Mining Equipment Industry Overview

The global Mining Equipment Market, valued at an estimated USD 141.31 billion in 2023, is projected to expand at a compound annual growth rate (CAGR) of 5.2% from 2024 to 2030. The ongoing wave of digital mine innovation is anticipated to fundamentally reshape key aspects of mining in the coming years. Increased investment, coupled with government support for these digital advancements, is expected to drive significant demand for mining equipment throughout the forecast period. Furthermore, improvements and innovations in extraction technologies and equipment have led to enhanced ore grades, effectively extending the operational lifespan of older mines.

The global COVID-19 crisis, which had serious economic repercussions across various sectors, including mining, has now largely subsided. The reduced economic activity resulting from lockdown restrictions during the pandemic had a notable impact on the demand for coal. Looking ahead, the mining sector is increasingly focused on transitioning into a climate-smart industry. Consequently, mining companies are actively exploring the adoption of electrification as a replacement for traditional fossil fuels like diesel.

Detailed Segmentation:

- Equipment Type Insights

The surface mining equipment type segment led the market and accounted for a 38.9% share of the global revenue in 2022. During the forecast period, rising demand for iron ore, coal, diamonds, and chromium in emerging nations is anticipated to open new opportunities for surface mining equipment. As the use of this equipment spreads, it has enabled selected mining activities that involve the exploration of high-quality resources and the construction of embankments and stable surfaces.

- Application Insights

The coal mining application led the market and accounted for a 37.8% share of the global revenue in 2022. The mining equipment is expected to witness significant growth in coal mining applications. The growth is attributed to its increased demand for electricity generation. Coal mining equipment has expanded its purposes and adoption as the excavation of coal has boomed.

- Regional Insights

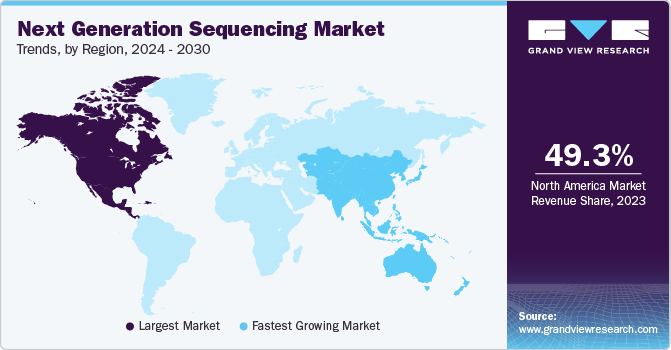

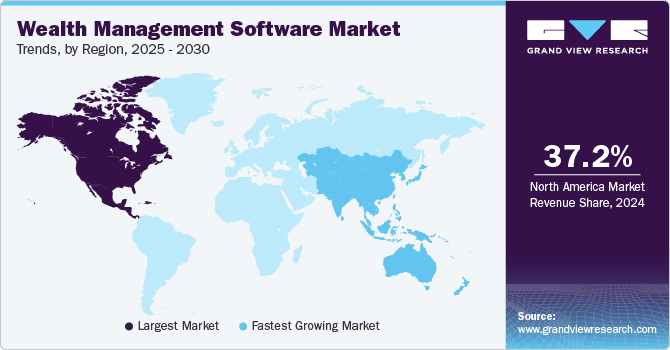

North America region is likely to expand at a CAGR of 4.1% during the forecast period. Rising mineral mining activity, increased use of cutting-edge mining equipment, and government initiatives in North America are the major drivers boosting market growth. In addition, the shift from traditional underground mining to cutting-edge, cost-effective open-pit mining is anticipated to drive the demand for these products during the forecast period.

Gather more insights about the market drivers, restraints, and growth of the Mining Equipment Market

Key Companies & Market Share Insights

Some of the key players operating in the market include Komatsu Ltd., Liebherr, Epiroc, Boart Longyear and Caterpillar Inc.

- Caterpillar Inc manufactures and sells mining and construction equipment, industrial gas turbines, diesel and natural gas engines, and diesel-electric locomotives for construction, energy & resource, and transportation industries. Furthermore, the company has established strong sales channel globally.

- Deere & Company invest significantly in research & development to stay at the forefront of emerging trends and technologies in construction equipment. For instance, in 2022, the company invested USD 1,912 million in research & development activities.

Key Mining Equipment Companies:

- The following are the leading companies in the mining equipment market. These companies collectively hold the largest market share and dictate industry trends. Financials, strategy maps & products of these mining equipment companies are analyzed to map the supply network.

- Epiroc

- Boart Long year Ltd

- Caterpillar Inc.

- China Coal Energy Group Co. Ltd

- Vipeak Mining Machinery Co. Ltd

- Guangdong Leimeng Intelligent Equipment Group Co. Ltd

- Henan Baichy Machinery Equipment Co. Ltd

- Komatsu Ltd

- Liebherr

- Metso Qutotec

Order a free sample PDF of the Market Intelligence Study, published by Grand View Research.

Recent Developments

- In July 2023, Komatsu Ltd. planned to launch PC210LCE-11 and 200LCE-11 models, and 20-ton electric excavators powered by Li-ion batteries. These machines will be launched in Japan and Europe. The introduction of these models marked a strategic move for Komatsu to tap into the electric construction equipment market. This initiative aligns with the company's broader commitment to achieving carbon neutrality by 2050.

- In July 2023, Liebherr joined forces with Leica Geosystems to provide an extensive range of machine control systems tailored for hydraulic excavators. These systems serve as driver assistance tools, enhancing the efficiency, safety, and productivity of construction projects.

- In July 2023, Metso Corporation entered into an agreement to acquire Brouwer Engineering, an Australian company. The diverse bulk material handling equipment of Mesto lineup aligns well with Brouwer Engineering's expertise in electrical and control systems. The collaboration aimed to provide customers with a holistic range of solutions by combining their respective capabilities.

- In June 2023, Epiroc introduced a mobile hydraulic powerpack for blast hole drills. The product is designed to improve the efficiency of the electric drill. A wagon-mounted powerpack enables off-grid operation for electric drills for without requiring the need for electrical infrastructure.