The global payment instruments market was valued at USD 111.97 billion in 2021 and is projected to reach USD 364.86 billion by 2030, expanding at a compound annual growth rate (CAGR) of 14.3% from 2022 to 2030. This growth is primarily attributed to the rising adoption of digital payment platforms such as mobile banking, personal finance management, and digital wallets.

The increasing development and usage of non-cash payment instruments, including mobile wallets, credit cards, and smart cards, are expected to further drive market expansion. Additionally, the widespread use of smartphones has significantly boosted the adoption of mobile wallet applications, contributing to the overall growth of the industry.

The rapid digitalization of the banking sector has accelerated the deployment of digital payment systems, enhancing the demand for mobile wallets and other electronic payment tools. Moreover, the rise in digital transactions has helped reduce bank operational costs, further fueling market growth. Several financial institutions, including Wells Fargo and Bank of America, have witnessed an increase in digital banking usage. For instance, in the U.S., bank loan sales via digital channels accounted for 61% in February 2021, marking a notable increase from the previous year.

The growing consumer inclination toward cashless payments, owing to the convenience and efficiency they offer, is expected to strengthen the demand for payment instruments over the forecast period. Furthermore, the increasing adoption of digital payment solutions among younger generations continues to support market growth. According to a Business Wire survey, 71% of Gen Z globally prefer cashless payment methods, while 68% of millennials have already adopted such solutions.

Key Market Trends & Insights

- North America accounted for the largest revenue share of over 31.0% in 2021.

- By type, the desktop segment held the largest revenue share of over 39.0% in 2021.

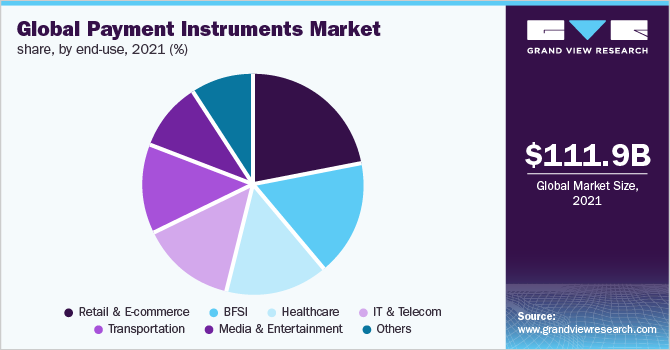

- By end-use, the retail & e-commerce segment represented the largest revenue share of more than 22.0% in 2021.

Download a free sample PDF of the Payment Instruments Market Intelligence Study, published by Grand View Research.

Market Performance

- 2021 Market Size: USD 111.97 Billion

- 2030 Projected Market Size: USD 364.86 Billion

- CAGR (2022–2030): 14.3%

- North America: Largest market in 2021

- Asia Pacific: Fastest growing market

Competitive Landscape

The market is highly competitive, characterized by the presence of several leading players. Companies are pursuing strategies such as new product launches, strategic partnerships, and geographic expansion to strengthen their market presence.

For example, in March 2022, NCR Corporation, a global technology solutions provider, acquired Spoke Technologies Limited’s fintech property rights for Open Banking. This acquisition supports NCR’s expansion into open and international digital banking, adding data integration capabilities to enhance personalization and customer-led experiences.

Players are also engaging in mergers and acquisitions to broaden their offerings and reach. In March 2022, PhonePe acquired GigIndia to enhance its service portfolio for business and corporate clients, enabling them to access blue-collar talent via GigIndia’s platform.

Key Companies

- NCR Corporation

- Ingenico

- PAX Technology

- Verifone, Inc.

- Newland Payment Technology

- Fiserv, Inc.

- Castles Technology

- Clover Network, LLC

- Equinox Payment

- Dspread Technology (Beijing) Inc.

Explore Horizon Databook – the world’s most comprehensive market intelligence platform by Grand View Research.

Conclusion

The global payment instruments market continues to experience strong growth, supported by rapid digitalization, the proliferation of mobile technologies, and increasing consumer demand for cashless and convenient payment solutions.

No comments:

Post a Comment