Contract Logistics Market Growth & Trends

The global Contract Logistics Market was valued at USD 324.6 billion in 2024 and is forecast to expand at a CAGR of 7.8% from 2025 to 2030. This upward trend is propelled by the rapid growth of e-commerce, the increasing globalization of supply chains, and the continuous pressure on businesses to optimize operations and cut overheads. Companies are increasingly turning to third-party logistics (3PL) providers to streamline costs and concentrate on their core competencies. However, maintaining end-to-end visibility across intricate, multi-modal logistics networks remains a significant hurdle. The adoption of automation, artificial intelligence (AI), and digital logistics platforms presents substantial growth opportunities for the market.

Key Market Drivers

Booming E-commerce Sector: The rapid expansion of e-commerce is a primary catalyst. In 2024, U.S. e-commerce sales reached USD 1.19 trillion, an 8.1% year-over-year increase, constituting 16.1% of total retail sales. India's market is also experiencing swift growth, projected to surge from USD 123 billion in 2024 to USD 292.3 billion by 2028 at an impressive CAGR of 18.7%. This growth fuels demand for faster, scalable, and technology-driven logistics solutions. Contract logistics providers are addressing this need through integrated warehousing, efficient last-mile delivery, and real-time visibility to support the evolving digital retail landscape.

Globalization of Supply Chains: The globalization of supply chains significantly boosts the demand for contract logistics. Businesses that source and distribute across international borders increasingly depend on 3PL providers to manage complex, multi-country operations. This reliance stimulates the growth of integrated logistics solutions that enhance efficiency, ensure compliance, and bolster resilience in global trade. These solutions also aid companies in cost reduction, supply chain streamlining, and swift adaptation to changing regulatory and geopolitical conditions.

Outsourcing to 3PL Providers: Companies are increasingly outsourcing to 3PL providers to focus on core operations and reduce costs. According to the U.S. Logistics Costs Report (CSCMP), outsourced logistics helps businesses mitigate rising warehousing and transportation expenses, which accounted for over 8.7% of GDP in the U.S. alone. Furthermore, complying with complex international regulations, such as the EU Import Control System 2 (ICS2) and the U.S. FDA's Food Safety Modernization Act (FSMA), makes outsourcing a strategic imperative for many businesses.

Major Market Restraints

Fuel Price Volatility and Fluctuating Transportation Costs: A significant market restraint is the high dependency on fuel prices and volatile transportation costs. Swings in global oil prices directly impact freight rates and overall logistics expenses, squeezing service provider margins.

Infrastructure Challenges in Emerging Markets: Infrastructure deficiencies in emerging markets, including poor road connectivity, limited warehousing facilities, and port congestion, disrupt supply chain continuity. These factors limit scalability and diminish service reliability in affected regions.

Curious about the Contract Logistics Market? Download your FREE sample copy now and get a sneak peek into the latest insights and trends.

Contract Logistics Market Report Highlights

- The transportation segment accounted for the largest share of 34.4% in 2024.

- The outsourcing segment accounted for the largest share in 2024.

- The roadways segment accounted for the largest share in 2024, driven by increasing demand for flexible, last-mile delivery, rising preference for cost-effective short- to mid-haul transport, and expanding road infrastructure.

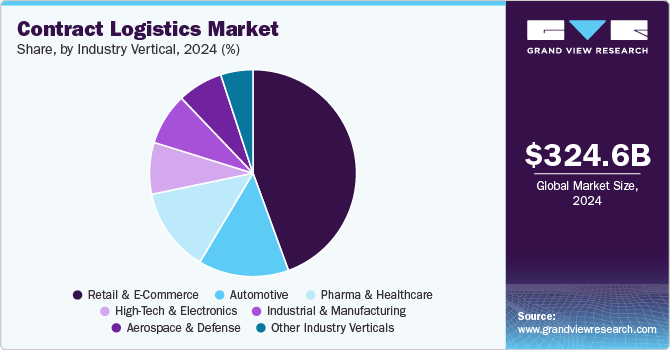

- The retail & e-commerce segment accounted for the largest share in 2024.

Contract Logistics Market Segmentation

Grand View Research has segmented the global Contract Logistics market based on service, type, transportation mode, industry vertical, and region:

- Service Outlook (Revenue, USD Billion, 2018 - 2030)

- Transportation

- Warehousing

- Distribution

- Aftermarket Logistics

- Other Services

- Type Outlook (Revenue, USD Billion, 2018 - 2030)

- Outsourcing

- Insourcing

- Transportation Mode Outlook (Revenue, USD Billion, 2018 - 2030)

- Roadways

- Railways

- Airways

- Waterways

- Industry Vertical Outlook (Revenue, USD Billion, 2018 - 2030)

- Retail & E-Commerce

- Automotive

- Pharma & Healthcare

- Industrial & Manufacturing

- Aerospace & Defense

- High-Tech & Electronics

- Other Industry Verticals

Download your FREE sample PDF copy of the Contract Logistics Market today and explore key data and trends.

No comments:

Post a Comment