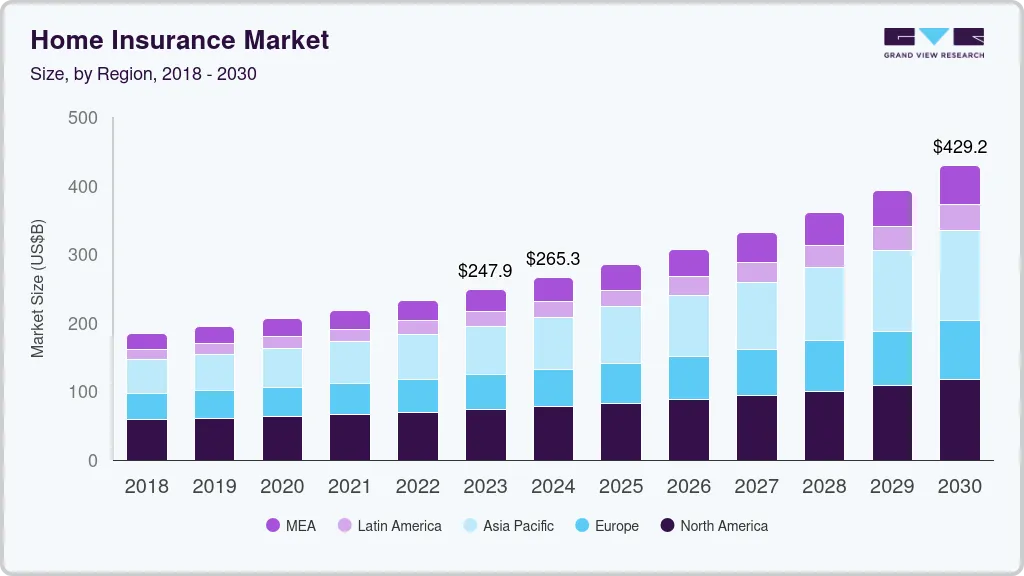

The global home insurance market size was estimated at USD 247.92 billion in 2023 and is projected to reach USD 429.24 billion by 2030, growing at a CAGR of 8.3% from 2024 to 2030. Home insurance, also referred to as household or homeowner’s insurance, provides financial protection against property damage, loss, and liability. The market is driven by growing demand for customized insurance products, rising awareness of homeownership risks, and the adoption of technology-enabled solutions such as AI, blockchain, data analytics, and geolocation to enhance services and customer experience.

Urbanization and the expansion of residential real estate, especially in developing regions, are further boosting demand for home insurance. Insurance providers are offering flexible coverage options and leveraging digital transformation to improve distribution, manage renter’s insurance, and provide personalized services.

Key Market Trends & Insights

- North America home insurance market is expected to experience significant growth.

- The U.S. market is projected to register substantial growth.

- Comprehensive coverage led the market with 38.2% of global revenue in 2023.

- Brokers accounted for the largest distribution channel revenue share.

- Landlords held a significant end-use market revenue share.

Download a free sample PDF of the Home Insurance Market Intelligence Study, published by Grand View Research.

Market Performance

- 2023 Market Size: USD 247.92 Billion

- 2030 Projected Market Size: USD 429.24 Billion

- CAGR (2024–2030): 8.3%

Competitive Landscape

The home insurance market is highly competitive, with traditional insurers and new entrants offering innovative, technology-driven, and customer-focused solutions. Expansion strategies include entering new regions and gaining regulatory approvals to write multi-peril insurance lines, as exemplified by Tailrow Insurance Company’s entry into Florida in April 2023.

Key Companies

- Zurich

- Chubb

- American International Group, Inc.

- Liberty Mutual Insurance

- Admiral

- State Farm Mutual Automobile Insurance Company

- Allstate Insurance Company

- Allianz

- PICC

- Nationwide

Explore Horizon Databook – the world’s most comprehensive market intelligence platform by Grand View Research.

Conclusion

The home insurance market is witnessing robust growth driven by increasing homeownership, urbanization, and demand for tailored insurance solutions. Technological innovations are enhancing service delivery and customer engagement, while competition among insurers is expanding coverage options and improving accessibility. Ongoing digital transformation and strategic market expansions are expected to further strengthen the market landscape and provide consumers with more comprehensive protection.

No comments:

Post a Comment