The U.S. Senior Living market was valued at USD 923.20 billion in 2023 and is projected to reach USD 1,224.20 billion by 2030, growing at a Compound Annual Growth Rate (CAGR) of 4.16% from 2024 to 2030. This expansion is primarily driven by the increasing elderly population. Currently, approximately 62 million adults aged 65 and older reside in the U.S., accounting for 18% of the total population. By 2054, projections indicate this demographic will grow to 84 million, comprising an estimated 23% of the population. As life expectancy continues to rise and the baby boomer generation ages, there is a heightened demand for diverse senior housing options, including independent living, assisted living, and memory care facilities. This demographic transformation is propelling the growth of the senior living sector, with a strong focus on delivering high-quality care and lifestyle amenities. Furthermore, the integration of advanced healthcare services within these communities ensures that the aging population has access to comprehensive medical and wellness support, thereby fostering market expansion.

The landscape of senior living has evolved considerably due to shifts in family structures. With more dual-income households and fewer multi-generational living arrangements, families are increasingly seeking professional care solutions for their elderly relatives. This trend is leading to a greater reliance on senior living communities to provide secure, supportive, and engaging environments for older adults. According to Gallup, the average retirement age in the U.S. increased from 57 in 1991 to 61 in 2022. Additionally, among non-retirees, the anticipated age of retirement has risen from 60 in 1995 to 66 in 2022. As traditional family caregiving becomes less practical, the demand for professionally managed senior living options is on the rise. Facilities that offer a combination of healthcare, social activities, and personal care are particularly attractive to families seeking holistic solutions.

Key Market Trends & Insights:

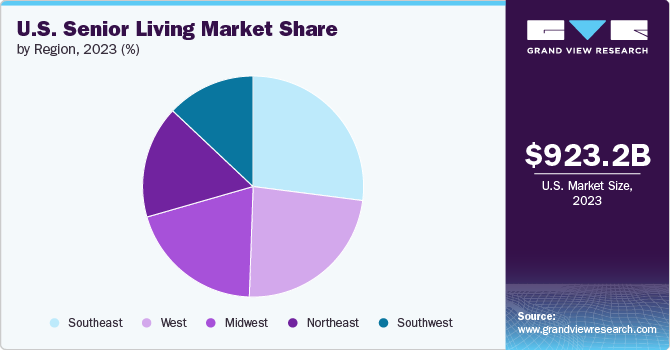

- Regional Dominance: The Southeast U.S. senior living market held the largest share of 27.03% in 2023, primarily due to its aging population and the increasing demand for specialized healthcare services.

- Fastest Growth in Southwest U.S.: The senior living market in the Southwest U.S. is experiencing the most rapid growth, propelled by a swiftly aging population and a rising need for specialized care services.

- Active Adult Communities Lead by Facility Type: In terms of facility type, active adult (55+) communities/independent living held the largest share of 66.19% in 2023. This growth is driven by the increasing number of baby boomers seeking vibrant, maintenance-free lifestyles within age-restricted communities.

Order a free sample PDF of the U.S. Senior Living Market Intelligence Study, published by Grand View Research.

Market Size & Forecast

- 2023 Market Size: USD 923.20 Billion

- 2030 Projected Market Size: USD 1,224.20 Billion

- CAGR (2024-2030): 4.16%

Key Companies & Market Share Insights

The U.S. senior living market is characterized by intense competition, with a strong presence from established. These prominent companies are actively engaged in various strategic initiatives to meet the evolving demands of their clientele.

Key competitive strategies observed in this market include:

- New Product & Service Development: Companies are continuously innovating to offer a wider range of senior living options, from independent and active adult communities to assisted living and memory care facilities. This also extends to integrating advanced healthcare services and wellness programs to provide comprehensive support.

- Collaborations: Partnerships with healthcare providers, technology firms, and other service organizations are becoming increasingly important to enhance the quality of care, streamline operations, and offer more integrated solutions.

- Acquisitions and Mergers: Consolidation through acquisitions and mergers is a common strategy to expand geographic reach, increase market share, and diversify service portfolios. This allows companies to leverage economies of scale and optimize their operational efficiencies.

- Focus on Affordability and Accessibility: With the growing demand, there's a strong emphasis on providing solutions that are not only high-quality but also financially accessible to a broader segment of the elderly population.

- Technological Integration: The adoption of technology for improved resident experience, operational efficiency, and healthcare delivery (e.g., remote monitoring, telemedicine, AI-powered insights) is a growing area of focus for competitive advantage.

The U.S. senior living market is dynamic, with providers constantly adapting to demographic shifts, changing family structures, and increasing consumer expectations for holistic and personalized senior care solutions. The ongoing strategic efforts by these key players are crucial for their sustained growth and leadership in this competitive landscape.

Key Players

- Genesis Healthcare

- Brookdale Senior Living Solutions

- Lincare, Inc.

- The Ensign Group, Inc

- Extendicare

- Sunrise Senior Living, LLC

- Life Senior Living Facilities

- Golden Living Centers

Explore Horizon Databook – The world's most expansive market intelligence platform developed by Grand View Research.

Conclusion

The U.S. senior living market is experiencing significant growth, primarily driven by the expanding elderly population and evolving family structures that increase demand for professional care solutions. Key trends include the dominance of homecare and active adult communities, alongside rapid growth in specific regions. The market is highly competitive, with major players innovating through new services, collaborations, and strategic acquisitions to meet the diverse and increasing needs of older adults.

No comments:

Post a Comment