The global cardiovascular clinical trials market was valued at USD 5.26 billion in 2022 and is anticipated to grow to USD 8.41 billion by 2030, exhibiting a Compound Annual Growth Rate (CAGR) of 6.0% from 2023 to 2030. This expansion is largely attributed to the increasing prevalence of cardiovascular diseases (CVDs), such as heart failure, stroke, and coronary artery diseases. For instance, according to the World Heart Federation, CVDs were a leading cause of global mortality, responsible for approximately 20.5 million deaths in 2021. Furthermore, heightened investments from governments and industry, coupled with a demand for cost efficiencies in Phase III trials, are contributing to market growth.

Ongoing innovations in medical research, particularly in areas like personalized medicine and genomics, are driving the need for clinical trials to explore novel therapeutic approaches. Technological advancements in medical research, including the integration of telemedicine and wearable devices for virtual patient monitoring in clinical trials, are enabling more cost-effective and efficient trial management, thereby supporting market expansion.

Key Market Trends & Insights:

- Regional Dominance: North America held the largest market share, at 42.1%, in 2022. This is due to the strong presence of established Contract Research Organizations (CROs) specializing in cardiovascular clinical trials, including Worldwide Clinical Trials, ICON plc, and Caidya.

- Phase Segment Leadership: The Phase IV segment dominated the market, accounting for a 34.3% revenue share in 2022. Regulatory bodies, such as the U.S. FDA and European Union agencies, often mandate post-marketing studies to ensure the continued efficacy and safety of cardiovascular treatments.

- Study Design Preference: Interventional studies represented the largest revenue share, at 64.8%, in 2022. These studies are categorized by the intervention being evaluated, which can include drugs, biologicals, behavioral interventions, surgical procedures, and devices.

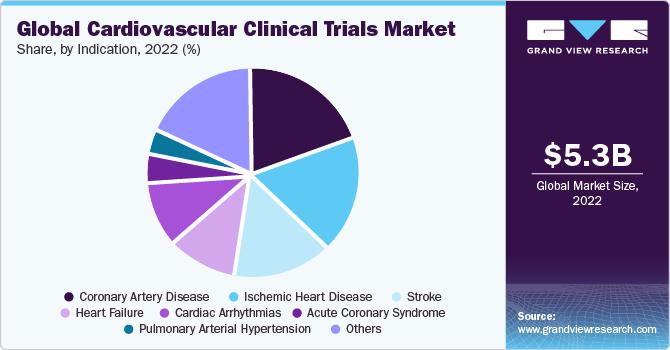

- Indication Dominance: The coronary artery disease category held the largest revenue share, at 20.0%, in 2022. This is attributed to the growing number of ongoing clinical trials related to coronary artery disease.

Order a free sample PDF of the Cardiovascular Clinical Trials Market Intelligence Study, published by Grand View Research.

Market Size & Forecast

- 2022 Market Size: USD 5.26 Billion

- 2030 Projected Market Size: USD 8.41 Billion

- CAGR (2023-2030): 6.0%

- North America: Largest market in 2022

Key Companies & Market Share Insights

Key players in the cardiovascular clinical trials market are actively pursuing inorganic growth strategies, including mergers, partnerships, and acquisitions, to strengthen their market presence. Companies are prioritizing collaborations to enhance their strategic positioning. For example, in September 2023, Cereno Scientific, a biopharmaceutical firm, entered into a collaboration agreement with Clinical Trial Consultants (CTC), a contract research organization, to commence a Phase I human study for CS014, a histone deacetylase inhibitor aimed at preventing arterial and venous thrombosis.

Key Players

- IQVIA Inc

- ICON plc

- SGS SA

- Eli Lilly and Company

- PPD Inc

- Syneos Health

- Caidya

- Worldwide Clinical Trials

- Vial

- Veeda Clinical Research

- Medpace, Inc.

Browse Horizon Databook for Global Cardiovascular Clinical Trials Market Size & Outlook

Conclusion

The cardiovascular clinical trials market is expanding due to rising heart disease prevalence, increased investments, and a push for cost efficiency. Innovations like personalized medicine and virtual monitoring are key drivers. North America leads regionally, with Phase IV and interventional studies being dominant. Coronary artery disease is the top indication. Market players are strategically collaborating and acquiring to enhance their global standing.

No comments:

Post a Comment