Wealth Management Software Industry Overview

The global Wealth Management Software Market was valued at approximately USD 5.51 billion in 2024, with an anticipated growth rate of 14.0% CAGR from 2025 to 2030. This expansion is largely driven by the increasing adoption of cutting-edge technologies within wealth management advisory services. Innovations in financial technology are leading to a transformative approach aimed at automating and enhancing the delivery of financial services, which is expected to significantly boost market growth during the forecast period. Consequently, the rising integration of financial technology in wealth management is favorable for market expansion.

The growing demand for automation in wealth management processes is projected to further accelerate market growth. Wealth management platforms offer a cost-effective solution for users aiming to streamline workflows and manage their wealth efficiently. In addition to providing an open architecture, these platforms facilitate comprehensive access and contribute to the digitalization of the entire wealth management process. They can also be seamlessly integrated with various wealth administration applications. Wealth managers have recognized that affluent clients are increasingly focused on diversifying their investments, achieving personal objectives, ensuring financial security, and safeguarding their wealth.

Detailed Segmentation:

- Advisory Mode Insights

The human advisory mode segment accounted for the largest revenue share of 57.31% in 2024. Human advisory remains the first preference for several HNWIs across the globe owing to security concerns. Moreover, human advisory services also help in strengthening relationships with the clients and conveying and communicating wealth management strategies and plans to them more efficiently. However, the trends are changing gradually, and clients have started preferring the hybrid advisory model over the human advisory model.

- Deployment Insights

On-premise deployment is expected to register a moderate CAGR of 11.6% during the forecast period. Several organizations still prefer on-premise deployment of solutions to ensure a higher level of control over all the systems and data. The on-premise deployment model also allows organizations to have more control over the implementation of software. While on-premise solutions ensure that business data is stored and handled internally, it also necessitates businesses to appoint dedicated, in-house IT staff for support and maintenance purposes.

- Enterprise Size Insights

SMEs are readily adopting cloud-based mobile POS software solutions owing to their affordability and The small & medium enterprises segment is expected to grow at the fastest CAGR during the forecast period. The growing demand for wealth monitoring software by SMEs to effectively meet the regulatory requirements and to condense the asset monitoring costs is anticipated to drive the growth of the segment. The growing number of small & medium enterprises in emerging economies is also driving the demand for wealth management solutions.

- Application Insights

The financial advice management segment is expected to grow at the fastest CAGR during the forecast period. Several businesses across the globe are focusing on accelerating digitization, increasing operational efficiency, and strengthening client relationships, which is expected to propel the adoption of financial advice & management solutions across various end use industries. Nowadays, several wealth management firms are using wealth management software to manage their multiple clients more effectively. Integrated financial advice & management technology-enabled solutions help financial managers in collaborating with their clients to create investment proposals, identify financial goals, and effectively deliver financial advice.

- End-user Insights

The trading and exchange firms segment is anticipated to grow rapidly during the forecast period.The evolving technological capabilities of wealth management solutions are expected to open new opportunities for the adoption of wealth management software for trading & exchange purposes. Trading & exchange firms are increasingly using wealth management solutions to effectively manage the assets of their clients. Furthermore, the growing digitalization across trading firms is efficiently allowing clients to access their trading accounts and effectively understand the progress of their financial portfolio, thereby creating new growth opportunities for the segment.

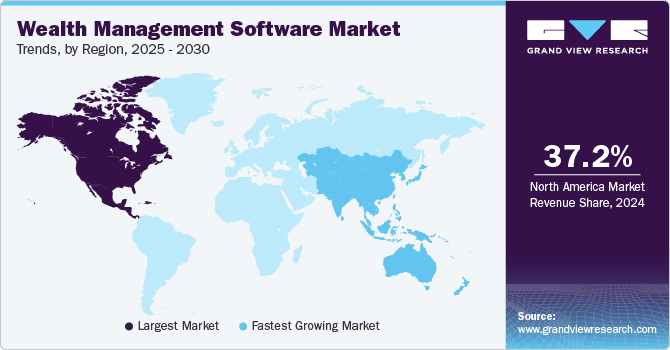

- Regional Insights

The Asia Pacific wealth management software market is anticipated to grow at a CAGR of 15.2% during the forecast period. The region typically holds promising growth opportunities for robo advisors owing to the increasing adoption of digital platforms. The combination of innovative analytics and advanced algorithms is encouraging techno-savvy customers to opt for robo advisory tools to efficiently meet their investment requirements. Furthermore, the increasing number of SMEs in emerging economies, such as China, Japan, and India, is expected to create growth opportunities for the market. In addition, the latest IT infrastructure being adopted by SMEs in the region is expected to drive the demand for digital financial services to enhance their business capabilities.

Gather more insights about the market drivers, restraints, and growth of the Wealth Management Software Market

Key Companies & Market Share Insights

Some of the key companies in the market for wealth management software include Comarch SA, Dorsum Ltd., Fidelity National Information Services, Inc., and others. Organizations are focusing on integrating advanced technologies into their offerings to maintain competitive advantages. Therefore, key players are taking several strategic initiatives, such as new product launches, mergers and acquisitions, and partnerships, among others.

- Comarch SA wealth management platform is designed to ensure that both advisors and clients receive an exceptional level of digital wealth services. The company’s wealth management software enables users to provide personalized and relevant wealth services by combining traditional human expertise with an intuitive, multi-module, and cloud-enabled platform.

- Dorsum Ltd. is a prominent provider of investment software solutions, particularly in the wealth management sector. The company specializes in delivering innovative technology that supports financial institutions in enhancing their wealth management services.

Key Wealth Management Software Companies:

The following are the leading companies in the wealth management software market. These companies collectively hold the largest market share and dictate industry trends.

- Comarch SA

- Dorsum Ltd.

- Fidelity National Information Services, Inc.

- Finantix

- Fiserv, Inc.

- Objectway S.p.A.

- Profile Software

- SEI Investments Company

- SS&C Technologies Holdings, Inc.

- Temenos Headquarters SA

Order a free sample PDF of the Market Intelligence Study, published by Grand View Research.

Recent Developments

- In October 2024, Communify Fincentric announced a next-generation suite designed to enhance client and advisor experiences in wealth management. Developed in the age of AI and built on Communify Fincentric’s deep expertise, this flexible platform delivers innovative solutions that offer exceptional access to information, personalization, and automation for advisors.

No comments:

Post a Comment