Mortgage Funding

- Liberty Home Equity Solutions

- One Reverse Mortgage

- Mutual of Omaha Mortgage

- HighTechLending

- Fairway Independent Mortgage Corporation

- Open Mortgage

- Longbridge Financial

Explore Horizon Databook – the world’s most comprehensive market intelligence platform by Grand View Research.

Conclusion

The global reverse mortgage market is poised for steady expansion, supported by demographic trends, rising property values, and increasing demand for retirement income solutions. As financial institutions continue to innovate and streamline offerings, reverse mortgages are expected to become an increasingly vital tool for senior financial planning, contributing to sustainable growth across global markets.

No comments:

Post a Comment