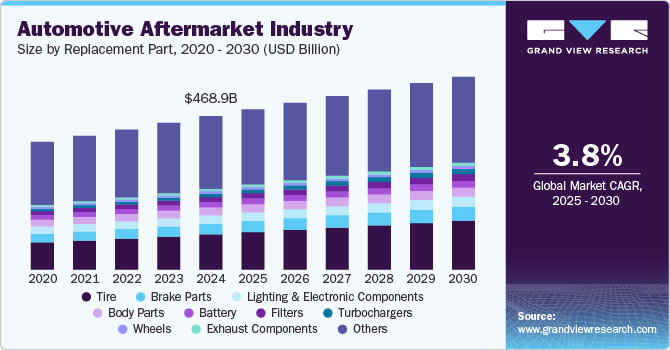

The global automotive aftermarket industry was valued at USD 468.91 billion in 2024. Projections indicate a rise to USD 589.01 billion by 2030, reflecting a Compound Annual Growth Rate (CAGR) of 3.8% from 2025 to 2030. This growth is primarily fueled by vehicle owners' desire to enhance their vehicles' performance, encompassing aspects like exhaust sound, speed, and aesthetic appeal.

Regulatory bodies such as the Japanese Automobile Sports Muffler Association (JASMA) and the U.S. Environmental Protection Agency play a crucial role in overseeing manufacturing standards and environmental impacts of automotive components. This oversight extends to areas like noise emission levels from modern automotive resonators and mufflers within exhaust systems.

The digitalization of component delivery, sales, and services, coupled with the emergence of online portals that distribute aftermarket parts in collaboration with global auto-part suppliers, is expected to attract significant investments from key industry players. Leading market component suppliers, including US Auto Parts Network, Inc. and CarParts.com, are poised to drive global market demand in the coming years.

Key Market Trends & Insights:

- Regional Dominance: The Asia Pacific automotive aftermarket held the largest market share, at 29.1%, in 2024. This region is also anticipated to experience substantial growth from 2025 to 2030.

- Replacement Part Segments: In 2024, the "other" replacement part segment accounted for the largest share at 47.33%. Looking ahead, the tire segment is expected to become the dominant category in terms of size among replacement parts.

- Distribution Channel Preferences: The retail segment commanded the largest share of the distribution channel at 54.8% in 2024. The retail segment is projected to maintain its leading position in the market by 2030.

- Service Channel Leadership: The original equipment (OE) segment held a significant 69.2% share of the service channel in 2024. The OE segment is anticipated to continue dominating the aftermarket in terms of size by 2030.

- Certification Preference: Genuine parts dominated the certification segment with a 51.4% share in 2024. This segment is expected to remain the largest in the aftermarket by 2030.

Order a free sample PDF of the Automotive Aftermarket Industry Intelligence Study, published by Grand View Research.

Market Size & Forecast

- 2024 Market Size: USD 468.91 Billion

- 2030 Projected Market Size: USD 589.01 Billion

- CAGR (2025-2030): 3.8%

- Asia Pacific: Largest market in 2024

Key Companies & Market Share Insights

Leading entities in the automotive aftermarket sector include prominent names such as 3M Company, Continental AG, Denso Corporation, Robert Bosch GmbH, and ZF Friedrichshafen AG. The expansion of this industry is anticipated to be significantly propelled by advancements in technology and a surge in research and development investments by both manufacturers and industry associations.

While numerous domestic and regional players contribute to the market, they face the ongoing challenge of providing innovative solutions that cater to evolving technologies, heightened security demands, and shifting business models. The major companies in this arena find themselves in a dynamic position, where they can either solidify or lose market share. Consequently, these key players are strategically pursuing mergers and acquisitions to broaden their global presence and reinforce their competitive standing.

Key Players

- 3M Company

- Continental AG

- Cooper Tire & Rubber Company

- Delphi Automotive PLC

- Denso Corporation

- Federal-Mogul Corporation

- HELLA KGaA Hueck & Co.

- Robert Bosch GmbH

- Valeo Group

- ZF Friedrichshafen AG

Browse Horizon Databook for Global Automotive Aftermarket Industry Size & Outlook

Conclusion

The automotive aftermarket is growing, driven by consumer demand for vehicle enhancement and regulatory oversight. Digitalization is attracting significant investment, with online platforms and key suppliers shaping future market dynamics. Regional strengths and segment shifts are evident. Leading companies are investing in R&D and employing strategic mergers to maintain competitiveness amidst evolving technologies and diverse market players.

No comments:

Post a Comment