Laparoscopic Devices Industry Overview

The global laparoscopic devices market size was valued at USD 6.9 billion in 2021 and is expected to expand at a compound annual growth rate (CAGR) of 7.2% from 2022 to 2030. The growth of the market is attributed due to the increasing incidence of obesity across all age groups, the rapidly growing geriatric population in the Asia Pacific region, especially in countries such as Japan, India, and China, and quick technological improvements. According to the WHO, in May 2020, there have been more than 42,48,389 COVID-19 reported cases and 2,94,046 deaths globally. The COVID-19 pandemic has created a significant challenge for the global healthcare industry. Restricted access to medical services has led to inadequate care for patients suffering from other diseases. Laparoscopy has been adversely impacted by the pandemic. During this period, surgeries are often even canceled or being postponed to the lower transmission of the virus.

However, the market for the laparoscopic device is expected to rebound and grow over the forecast period, as most countries across the globe have started easing lockdown measures and resumed some of the elective procedures. Key players are planning to extend their businesses regionally and create new warehouses in other locations, as well as run their operations through numerous channels in the worst-affected areas. Companies are using a variety of tactics to deal with supply chain disruptions, including rerouting logistics, sourcing from extra partners, and air freight delivery. Local manufacturers have also benefited from the pandemic. These factors are expected to create lucrative opportunities for market growth.

Gather more insights about the market drivers, restraints, and growth of the Global Laparoscopic Devices market

In recent times, laparoscopic surgery is preferred more than conventional ones owing to its numerous benefits, such as shorter hospital stay, decreased blood loss, and lower patient morbidity of laparoscopy, as well as offering quick recovery time, rapid and successful outcomes, low risk of infection, small or no incision and less pain. Since the demand for laparoscopic surgery is significantly increasing, the demand for laparoscopic devices is likely to also grow during the forecast period. The factors driving the growth of the market are the increasing number of patients suffering from health issues such as uterine fibroids, and endometriosis, the rising number of hysterectomy and myomectomy procedures, and growing awareness about the improving healthcare infrastructure in emerging economies.

In addition, supportive government policies and laws of the countries are boosting the growth of the market for the laparoscopic device. Moreover, some countries have supportive reimbursement policies, which are anticipated to increase the sales of the laparoscopic power morcellators in those regions. Laparoscopic devices applications are expanding due to a noteworthy increase in worldwide elderly demographics and the expansion of energy systems, which is increasing their availability and affordability. Laparoscopic devices, which incorporate energy systems, are expected to find lucrative uses in various applications in bariatric surgeries, such as gastric bypass, sleeve gastrectomy, adjustable gastric band, and biliopancreatic diversion with duodenal switch.

For instance, in June 2021, Ethicon introduced ENSEAL X1 Curved Jaw Tissue Sealer, the newest, latest, and advanced laparoscopic bipolar energy device that provides stronger sealing, with better grip to tissues as well as improves procedural efficiency. It is indicated for bariatric surgery, gynecological, thoracic, and colorectal procedures. In addition, the market for the laparoscopic device is consolidating due to the rising popularity of medical equipment and along with increased research collaboration and agreements between diverse manufacturers. For instance, in February 2020, Medtronic announced the acquisition of Digital Surgery-a medical device company and innovator in surgical Artificial Intelligence (AI), digital education, training, and data analytics. This acquisition will enhance its robotic-assisted surgery platform and provide AI and data analytics within laparoscopic procedures.

Furthermore, a rising inclination for minimally invasive laparoscopic equipment is moving this market ahead. Minimally invasive surgical methods are becoming more popular as a result of the reduced trauma they cause. For instance, in December 2020, Olympus has announced the addition of 3D and infrared capabilities to their VISERA ELITE II surgical imaging platform for minimally invasive surgery. The addition of such an imaging platform could help hospitals and operation centers to improve efficiency and cut expenses. The product is useful in a variety of applications, such as gynecology, general surgery, orthopedic surgery, endourology, and ENT. Furthermore, in some countries, health insurance companies pay for minimally invasive laparoscopic surgeries. For example, according to the Medicare Benefits Schedule, Medicare now covers up to 75% of laparoscopic procedures (MBS). Patients' preferences for minimally invasive surgeries have risen as a result of these considerations.

Browse through Grand View Research's Medical Devices Industry Research Reports.

Vessel Sealing Devices Market - The global vessel sealing devices market size was estimated at USD 1,510.0 million in 2022 and is expected to expand at a compound annual growth rate (CAGR) of 9.04% from 2023 to 2030.

Cholecystectomy Devices Market - The global cholecystectomy devices market size was estimated at USD 41.34 million in 2021 and is expected to expand at a compound annual growth rate (CAGR) of 6.85% during the forecast period.

Laparoscopic Devices Market Segmentation

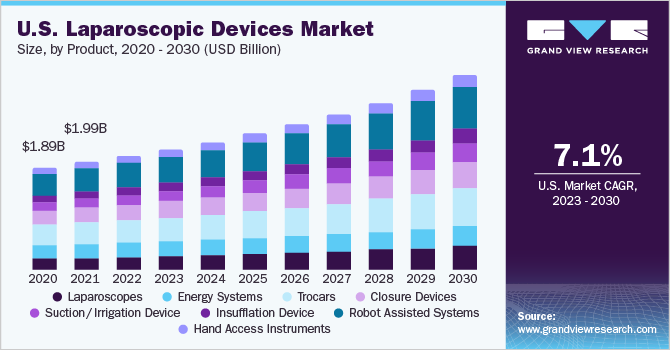

Grand View Research has segmented the global laparoscopic devices market on the basis of product, application, end-user, and region:

Laparoscopic Devices Product Outlook (Revenue, USD Million, 2017 - 2030)

- Laparoscopes

- Energy Systems

- Trocars

- Closure Devices

- Suction/ Irrigation Device

- Insufflation Device

- Robot-Assisted Systems

- Hand Access Instruments

Laparoscopic Devices Application Outlook (Revenue, USD Million, 2017 - 2030)

- Bariatric Surgery

- Urological Surgery

- Gynecological Surgery

- General Surgery

- Colorectal Surgery

- Other Surgeries

Laparoscopic Devices End-user Outlook (Revenue, USD Million, 2017 - 2030)

- Hospital

- Clinic

- Ambulatory

Laparoscopic Devices Regional Outlook (Revenue, USD Million, 2017 - 2030)

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa (MEA)

Market Share Insights

August 2020: B. Braun Medical and Kerma Medical Products announced a collaboration to advance the development and delivery of healthcare products and services, with an emphasis on veterans, minorities, and other underserved communities.

September 2019: Ethicon Inc. has launched a powered circular stapler indicated for gastric, colorectal, and thoracic surgery. This reduces leaks by 61% at the staple line without compromising perfusion.

Key Companies profiled:

Some of the prominent players in the laparoscopic devices market include:

- Karl Storz SE & CO. Kg

- Medtronic

- Johnson and Johnson

- Olympus Corporation

- CONMED Corporation

- Braun Melsungen AG

- The Cooper Companies Inc.

- Richard Wolf GmbH

- Microline Surgical

- BD

- Welfare Medical Ltd

- DEAM

- Intuitive Surgical

- Shenzen Mindray Bio-Medical Electronics Co., Ltd.

Order a free sample PDF of the Laparoscopic Devices Market Intelligence Study, published by Grand View Research.

No comments:

Post a Comment