Point-of-Sale Software Industry Overview

The global Point-of-Sale (POS) Software Market was valued at USD 11.99 billion in 2022 and is projected to grow at a compound annual growth rate (CAGR) of 10.8% from 2023 to 2030. The demand for POS software is driven by the need for cashless transactions, efficient tracking of sales and inventory data, and enhanced sales strategies through analytics in various sectors, including retail chains, restaurants, hotels, drug stores, and auto shops. The increasing demand for advanced features such as employee management analytics, inventory tracking, sales monitoring, customer data management, and reporting is expected to accelerate the adoption of POS software across multiple industries.

The requirement for POS systems with improved functionality and analytics has risen significantly due to the diverse operational scenarios of businesses. These systems enable users to effectively manage staff, customers, payments, and invoices. They also facilitate efficient handling of inventory, billing, and employee management. POS software supports a wide range of business operations and can be installed on desktops, laptops, notebooks, or tablets with the compatible operating systems. The growing popularity of cloud-based mPOS solutions has further driven demand, while web-based POS systems have gained traction among small- and medium-sized stores due to their accessibility via web browsers or the internet.

Detailed Segmentation:

- Application Insights

The mobile POS market is projected to grow significantly during the forecast period. The expansion of technology has transformed how people make payments, and the installation of mPOS guarantees speedy payments through applications without the system needing to be connected to a local network. The credit card reader on a smartphone or tablet with apps installed to control the scanner and charging system is being utilized to initiate payments. The market has flourished as a result of the increasing use of mobile POS terminals by small businesses for payment processing as well as for carrying out cutting-edge functions, including inventory management, shop management, and analytics to enhance business operations.

- Deployment Mode Insights

On the basis of deployment, the industry has been further categorized into on-premise and cloud. The on-premises segment held the highest share of more than 65.70% in 2022. This can be attributed to the higher adoption of software for on-premise POS systems by large enterprises, which run on the local server over the remote facility. Large enterprises have a huge volume of sensitive customer information prone to data breaches. Hence, the on-premises deployment of software provides more control to the owner of the POS system, thus ensuring better security of crucial data.

- Organization Size Insights

SMEs are readily adopting cloud-based mobile POS software solutions owing to their affordability and scalability. Moreover, small- and medium-sized businesses in large numbers across the globe often expand at the city or state level and prefer budget-friendly POS software solutions based on word-of-mouth by similar business owners. Therefore, the SME user contribution to the industry has been vital in helping POS software vendors expand their presence in the local markets. Vendors targeting local business owners are focusing on small and medium-sized local businesses across the retail, hospitality, healthcare, and other major industries.

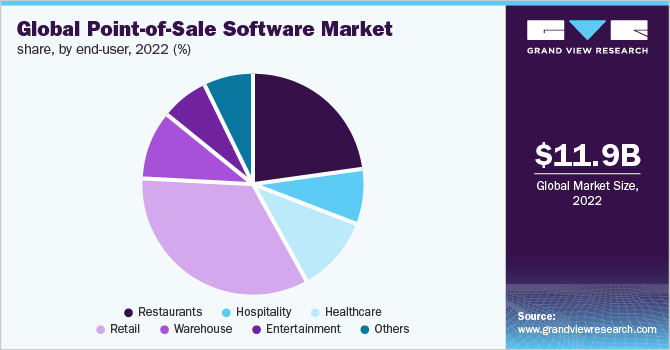

- End-user Insights

The restaurant POS software industry is poised to expand at a healthy growth rate from 2023 to 2030. The restaurant sector is another lucrative segment for POS software vendors. The rising integration of restaurants with online delivery providers is a key feature influencing POS purchases. Online ordering and delivery are expected to drive POS investments in 2022, which will help restaurants avoid costly third-party fees. Data analytics, order management, marketing, and payments in the restaurant industry have created a staggering trajectory and are expected to augment over the forecast year. Also, the tourism industry’s growth positively affected the restaurant business and boosted the demand for the deployment of POS software for better service to travelers.

- Regional Insights

Asia Pacific is expected to progress at the fastest CAGR of 14.1% over the forecast period. A rise in the adoption of POS terminals in the region due to strong growth in the electronic payment industry is expected to boost the POS software market growth. In developing countries, such as China, India, Indonesia, and Vietnam, the demand for cashless payment in retail, restaurant, entertainment, and other industries is accelerating the proliferation of POS software in the region. Moreover, the ever-increasing demand for POS solutions with advanced features among rapidly growing businesses, such as e-commerce retail, the food service industry, and entertainment, is expected to drive market growth over the forecast period. North America accounted for a significant share of the overall revenue in 2022.

Gather more insights about the market drivers, restraints, and growth of the Point-of-Sale Software Market

Key Companies & Market Share Insights

The key players focus on providing a differentiated and consistent brand experience, as operators are looking for more functionalities and features from existing systems. There is strong competition in the market owing to the presence of a large number of POS software vendors. POS software vendors have opted for a mix of inorganic and organic growth strategies to increase their market share. For instance, in May 2022, Blaze Solutions, Inc. acquired a Vancouver-originated POS software by offering services to the U.S. and Canada. This acquisition is aimed to serve international clients, while also enabling clients to gain experience in the Canadian and U.S. marketplace.

Key Point-of-Sale Software Companies:

Some of the prominent players in the global point-of-sale software market include:

- Clover Network, Inc.

- H&L POS

- IdealPOS

- Lightspeed

- NCR Corp.

- Oracle Micros

- Revel Systems

- SwiftPOS

- Square Inc.

- TouchBistro Toast Inc.

Order a free sample PDF of the Market Intelligence Study, published by Grand View Research.

No comments:

Post a Comment