U.S. Medical Coding Industry Overview

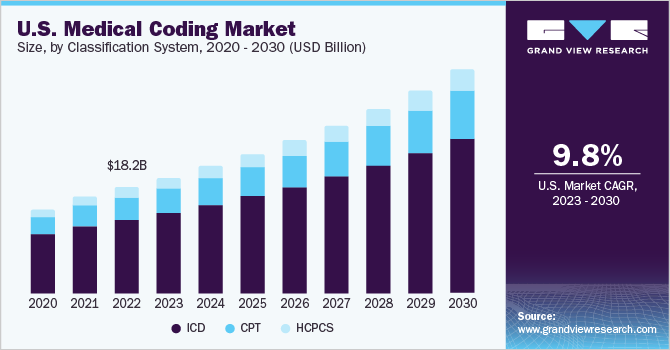

The U.S. medical coding market size was valued at USD 17.9 billion in 2021 and is expected to expand at a compound annual growth rate (CAGR) of 8.0% from 2022 to 2030. Errors in billings, insurance fraudand misinterpretations of medical documents result in large losses. Healthcare fraud results in USD 68 billion each year in the U.S. Increasing losses due to ineffective medical billing and revenue cycle management is increasing demand for revenue cycle management including medical coding software and services. This in turn is estimated to drive the market growth.

High adoption of digital technologies such as electronic health records, revenue cycle management software, mhealth applications, telehealth, and increasing efforts towards digitalization of healthcare in the U.S. is positively driving the market growth. 85.9% of the physicians’ offices were using electronic health records in the U.S., as per the data provided by the Centers for Disease Control and Prevention. Additionally, the impact of social media on healthcare is significantly growing. For instance, according to Binary Foundation, 51% of Americans were looking for providers on social media in 2019. Social media is used for seeking feedback, managing appointments, health promotion campaigns, awareness of product recalls, patient education, and recruitment. There is increasing utilization of medical coding in the revenue cycle management process. New revisions are included in the codes to increase flexibility and scalability.

Gather more insights about the market drivers, restraints, and growth of the U.S. Medical Coding market

New ICD 11 was implemented in January 2022. It has several new chapters and supports electronic health records. It has approximately 55 thousand codes for the classification of disorders, diseases, injuries, and deaths. Moreover, many new codes were created during the COVID-19 pandemic for COVID-19 and telehealth. The World Health Organization (WHO) introduced new ICD 10 codes which were taken into effect between April and September 2020. Thus, the introduction and revisions of codes are positively impacting the market growth.

The Bureau of Labor Bureau of Labor Statistics, Office of Occupational Statistics and Employment Projections, estimated that medical records and health information employees are estimated to grow by 9% between 2020 and 2030. Certified medical coders are one of the major sought-after jobs in the U.S., according to an article published by Randstad, a staffing firm. The increasing demand for universal language in medical documentation is positively impacting the demand for medical coders and the coding industry.

The increasing workload on healthcare staff and physicians for medical coding are increasing the adoption of various automation solutions. For instance, according to a survey conducted by Athena health, physicians are working overtime for an average of 90 minutes for coding. There is an increase in the adoption of computer-assisted coding solutions for rapid, accurate, and efficient medical coding. Computer-assisted coding can increase productivity by 30%, as per a survey conducted by 3M. Furthermore, the development of artificial intelligence-assisted medical coding is estimated to drive the growth of U.S. medical coding.

Healthcare spending in the U.S. is rapidly growing. Moreover, hospital administration costs are the highest in the U.S. Healthcare organizations are facing increasing pressure to provide quality care at reduced costs. Thus, healthcare providers are adopting medical coding software and outsourcing services to reduce administration costs and increase return on investment. This in turn is estimated to drive the market growth.

Browse through Grand View Research's Healthcare IT Industry Research Reports.

Revenue Cycle Management Market - The global revenue cycle management market size was valued at USD 243.1 billion in 2021 and is projected to expand at a compound annual growth rate (CAGR) of 11.6% from 2022 to 2030.

Electronic Health Records Market - The global electronic health records market size was estimated at USD 27.2 billion in 2021 and it is anticipated to expand at a CAGR of 4.0% from 2022 to 2030.

U.S. Medical Coding Market Segmentation

Grand View Research has segmented the U.S. medical coding market based on classification system and component:

U.S. Medical Coding Classification System Outlook (Revenue, USD Million, 2017 - 2030)

- ICD

- HCPCS

- CPT

U.S. Medical Coding Component Outlook (Revenue, USD Million, 2017 - 2030)

- In-house

- Outsourced

Market Share Insights

March 2021: Athenahealth, a provider of software and services to healthcare organizations has announced the launch of athenaOne, a medical coding solution. The platforms provide complete support for medical coding and relieve the burden on hospital staff.

Key Companies profiled:

Some prominent players in the U.S. medical coding market include:

- STARTEK Health

- Maxim Health Information Services

- Oracle Corporation

- Verisk Analytics

- Aviacode, Inc.

- Precyse Solutions, LLC.

- Parexel International Corporation

- Medical Record Associates LLC

Order a free sample PDF of the U.S. Medical Coding Market Intelligence Study, published by Grand View Research.

No comments:

Post a Comment