The global precision harvesting market was valued at USD 18.68 billion in 2024 and is projected to reach USD 27.41 billion by 2030, exhibiting a Compound Annual Growth Rate (CAGR) of 6.4% from 2025 to 2030. This expansion is largely fueled by the increasing integration of harvesting robots and autonomous combine harvesters, which effectively mitigate agricultural labor shortages. These advanced technologies not only boost operational efficiency and enable highly precise harvesting methods but also significantly reduce crop wastage, ultimately leading to enhanced yields.

The growing global population and escalating concerns regarding food security are major impetuses for the precision harvesting sector, driving farmers to adopt cutting-edge solutions to meet rising demands. Furthermore, precision harvesting technologies optimize various farming processes, thereby improving crop quality and overall profitability. As urbanization intensifies pressure on agricultural systems, the need for such efficient and sustainable solutions becomes increasingly critical.

Key Market Trends & Insights:

- Regional Dominance: North America led the global precision harvesting market in 2024, accounting for a 43.6% revenue share. This can be attributed to the region's proactive embrace of advanced agricultural technologies and substantial investments in research and development.

- Product Segment Leadership: In 2024, the combine harvesters segment held the largest share of the market. This dominance is driven by the consistent demand for efficient agricultural machinery that enhances productivity and reduces labor expenses.

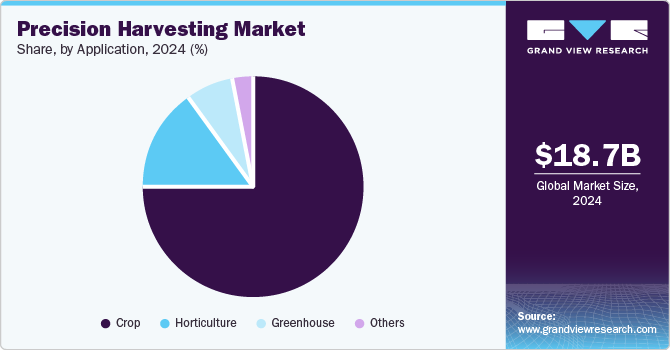

- Application Segment Dominance: The crop segment commanded the largest share in the market, with 75.5% in 2024. This is due to the increasing adoption of precision harvesting technologies by farmers seeking to boost productivity and improve crop yields across a wide range of crops.

- Offering Segment Leadership: The hardware segment secured the largest market share in 2024. This is primarily due to the rising deployment of advanced agricultural machinery and equipment designed to optimize operational efficiency in farming.

Order a free sample PDF of the Precision Harvesting Market Intelligence Study, published by Grand View Research.

Market Size & Forecast

- 2024 Market Size: USD 18.68 Billion

- 2030 Projected Market Size: USD 27.41 Billion

- CAGR (2025 - 2030): 6.4%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

Key Companies & Market Share Insights

Leading the precision harvesting market are key companies such as Deere & Company, AGCO Corporation, KUBOTA Corporation, Raven Industries, Inc., and CLAAS KGaA mbH. These organizations are strategically focused on expanding their market presence and strengthening their competitive position. To achieve these objectives, they are actively pursuing various strategic initiatives, including mergers and acquisitions, as well as fostering partnerships with other prominent industry players. Through these strategies, they aim to enhance their capabilities in delivering data-driven insights, optimizing operational efficiency, and driving innovation within the precision harvesting sector.

- Deere & Company stands as a global leader in agricultural, construction, and forestry machinery. The company offers advanced precision farming and harvesting technologies, encompassing GPS-guided equipment, automated combine adjustments, and comprehensive yield mapping. Furthermore, its John Deere Operations Center empowers data-driven decision-making for farmers. Consistent investments in research and development underscore Deere & Company's commitment to innovation in autonomous machinery and sustainable farming solutions.

- AGCO Corporation is a prominent designer and manufacturer of agricultural equipment, with well-known brands like Fendt and Massey Ferguson under its umbrella. Their Fuse Smart Farming platform provides a suite of precision farming and harvesting tools, including automated systems and telemetry solutions. AGCO's strategic focus revolves around continuous innovation and sustainability, aiming to deliver tailored solutions that address the evolving needs of modern agriculture.

- KUBOTA Corporation is actively involved in advancing smart agriculture through its precision farming system (FMIS). This system visualizes farm management data, enabling evidence-driven farming decisions. Kubota's FMIS integrates with various technologies like GPS and sensors, collecting and analyzing data on taste, yield, and growth for optimized farm management plans. The company is also exploring financing strategies for autonomous equipment, demonstrating its commitment to the future of agricultural automation.

- Raven Industries, Inc. (now a brand of CNH) specializes in automated and autonomous farm technologies, with a strong focus on enhancing productivity, sustainability, and profitability in agriculture. Their harvesting solutions include guidance and steering systems, advanced displays, and harvest controls. Raven's Cart Automation™ system, for example, synchronizes grain cart and combine movements to minimize spillage and maximize efficiency. The company emphasizes customer-focused innovation and a connected workflow through solutions like Raven Slingshot®, designed to seamlessly manage operations from the office to the field.

- CLAAS KGaA mbH is a significant player offering advanced smart farming solutions. Their digital tools, such as CLAAS connect, facilitate efficient farm and fleet management, automated documentation, and improved field performance. CLAAS's precision farming systems, like GPS PILOT CEMIS 1200, enable automatic steering and precise operations. The company's focus on Smart Farming aims to empower farmers with data-driven decision-making, optimize resource usage, and contribute to sustainable agricultural practices.

Key Players

- Deere & Company

- AGCO Corporation

- KUBOTA Corporation

- Raven Industries, Inc.

- CLAAS KGaA mbH

- Ag Leader Technology

- TeeJet Technologies

- TOPCON CORPORATION

- DICKEY-john

- CNH Industrial N.V.

Browse Horizon Databook for Global Precision Harvesting Market Size, Share & Trends Analysis

Conclusion

The precision harvesting market is experiencing significant growth, driven by the adoption of advanced technologies like harvesting robots and autonomous combines. These innovations address labor shortages, enhance efficiency, reduce waste, and boost crop yields, crucial for meeting increasing global food demands amidst urbanization. North America currently leads the market, with combine harvesters, crop applications, and hardware offerings dominating segments. Leading companies are focused on strategic initiatives to expand their reach and innovate, leveraging data-driven insights and fostering partnerships for a more efficient and sustainable agricultural future.

No comments:

Post a Comment