Veterinary Orthopedics Industry Overview

The global veterinary orthopedics market size was valued at USD 434.01 million in 2021 and is expected to expand at a compound annual growth rate (CAGR) of 7.5% from 2022 to 2030. Growing pet adoption, pet expenditure, chronic diseases, number of veterinarians, and pet insurance is expected to accelerate the market growth. The 2020 PDSA Animal Wellbeing (PAW) Report stated that about 51% of U.K. citizens owned a pet. In addition, the report pegged U.K.’s dog and cat population at around 10.1 million and 10.9 million, respectively.

The COVID-19 pandemic led to a slowdown in the market due to movement restrictions, reduced veterinary visits, and delayed or canceled elective veterinary orthopedic surgeries. In March 2020, Harmony Veterinary Center in Colorado U.S. suspended all veterinary elective procedures, surgeries, and dentistry. According to the findings of an April 2020 survey by the American Veterinary Medical Association (AVMA), 98% of the respondent veterinary practitioners reported limiting client contact due to the outbreak while about two-thirds had deferred at least some surgical procedures.

Gather more insights about the market drivers, restraints, and growth of the Global Veterinary Orthopedics market

The surgery volume across the globe recovered gradually as lockdown protocols were eased in several countries and many public health bodies released guidelines to support the resumption of veterinary surgeries. For instance, the Seven Hills Veterinary Hospital updated its protocols effective June 2021 and reported an increase in the volume of appointments/telephone calls/urgent care and emergency services including surgeries. Thus, although the COVID-19 pandemic led to a reduction in elective surgeries, the number is expected to bounce back in the coming years.

According to Banfield Pet Hospital’s 2020 report on Veterinary Emerging Topics, pet obesity in the U.S. has become an epidemic. Of the 1.9 million adult dogs examined at the hospital, 51% were reported to be overweight. Banfield Pet Hospital has observed this upward trend in pet obesity since 2007. The hospital reports that every 1 out of 3 cats and dogs were overweight. Obesity leads to comorbid conditions, such as osteoarthritis, which often require surgical interventions. For instance, as per Banfield Pet Hospital in 2017, arthritis/DJD, ligament/tendon conditions, and hip/pelvis conditions were the most common osteoarthritis conditions affecting dogs and cats. This led to an increase in orthopedic surgeries in canine pets.

According to the North American Pet Health Insurance Association (NAPHIA), there was a 21% increase in the pet health insurance sector in the region in 2019. NAPHIA reported continued growth in its sector even in 2020, despite some COVID-related challenges. All these factors are expected to continue fueling the regional growth over the forecast period. According to the 2019 Chinese Pet Industry report by Pet Fair Asia, urban Chinese were estimated to have spent about USD 28.8 billion on their pets (mainly cats and dogs). China’s pet insurance market, although in its early stages, is expected to grow significantly, thus making pet care and treatments affordable in the future. All these factors are anticipated to drive the Chinese market for veterinary orthopedics.

Browse through Grand View Research's Animal Health Industry Research Reports.

Veterinary Electrosurgery Market - The global veterinary electrosurgery market size was valued at USD 501.6 million in 2021 and is expected to expand at a compound annual growth rate (CAGR) of 6.9% from 2022 to 2030.

Veterinary Hospitals Market - The global veterinary hospitals market size was valued at USD 76.16 billion in 2021 and is expected to grow at a compound annual growth rate (CAGR) of 5.7% from 2022 to 2030.

Veterinary Orthopedics Market Segmentation

Grand View Research has segmented the global veterinary orthopedics market based on application, product, end use, and region:

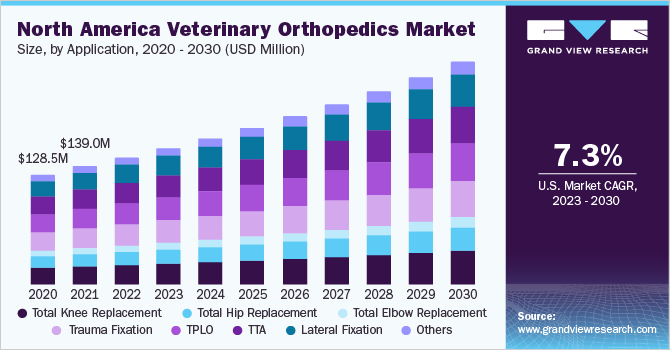

Veterinary Orthopedics Application Outlook (Revenue, USD Million, 2017 - 2030)

- Total Knee Replacement

- Total Hip Replacement

- Total Elbow Replacement

- Trauma Fixation

- TPLO

- TTA

- Lateral Fixation

- Others

Veterinary Orthopedics Product Outlook (Revenue, USD Million, 2017 - 2030)

- Instruments

- Implants

Veterinary Orthopedics End-use Outlook (Revenue, USD Million, 2017 - 2030)

- Hospitals & Clinics

- Others

Veterinary Orthopedics Regional Outlook (Revenue, USD Million, 2017 - 2030)

- North America

- Europe

- Asia Pacific

- Latin America

- MEA

Key Companies profiled:

Some prominent players in the global veterinary orthopedics market include:

- B. Braun Melsungen AG

- Narang Medical Limited

- STERIS

- Arthrex, Inc.

- Integra LifeSciences Corporation

- Movora

- Johnson & Johnson (Depuy Synthes Vet)

- AmerisourceBergen

- Surgical Holdings Veterinary

- GerVetUSA

Order a free sample PDF of the Veterinary Orthopedics Market Intelligence Study, published by Grand View Research.

No comments:

Post a Comment