Next Generation Sequencing Industry Overview

The global Next-Generation Sequencing (NGS) Market was valued at $8.40 billion in 2023 and is projected to grow at a robust CAGR of 21.7% from 2024 to 2030. Next-generation sequencing encompasses high-throughput DNA sequencing technologies crucial for genomic discovery. Following the WHO's declaration of COVID-19 as a pandemic, numerous prominent pharmaceutical and biotechnology firms accelerated global research efforts for test kit and vaccine development.

This intensified focus on COVID-19 vaccine development by major global companies presented a significant opportunity for NGS adoption during the pandemic. For example, Chinese researchers utilized Oxford Nanopore Technologies' MinION Mk1C (U.K.) for sequencing COVID-19 samples. Moreover, the widespread integration of NGS technologies in clinical diagnostics, driven by rapid turnaround times and faster processing, is expected to further foster market growth throughout the forecast period. Illustratively, in August 2020, Pediatrix Medical Group, GeneDx Inc., and OPKO Health partnered to offer advanced next-generation gene sequencing to improve the clinical diagnosis of rare conditions in newborn intensive care units.

Detailed Segmentation:

- Application Insights

Furthermore, the consumer genomics segment is anticipated to be the fastest-growing segment with a CAGR of 24.84% during the forecast period. Continuous introduction of new products by the key players is driving growth in the consumer genomics segment. Presence of companies such as 23andMe that are involved in the provision of the “Personal Genome Service” can be attributed to growth in the coming years. Moreover, Ancestry.com, Color Genomics, Cloud Health (which purchased a HiSeq X Ten), National Geographic and several Japanese consumer companies, as well as a nascent consumer business, Helix, which was launched by Illumina are expected to impact revenue generation in this segment. Rapid proliferation in genealogy, paternity testing, and personal health awareness is expected to drive the growth in the consumer genomics, as an application of NGS.

- Product Insights

The consumables segment held the larger market share in 2023 and will continue to grow at a faster CAGR of 22.47% from 2024 to 2030. The larger share and exponential growth rate of this segment is mainly attributed to the recurrent usage and high demand of the consumables in the commercial as well as research applications of NGS. These consumables include sample preparation kits as well as kits for target enrichment. The adoption of NGS consumables has increased as most of the pharmaceutical companies and research institutes are utilizing NGS for several diagnostic applications and cancer research.

- Technology Insights

The targeted sequencing & resequencing segment held the highest market share in 2023. This segment is expected to witness growth in demand subsequent to the growth of whole genome sequencing, as the availability of a large amount of whole genome data will required to be analyzed at specific gene locations and isolated genetic expressions. There are many companies in the NGS market offering targeted sequencing services. Thus, this segment is expected to grow in tandem with WGS segment throughout the forecast period.

- Workflow Insights

The sequencing segment held the highest market share in 2023. NGS sequencing is the most important phase of the workflow and consequently accounts for the largest share of the market. These systems are able to provide accurate amount of liquid, which is important in NGS. Moreover, functions such as changing tubes and micro liter plates are also carried out by the system, which helps streamline workflow. The advantage of using robotic liquid handling system is that it enables researchers focus on analyzing the data rather than managing the process.

- End use Insights

Clinical research segment is anticipated to be the fastest growing segment with a CAGR of 22.92% during the forecast period. Owing to the use of NGS in cancer research and, more specifically, in discovery of new cancer-related genes, studying tumor heterogeneity, and identification of alterations that are contributive in tumorigenesis the segment is expected to witness significant growth through to 2030. In addition, availability of clinical research solutions through market entities such as Illumina, Thermo Fisher Scientific Corporation, and Agilent Technologies for the purpose of target enrichment & detection is anticipated to provide this segment with high growth opportunities over the forecast period.

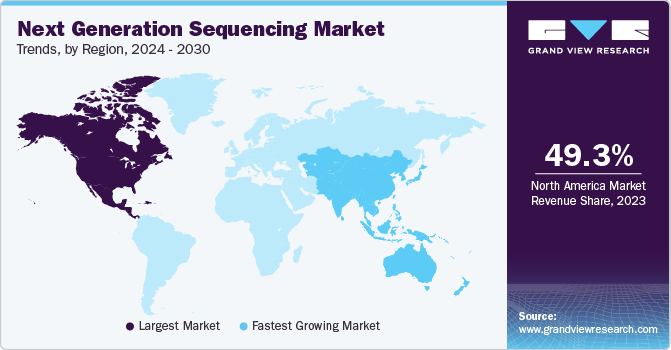

- Regional Insights

The Asia Pacific region is estimated to be the fastest-growing region owing to the presence of significant developments by China and Japan for technological integration of NGS methodologies, and the development of healthcare, R&D and clinical development frameworks of emerging economies such as India and Australia have poised the Asia Pacific NGS market to witness lucrative opportunities o growth throughout the forecast period.

Gather more insights about the market drivers, restraints, and growth of the Next Generation Sequencing Market

Key Companies & Market Share Insights

- Illumina

- F. Hoffman-La Roche Ltd.

- QIAGEN

- Thermo Fisher Scientific, Inc.

- Bio-Rad Laboratories, Inc.

- Oxford Nanopore Technologies

- PierianDx

- Genomatix GmbH

- DNASTAR, Inc.

- Perkin Elmer, Inc.

- Eurofins GATC Biotech GmbH

- BGI

Order a free sample PDF of the Market Intelligence Study, published by Grand View Research.

Recent Developments

- In December 2023, Oxford Nanopore launched TurBOT beta access in partnership with Tecan. The buyers are expected to recive the products in Q1 2024. TurBOT is a benchtop instrument offering efficient basecalling, data analysis, automated extraction, and library preparation of multiple samples in one single unit.

- In December 2023, Illumina signed a memorandum of understanding with African Society for Laboratory Medicine to increase access to genomics within the African region to fight infectious diseases.

- In December 2023, Illumina partnered with HaploX to provide locally manufactured sequencing instruments in China.

No comments:

Post a Comment