U.S. Concierge Medicine Industry Overview

The U.S. Concierge Medicine Market, estimated at $7.35 billion in 2024, is anticipated to grow at a compound annual growth rate (CAGR) of 10.33% from 2025 to 2030. This growth is being driven by increasing patient awareness of the advantages of this healthcare model and its growing adoption among physicians. Additionally, the existing shortage of primary care physicians across the nation is further contributing to the market's expansion.

The significant number of daily hospital visits, combined with a scarcity of primary care physicians, has led to longer waiting times for patients. Individuals often experience hours of waiting for consultations in traditional healthcare settings. For example, according to an article published by the Association of Health Care Journalists in August 2024, the typical wait time for new patients to schedule an appointment with a physician in major U.S. cities ranges from 27 to 70 days. Moreover, the high patient volume often results in physicians having less time to spend with each individual. Concierge medicine offers advantages for both patients and healthcare providers, leading to a growing number of physicians transitioning to this practice model. A 2020 survey by the Robert Wood Johnson Foundation, the Harvard T.H. Chan School of Public Health, and NPR indicated that approximately 22% of the top 1% of income earners in the U.S. were utilizing concierge medicine. The shift of physicians from conventional to concierge medicine is highlighted by significant efforts from both healthcare providers and service organizations to collaborate in delivering optimal concierge healthcare services to patients.

Detailed Segmentation:

- Ownership Insights

The standalone ownership segment is expected to experience significant growth at a lucrative CAGR over the forecast period. This growth is primarily driven by the reduced drudgery burden, career satisfaction, and higher compensation and profitability offered in this segment. Moreover, various regulations associated with Medicare and Medicaid require physicians to dedicate more time to electronic health records than direct patient care. By maintaining a smaller patient panel, physicians can spend more time with each patient, improving work-life balance. This shift is fueling the growth in this segment.

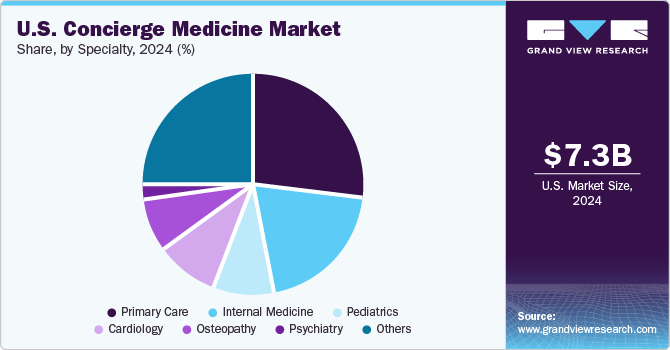

- Specialty Insights

The internal medicine segment is projected to witness lucrative growth during the forecast period. Internal medicine is among the top 5 specialties in concierge care. This growth can be attributed to the increasing number of visits for digestive diseases and the rising prevalence of diabetes & hypertension. As per the National Diabetes Statistics Report, in 2021, 38.4 million people in the U.S. had diabetes. This increasing number of patients is contributing to the demand for healthcare services. Therefore, many internal medicine doctors, as well as patients, are showing less interest in traditional care, which is anticipated to propel segment growth.

Gather more insights about the market drivers, restraints, and growth of the U.S. Concierge Medicine Market

Key Companies & Market Share Insights

The market is fragmented due to diverse service offerings and regulations. Companies such as MDVIP, Signature MD, and Crossover Health dominate the market due to the diverse network of doctors across the U.S. For instance, MDVIP comprises more than 1,000 affiliated physicians across the U.S. Companies such as MDVIP, Specialdocs Consultants LLC, Signature MD, and Castle Connolly Private Health Partners are focusing on converting more physicians to concierge medicine under their network by providing legal, operational, and marketing support. As companies continue to adapt to evolving healthcare needs and consumer preferences, their market shares may fluctuate based on strategic mergers and acquisitions or expansions into new regions.

Key U.S. Concierge Medicine Companies:

- MDVIP

- Signature MD

- Crossover Health

- Specialdocs Consultants, LLC

- PartnerMD

- Concierge Consultants & Cardiology

- Castle Connolly Private Health Partners

- Peninsula Doctor

- Campbell Family Medicine

- Destination HealthMDI

- Priority Physicians, Inc.

- U.S. San Diego Health

Order a free sample PDF of the Market Intelligence Study, published by Grand View Research.

Recent Developments

- In September 2024, BayCare Health System announced a partnership with Metro Development Group to offer customized concierge medicine services specifically tailored for Pasco County communities. This collaboration aims to enhance healthcare accessibility and provide personalized medical care that meets the unique needs of residents in the area.

- In July 2024, Dr. Keisha B. Ellis introduced a new primary care practice affiliated with MDVIP;in the Metro Atlanta area. MDVIP is a network of primary care physicians that emphasizes personalized healthcare and preventive medicine, allowing doctors to spend more time with their patients compared to traditional practices.

- In February 2024, Concierge Choice Physicians (CCP) announced that four additional physicians from the Primary Care Division at Weill Cornell Medicine are now participating in CCP’s Hybrid Choice program. This enhanced service aims to provide patients with improved connectivity and peace of mind through better communication between doctors and their patients.

No comments:

Post a Comment