Enhanced Oil Recovery Industry Overview

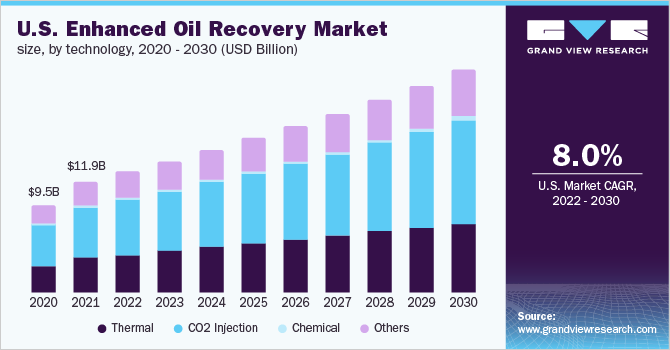

The global enhanced oil recovery market size is expected to reach USD 76.78 billion by 2030, according to a new report by Grand View Research, Inc. The market is expected to expand at a CAGR of 7.8% from 2022 to 2030. A growing number of aging wells witnessing declining production rates, coupled with rising government investment in research and development activities, is likely to drive the market for enhanced oil recovery (EOR) over the forecast period.

A rise in environmental concerns regarding carbon emissions has resulted in enhancing the demand for carbon capture and storage (CCS), which has emerged as a viable solution to limit carbon emissions. These factors are expected to positively impact the market growth as captured carbon in CCS projects is usually utilized by oil and gas companies for CO2 injection EOR technology.

Enhanced Oil Recovery Market Segmentation

Grand View Research has segmented the global enhanced oil recovery market based on technology, application, and region:

Based on the Technology Insights, the market is segmented into Thermal, CO2 Injection, Chemical, and Others

- The thermal segment occupied the largest revenue share of over 35.0% in 2021. The method entails the application of heat to the oil wells for lowering the oil viscosity and increasing its mobility ratio.

- CO2 injection technology injects CO2 into the rock pores to recover the crude oil. Carbon Dioxide (CO2) is miscible with crude oil and is comparatively less expensive than other similar miscible fluids used for these applications, making it a preferred choice for EOR applications.

- In addition, this method provides highly significant environmental benefits, thereby driving the demand for CO2 injection technology in the market in the forecast period.

- Chemical EOR technology involves the use of polymers and surfactants, which are injected into the oil well, which reduces interfacial pressure and enhances flooded viscosity, thereby increasing the production from the oil well.

Based on the Application Insights, the market is segmented into Onshore and Offshore

- The onshore segment occupied the largest revenue share of over 90.0% in 2021 owing to the significant presence of onshore exploration and production projects across the world.

- The steady development of the existing offshore wells, particularly in the South China Sea, the Persian Gulf, the North Sea, and the Gulf of Mexico, is expected to drive the offshore segment over the forecast period.

- However, the offshore oil industry is expected to witness sluggish growth due to high capital investments and operating costs, coupled with the pandemic impact. These factors will cause hindrance in the growth of the offshore oil industry.

- However, the ongoing technological advancements in the offshore segment are anticipated to boost the growth of the offshore segment in the forecast period

Enhanced Oil Recovery Regional Outlook

- North America

- Europe

- Asia Pacific

- South & Central America

- Middle East & Africa (MEA)

Key Companies Profile & Market Share Insights

The EOR market is highly competitive and moderately consolidated with the presence of giant, multinational, and experienced players. Oil and gas exploration companies procure raw materials such as polymer, carbon dioxide, nitrogen, and others from specialized vendors. The technologies used in EOR are usually in-housed by the oil and gas exploration companies.

Some prominent players in the global Enhanced Oil Recovery market include:

- BP plc

- Cenovus Energy, Inc.

- Chevron Corporation

- Equinor ASA

- ExxonMobil Corporation

- LUKOIL

- Petróleo Brasileiro S.A.

- Total SA

Order a free sample PDF of the Enhanced Oil Recovery Market Intelligence Study, published by Grand View Research.

No comments:

Post a Comment