Pet Insurance Industry Overview

The pet insurance market size was valued at USD 9.4 billion in 2022 and is estimated to expand at a compound annual growth rate (CAGR) of 17.04% from 2023 to 2030. Growing pet population, adoption of pet insurance in underpenetrated markets, increasing veterinary care costs, initiatives by key companies, and humanization of pets are some of the key drivers of this market. In 2020, Trupanion reported that over 800,000 pets were insured under the company’s policies across key markets in the U.S., Canada, and Australia.

The COVID-19 pandemic presented several challenges for the companion animal industry including pet owners, veterinarians, veterinary hospitals, and animal health companies. However, the industry soon began to respond to the pandemic by deploying supportive measures to ensure access to veterinary care and other services. The challenges brought on by the pandemic also led to awareness among pet parents to reduce financial risk by getting a pet insurance policy. According to a survey conducted by Petplan- a market leader in the U.K., there was a boom in pet ownership during 2020. Dogs were the most popular pets followed by cats. About 47% of the respondents bought pets for the first time and overall around 26% of pet owners in the U.K. bought a pet amidst the COVID-19 pandemic.

Gather more insights about the market drivers, restraints, and growth of the Global Pet Insurance market

The 3 key reasons for getting a pet were identified to be work-from-home conditions, desire for companionship, and more time spent at home due to lockdown and movement restrictions. One-fifth of the pet owner respondents stated that they were more likely to buy an insurance policy for their pets. Overall, the pandemic increased the demand for risk protection among pet parents. Companies such as the Animal Friends Insurance began offering coverage for remote consultation to pet parents by partnering with Joii Pet Care. This combined with growing pet humanization and expenditure is anticipated to propel the market growth over the forecast period.

The growing prevalence of feline and dog-related diseases and rising pet adoption are major drivers for this market. Furthermore, the growing demand for pet insurance to assist in limiting the out-of-pocket expenditure on serious medical issues, such as accidental injuries and cancer is anticipated to boost the market growth in the near future. There is also an increase in demand for veterinary healthcare facilities, which is estimated to contribute to the demand for pet insurance. Veterinary services are usually capital intensive and also require specialized veterinarians, skilled technicians, and specifically designed diagnostic equipment. This can drive up the cost of treatment for pet owners thus increasing demand for suitable pet insurance policies.

According to the North American Pet Health Insurance Association (NAPHIA), about 3.45 million pets were insured across the North American region in 2020. This number was significantly greater than the 2.81 million pets insured in North America in 2019. The surge was attributed to the stay-at-home and work-from-home conditions created by the COVID-19 crisis. However, the introduction of new insurance products by new and large market entrants is expected to increase the competition in the North American market. The market is projected to mature over time with increased competition and the volume of claims being processed.

Browse through Grand View Research's Healthcare IT Industry Research Reports.

Veterinary Hospitals Market - The global veterinary hospitals market size was valued at USD 76.16 billion in 2021 and is expected to grow at a compound annual growth rate (CAGR) of 5.7% from 2022 to 2030.

Veterinary Services Market - The global veterinary services market size was valued at USD 97.34 billion in 2020 and is expected to grow at a compound annual growth rate (CAGR) of 5.7% from 2021 to 2028.

Pet Insurance Market Segmentation

Grand View Research has segmented the global pet insurance market on the basis of coverage type, animal type, sales channel, and region:

Pet Insurance Coverage Type Outlook (Revenue, USD Million, 2018 - 2030)

- Accident & Illness

- Accident only

- Others

Pet Insurance Animal Type Outlook (Revenue, USD Million, 2018 - 2030)

- Dogs

- Cats

- Others

Pet Insurance Sales Channel Outlook (Revenue, USD Million, 2018 - 2030)

- Agency

- Broker

- Direct

- Bancassurance

- Others

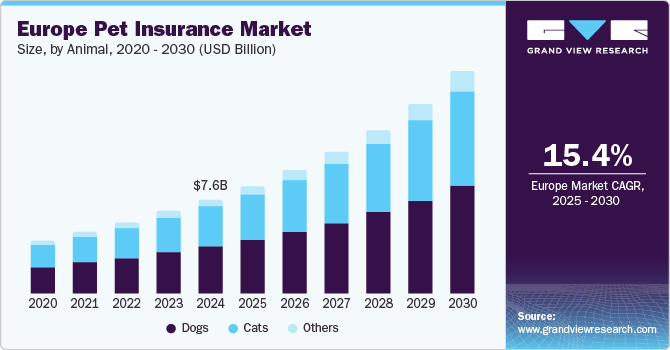

Pet Insurance Regional Outlook (Revenue, USD Million, 2018 - 2030)

- North America

- Europe

- Asia Pacific

- Latin America

- MEA

Market Share Insights

November 2021: AXIS Capital Holdings Limited’s specialty insurance business segment- AXIS Insurance, entered the market by partnering with Managing General Underwriter Petplan. The company partnered with Petplan via its Accident and Health unit and this strategic collaboration supported its growth objectives.

June 2020: Trupanion signed a partnership with Vetter Software, a provider of technology solutions for animal healthcare. This partnership included integration between Vetter Software’s cloud veterinary practice management platform software and Trupanion’s software which enables direct payment to the veterinarian at the time of check-out.

Key Companies profiled:

Some prominent players in the global Pet Insurance market include:

- Trupanion, Inc.

- Deutsche Familienversicherung AG (DFV)

- Petplan (Allianz)

- Animal Friends Insurance Services Limited

- Figo Pet Insurance, LLC

- Direct Line

- Nationwide Mutual Insurance Company

- Embrace Pet Insurance Agency, LLC

- Anicom Insurance

- ipet Insurance Co., Ltd.

- MetLife Services and Solutions, LLC

- Pumpkin Insurance Services Inc.

Order a free sample PDF of the Pet Insurance Market Intelligence Study, published by Grand View Research.

No comments:

Post a Comment