Sneakers Industry Overview

The global Sneakers Market was valued at approximately USD 78.59 billion in 2021 and is projected to grow at a compound annual growth rate (CAGR) of 5.2% from 2022 to 2030. One of the primary factors driving this industry’s growth is the rise of online platforms worldwide. There is an increasing preference for fashionable, branded, and high-fashion sneakers across all age groups, coupled with a rise in disposable income that boosts demand for both comfortable and innovative sneaker designs. However, the widespread availability of counterfeit products from local manufacturers may hinder growth. On the other hand, the presence of customizable and innovative features in sneakers presents lucrative opportunities for market players. The growing population and heightened concerns about health and wellness are encouraging more individuals to engage in fitness-related activities, further propelling industry growth. Additionally, the youthful population's increasing interest in fitness and sports is driving demand for sneakers.

The COVID-19 pandemic negatively impacted the global sneakers market. Strict lockdown measures imposed by governments led to halted production and a significant drop in sales, as global demand plummeted during the lockdown period.

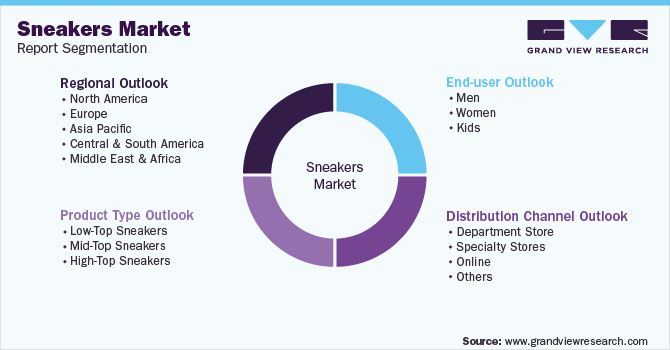

Detailed Segmentation:

- Product Insights

The mid-top product type segment is projected to register the fastest CAGR of 6.9% over the forecast period. Increasing consciousness toward health and fitness has led to an increase in demand for mid-top sneakers, primarily in emerging nations. Originally manufactured for sports, such as tennis and basketball, mid-top sneakers are now also a famous choice among skaters. Innovative product launches as well as a high level of comfort provided by mid-top sneakers are likely to increase the demand over the forecast period.

- Distribution Channel Insights

The online segment is projected to register the fastest CAGR of 5.8% over the forecast period. With increasing internet penetration and benefits, such as easy access and payment options, consumers prefer purchasing products from online channels. The selling price of any sneaker sold online differs from its market price. This is usually due to offers and discounts available on company websites or any other online platform. Moreover, reviews and feedback on particular products help customers make informed purchases.

- End-user Insights

The women end-user segment is projected to grow at the fastest CAGR of 5.5% over the forecast period. Many sneaker brands majorly focus on women, with Aquazzura being exclusively women’s shoes. Striving to empower women, athleisure and sports brands like Nike Inc., Skechers USA Inc., and Reebok, have followed their calls for sizing inclusivity and carried out new personalized methods in product design as well as sales techniques. Nike Inc. revealed the first glimpse of its “fantasy sneaker destination for women” at the Fall 2018 Paris Fashion Week: a classic Air max sneaker collaboration with Off-White’s Virgil Abloh.

- Regional Insights

North America is anticipated to register the fastest CAGR of 5.6% over the forecast period. This is attributed to the changing lifestyles, increasing fashion consciousness, and high consumer disposable income, which is leading to an inclination toward comfort rather than price among customers. The U.S. is the major country with an increasing demand for sneakers in the region. Sneakers have long been related to American culture, but they have now spread all over the globe. Sneakers are in large demand, particularly among the younger generation. The Asia Pacific region accounted for the highest revenue share in 2021.

Gather more insights about the market drivers, restraints, and growth of the Sneakers Market

Key Companies & Market Share Insights

The key companies are growing internationally to cater to the rising demand and are presenting new designs through continuous development. These factors are is likely to intensify the industry growth. For instance,

- In July 2022, Adidas AG and Guccio Gucci S.p.A. planned to release their highly anticipated footwear collection centering around the Gazelle silhouette

- In December 2021, Chloe SAS introduced the Nama sneaker. The new sneaker reflects the company’s aim to reduce its impact on the environment by manufacturing the sneaker with lower-impact materials including recycled materials and components, which make up 40% of the sneaker's materials in weight

- In March 2020, ASICS launched a trio of sports shoes in a VR showroom and it also includes the first carbon-plate running shoes named ASICS Metaracer. This is a distance running shoe that comprises enhanced stability, redesigned mesh upper to keep the feet cool, and also redesigned toe-spring shape to decrease the strain

- In November 2019, Adidas AG launched limited-edition sneakers represented as VIT.01 shoe in collaboration with Team Vitality. Through this launch, Adidas planned to strengthen its position as a pioneering and innovative sports brand

Key Sneakers Company Insights

Some of the key players operating in the global sneakers market include:

- Nike Inc.

- Adidas AG

- New Balance Athletics, Inc.

- ASICS Corp.

- Kering SA

- Skechers USA, Inc.

- Under Armour Inc.

- VF Corp.

- Puma SE

- Relaxo Footwears Ltd

Order a free sample PDF of the Market Intelligence Study, published by Grand View Research.

No comments:

Post a Comment