Phosphate Fertilizers Industry Overview

The global phosphate fertilizer market size is estimated to reach USD 176.06 billion by 2040, registering a CAGR of 5.7% from 2022 to 2040, according to a new report by Grand View Research, Inc. Growth can be attributed to increasing demand for fertilizers for usage in agricultural applications and is expected to drive the growth of the market during the forecast period.

Phosphorus rocks are the key raw materials used to manufacture phosphate fertilizers. Globally, the U.S. is the leading producer and consumer of phosphate rocks, which are primarily used for the manufacturing of the product. Rising global demand for food is a significant factor driving the growth of phosphate fertilizer market.

Phosphate Fertilizers Market Segmentation

Grand View Research has segmented the global phosphate fertilizer market report based on the product, application, and region:

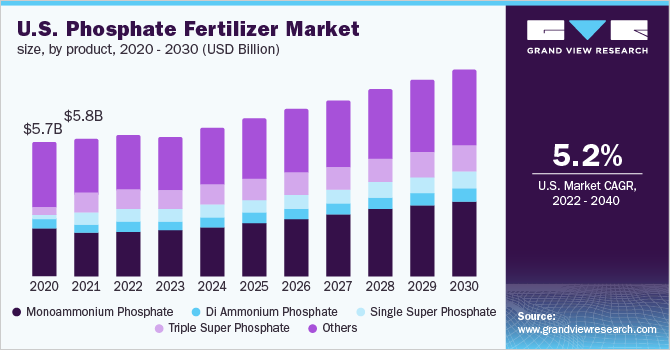

Based on the Product Insights, the market is segmented into Monoammonium Phosphate (MAP), Diammonium Phosphate (DAP), Single Superphosphate (SSP), Triple Superphosphate (TSP), and Others

- The monoammonium phosphate segment accounted for the largest revenue share of around 31% in 2021. This is attributed to the low costs of MAP and the high level of phosphorous present in it.

- Triple superphosphate was the second-largest product segment in 2021 accounting for around 17% of the revenue share. It is a highly concentrated phosphorus fertilizer containing approximately 46% of diphosphorus pentoxide.

- With the increasing demand for agriculture in emerging economies such as Brazil and India, the demand for DAP for use in agricultural applications is anticipated to increase over the forecast period.

Based on the Application Insights, the market is segmented into Cereals & Grains, Oilseeds & Pulses, Fruits & Vegetables, and Others

- The cereals & grains application accounted for the largest revenue share of around 46% in 2021. The growth is attributed to the increasing demand for major cereals & grains worldwide on account of the growing population has led to high demand for phosphorous fertilizers across all developing as well as emerging agrarian economies of the world.

- The oilseeds & pulses segment accounted for the second-largest market share and is anticipated to expand at a 5.6% CAGR over the forecast period in terms of revenue. This is attributed due to the increasing demand for various agricultural products, including soybean, groundnut, sesame, and sunflower, among other products, in these regions.

Phosphate Fertilizers Regional Outlook

- North America

- Europe

- Asia Pacific

- South & Central America

- Middle East & Africa (MEA)

Key Companies Profile & Market Share Insights

The market is highly fragmented owing to the presence of numerous manufacturers of fertilizers, especially in agriculture-dependent countries. Players in the market are focusing on expanding their manufacturing capacity, as agrochemical demand is increasing in various regions. For instance, in August 2021, EuroChem Group signed an agreement to acquire a phosphate project of Serra do Salitren based in Brazil. This acquisition is expected to strengthen the crop nutrient production and distribution capabilities of the company.

Some prominent players in the global Phosphate Fertilizers market include:

- Eurochem Group AG

- Agrium Inc.

- Potash Corp. of Saskatchewan Inc.

- Yara International ASA

- CF Industries Holdings Inc.

- Israel Chemicals Ltd.

- Coromandel International Ltd.

- The Mosaic Co.

- A OCP

- PJSC PhosAgro

Order a free sample PDF of the Phosphate Fertilizers Market Intelligence Study, published by Grand View Research.

No comments:

Post a Comment