Nitrogenous Fertilizer Industry Overview

The global nitrogenous fertilizer market size is estimated to reach USD 94.02 billion by 2030 according to a new report by Grand View Research, Inc. Growth can be attributed to the increasing awareness amongst farmers regarding maintaining nutritional balance in the soil. Increasing population across the globe has generated the need to improve the annual crop yield to feed the population, which has boosted the agriculture sector across the globe.

Hydrogen and nitrogen are the major raw materials used for manufacturing nitrogenous fertilizers. Nitrogen is required in large quantities by plants and is the primary nutrient in fertilizers. Hydrogen is a crucial component of ammonia, which is an important ingredient in numerous fertilizers. Nearly all commercial-scale ammonia incorporates nitrogen and hydrogen. Raw material Availability impacts nitrogenous fertilizer prices and production.

Nitrogenous Fertilizer Market Segmentation

Grand View Research has segmented the global nitrogenous fertilizer market report based on the product, application, and region:

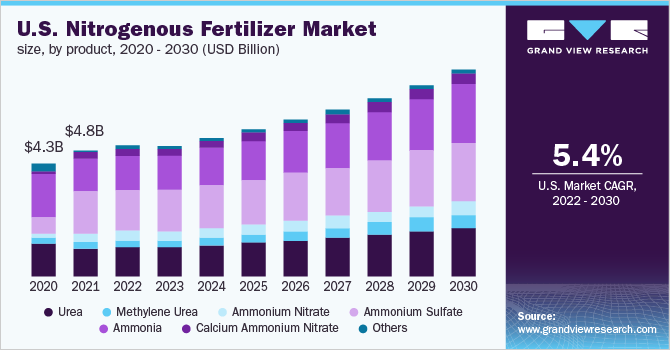

Based on the Product Insights, the market is segmented into Urea, Methylene Urea, Ammonium Nitrate, Ammonium Sulfate, Ammonia, Calcium Ammonium Nitrate, and Others

- The urea product segment accounted for the highest share of over 33% in terms of revenue in 2021. The nitrogenous fertilizer market growth is attributed to the presence of the higher amount of nitrogen and lower costs of urea.

- The ammonia product segment stood in the second position in 2021 accounting for around 18% of the revenue share. The growth is attributed to higher leaching loss resistance and excellent solubility.

Based on the Application Insights, the market is segmented into Cereals & Grains, Oilseeds & Pulses, Fruits & Vegetables, and Others

- The cereals & grains segment held the highest revenue share of over 44% in 2021. The growth is attributed to the maximum care required by cereals & grains crops for producing higher yields and generating higher profitability for the farmers and the overall agriculture industry.

- The oilseeds & pulses held the second position in the application segment and is anticipated to reach a CAGR of 5.6% during the forecast period in terms of revenue. The growth is attributed to the requirement of improving the percentage of germination of seeds and also obtaining dense pulse canopies.

Nitrogenous Fertilizer Regional Outlook

- North America

- Europe

- Asia Pacific

- South America

- Middle East & Africa (MEA)

Key Companies Profile & Market Share Insights

The players in the market are largely focusing on developing advanced nitrogenous fertilizers having sustainable qualities. Various factors having a huge impact on the growth of the market include manufacturing technology, product portfolio, regulatory approvals, and pricing. Local players in the market are majorly focusing on retaining their respective customers by offering customized services to the farmers.

Several manufacturers in the Asia Pacific region are also focusing on expanding their manufacturing capacities owing to the increasing adoption of agrochemicals in some countries including India and China. Players are inclined towards escalating investments for serving the increasing product demand all over the world.

For example, CF Industries Holdings, Inc. has declared a large investment of around USD 41.4 Million for enhancing nitric acid production at the biggest nitrogen fertilizer facility across the globe located in Donaldsonville, Louisiana.

Some prominent players in the global Nitrogenous Fertilizer market include:

- Kynoch Fertilizer

- Sorfert

- Bunge Ltd.

- Nutrien Ltd.

- Yara

- Omnia Holdings Limited

- Sasol

- Aquasol Nutri

- TriomfSA

- Rolfes Agri (Pty) Ltd.

- OCI Nitrogen

- ICL Fertilizers

- Eurochem Group AG

Order a free sample PDF of the Nitrogenous Fertilizer Market Intelligence Study, published by Grand View Research.

No comments:

Post a Comment