Aluminum Die Casting Industry Overview

The global aluminum die casting market size was valued at USD 69.36 billion in 2021 and is expected to expand at a compound annual growth rate (CAGR) of 5.5% from 2022 to 2030.

Increasing usage of aluminum in various applications, such as transportation and telecommunication, is expected to boost market growth during the forecast period. A rising preference for high strength and lightweight castings is a prominent driving factor. Manufacturers are required to comply with the regulations, to enhance fuel efficiency and reduce harmful emissions, in the transportation industry. This is possible by the incorporation of lightweight materials in production of the vehicles.

Gather more insights about the market drivers, restrains and growth of the Global Aluminum Die Casting Market

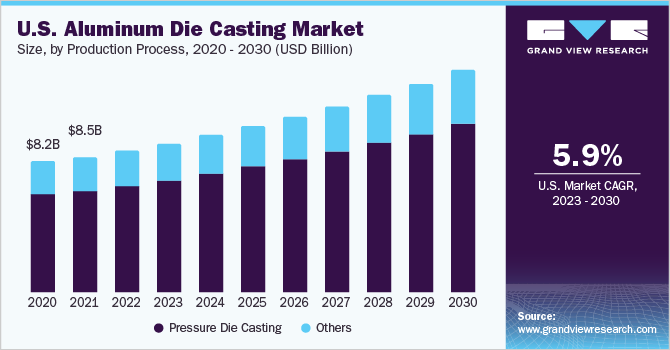

The U.S. is a prominent producer and consumer of aluminum die casting. The upward growth trajectory of the U.S. market was severely impacted in 2020 as the product demand reduced drastically on account of the emergence of the COVID-19 pandemic, which led to a downfall in both production and consumption activities. However, during this period, the acquisition activities increased significantly wherein global players targeted regional players.

For instance, in March 2020, Martinrea International Inc., which is engaged in the design, development, and manufacturing of propulsion systems and lightweight structures, announced that it has acquired the structural components business segment of Metalsa S.A. de C.V. The acquisition has resulted in the addition of six plants including facilities in the U.S., Mexico, Germany, South Africa, and two in China. The strategic initiative is projected to propel the growth of Martinrea International Inc., thereby expanding its product portfolio and customer base.

Even though, the product demand is expected to remain steady during the forecast period. The rise in military spending in the country, coupled with rising investments in automation and robotics, is anticipated to prove fruitful for the market growth. The U.S. has been ranking first in terms of military spending in the world for the past many years. The utilization of castings in military aircraft and other equipment is likely to augment due to the rising spending in the military sector.

The growth of the building and construction industry is another growth driver for the market. For instance, construction spending in the U.S. increased by 1.7% from December 2020 to January 2021. This is a positive sign for the market. Aluminum die castings find application in windows, curtain walling, shop partitions, cladding, and prefabricated buildings, among others, in the construction industry.

The market growth declined in 2020 and was expected to remain sluggish in 2021 as well because of the pandemic. A steep decline in raw material prices, unemployment, minimal production, and disruptions in transport impacted the manufacturing of the aluminum die castings. For example, primary aluminum prices peaked at USD 1,810 per ton on January 21, 2020, and dropped to 1,421.5 on April 8, 2020.

Browse through Grand View Research's Advanced Interior Materials Industry Related Reports

- North America & Asia Aluminum Die Casting Market - The North America and Asia aluminum die casting market size was valued at USD 19.30 billion in 2019 and is expected to grow at a CAGR of 7.1% from 2020 to 2027. The market growth is mainly attributed to the increasing demand for aluminum in the transportation industry in passenger vehicles, commercial vehicles, aircraft, and railways.

- Aluminum Casting Market - The global aluminum casting market size was valued at USD 86.92 billion in 2021 and is expected to expand at a compound annual growth rate (CAGR) of 5.0% from 2022 to 2030. The increasing use of aluminum in automobiles owing to its high strength and lightweight is likely to drive the market over the coming years.

Market Share Insights

December 2020: Rio Tinto introduced a new series of high-quality aluminum alloys to support recycling by the die casters.

September 2020: Tesla announced its plan to replace hundreds of robots in its car factory in Germany with giant machines for making simpler chassis parts for raising its EV production.

Key Companies profiled:

Some prominent players in the global Aluminum Die Casting market include

- Alcast Technologies

- BUVO Castings

- Chongqing CHAL Precision Aluminum Co., Ltd.

- Consolidated Metco, Inc.

- Endurance Technologies Limited

- FAIST Group

- GF Casting Solutions

- GIBBS

- Martinrea Honsel Germany GmbH

- Madison-Kipp Corporation

- Ryobi Limited

Order a free sample PDF of the Aluminum Die Casting Market Intelligence Study, published by Grand View Research.

No comments:

Post a Comment