The global vegan tuna market, valued at USD 945.3 million in 2023, is projected to reach USD 1.59 billion by 2030, demonstrating a Compound Annual Growth Rate (CAGR) of 7.8% from 2024 to 2030. A primary driver for this market expansion is the escalating consumer demand for plant-based diets, influenced by growing concerns regarding health, ethical considerations, and environmental sustainability. As more individuals adopt vegetarian, vegan, or flexitarian eating habits, the need for plant-based protein alternatives has surged. Vegan tuna is gaining significant traction as a substitute for traditional tuna, effectively replicating its taste, texture, and nutritional profile.

Research indicates a global rise in plant-based diets, particularly in developed markets. This demographic shift is notably propelled by millennials and Gen Z, who exhibit strong concerns about animal welfare, sustainability, and personal health. Additionally, flexitarians—consumers who are reducing their meat intake—represent a substantial and expanding consumer base. This broad dietary shift has laid the groundwork for the emergence of vegan tuna and other plant-based seafood options. Furthermore, the critical issue of overfishing, which severely impacts marine ecosystems and has led to several tuna species being classified as endangered, has heightened consumer awareness of the environmental consequences of seafood consumption. This concern is driving consumers towards ethical and sustainable alternatives. Plant-based tuna, with no impact on marine biodiversity, appeals greatly to environmentally conscious consumers seeking to mitigate the negative effects of overfishing.

Key Market Trends & Insights:

- North American Dominance: The North America vegan tuna market commanded a revenue share of 40.2% in 2023, largely attributable to high consumer awareness regarding plant-based diets and sustainability in the region.

- Asia Pacific's Rapid Growth: The vegan tuna market in Asia Pacific is anticipated to expand at a CAGR of 8.4% from 2024 to 2030, fueled by increasing awareness of plant-based diets, rising disposable incomes, and evolving dietary preferences.

- Frozen Product Preference: Frozen vegan tuna held a significant revenue share of 40.2% in 2023. This dominance is primarily due to the ability of frozen products to better preserve the texture, flavor, and nutritional value of ingredients over longer periods compared to canned or fresh alternatives.

- Household End-User Lead: Households accounted for a 60.5% revenue share of vegan tuna consumption in 2023, driven by the increasing adoption of plant-based diets at the consumer level due to health, environmental, and ethical motivations.

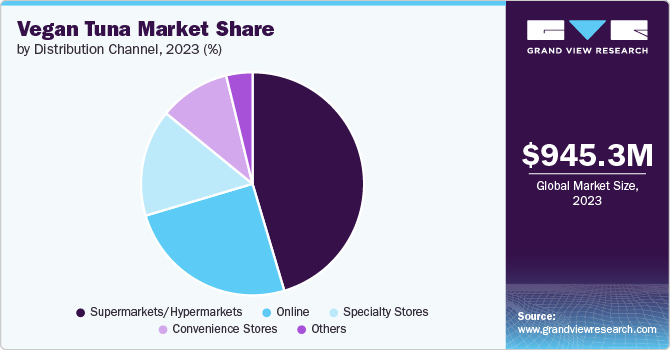

- Supermarket/Hypermarket as Key Distribution Channel: Sales through supermarkets and hypermarkets captured a 45.4% revenue share of the market in 2023. This is attributed to their extensive consumer reach, diverse product selections, and convenience for shoppers.

Order a free sample PDF of the Vegan Tuna Market Intelligence Study, published by Grand View Research.

Market Size & Forecast

- 2023 Market Size: USD 945.3 Million

- 2030 Projected Market Size: USD 1.59 Billion

- CAGR (2024-2030): 7.8%

- North America: Largest market in 2023

Key Companies & Market Share Insights

The global vegan tuna market is fiercely competitive, with a strong presence from key players. These companies are actively engaged in a variety of strategic initiatives to capture new market opportunities and cater to the growing demand for plant-based seafood alternatives.

Some notable strategic moves include:

- New Product Launches: Companies are continuously innovating to create vegan tuna products that closely mimic the taste, texture, and nutritional profile of traditional tuna. For instance, Garden Gourmet (Nestlé) launched its "Vuna" product in several European markets, and Sophie's Kitchen consistently expands its range of plant-based seafood options. Other brands like Endori and John West have also recently introduced their own vegan tuna varieties.

- Partnerships and Collaborations: Strategic alliances are crucial for expanding reach and leveraging expertise. Thai Union, a major traditional seafood company, has partnered with plant-based seafood businesses like The Ish Company to enter and grow within the U.S. plant-based market. Similarly, Good Catch Foods and Bumble Bee Foods announced a partnership in March 2024 to enhance the development and distribution of plant-based seafood products.

- Mergers and Acquisitions (M&A): Larger food corporations are increasingly acquiring or investing in plant-based startups to diversify their portfolios and gain a foothold in this burgeoning market. This trend reflects a broader consolidation within the plant-based food industry.

- Focus on Sensory Attributes and Nutritional Value: Players are heavily investing in research and development to improve the sensory experience of vegan tuna, making it more appealing to a wider consumer base, including flexitarians. This involves using innovative ingredients (e.g., pea protein, soy, wheat, algae) and advanced food processing techniques to achieve authentic taste and texture.

- Expanding Distribution Channels: Companies are working to increase the availability of vegan tuna through various channels, including supermarkets, hypermarkets, online platforms, and foodservice establishments, making it easier for consumers to access these products.

Key Players

- Thai Union

- Good Catch

- Ocean Hugger Foods, Inc.

- Atlantic Natural Foods

- Garden Gourmet Vuna

- Sophie’s Kitchen

- OmniTuna

- Hooked

- Vgarden Ltd.

- Endori

Browse Horizon Databook for Global Vegan Tuna Market Size & Outlook

Conclusion

The global vegan tuna market is experiencing substantial growth, primarily driven by rising consumer demand for plant-based diets. This shift is influenced by increasing concerns about health, ethics, and environmental sustainability, particularly overfishing. Vegan tuna is gaining popularity due to its ability to mimic traditional tuna's taste, texture, and nutritional profile. Key trends include significant adoption in North America and rapid growth in Asia Pacific, with frozen products and household consumption leading the market segments. Supermarkets and hypermarkets are crucial distribution channels. The market is highly competitive, with major players continuously innovating through new product launches, strategic partnerships, and mergers and acquisitions to meet evolving consumer preferences.

No comments:

Post a Comment