U.S. Long Term Care Industry Overview

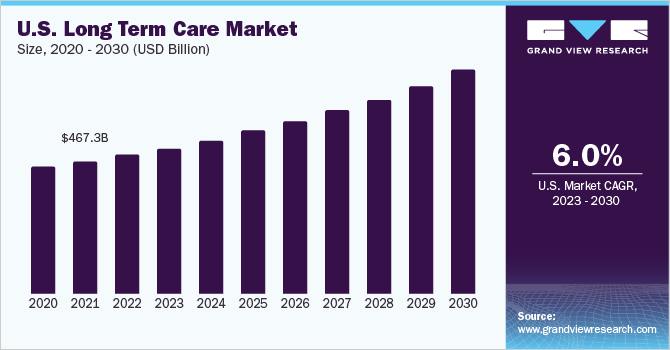

The U.S. long term care market size was valued at around USD 467.3 billion in 2021 and is expected to register a CAGR of 5.97% in the forecast period.

Demand for long-term care (LTC) has increased owing to the recognition of unmet needs of the elderly which are not fulfilled by hospital settings. According to estimates of the U.S. Department of Health and Human Services (HHS), around 69% of the U.S. population is expected to use long-term care services in their lives for an average of about three years, thus impelling their demand in the forthcoming times.

Gather more insights about the market drivers, restrains and growth of the U.S. Long Term Care Market

High geriatric population in the U.S. is rapidly rising due to increased life expectancy. In 2020, around 73 million adults in the U.S were aged 65 and above, accounting for 16.5% of the country’s population as per the U.S. Census Bureau. The geriatric population in the U.S. has a high prevalence of chronic diseases driving the market. For instance, as per the Alzheimer’s Association, 6 million people in the U.S. aged 65 & above have dementia.

Technological developments in the long-term care industry are one of the major factors responsible for the expansion of these services across the U.S. Earlier, durable medical devices such as wheelchairs, walkers, and safety rugs were mostly used for care management. The development of sophisticated & easy-to-use devices and services such as internet-enabled home monitors, telemedicine, and apps for mobile health is likely to boost the market in the forecast period.

The adoption of telehealth applications by providers of long-term care services is helping the market transform into an organized sector, attracting the interest of investors and entrepreneurs. Important advantages of technology integrated service are the reduction in financial burden associated with medical procedures and a decrease in the requirement of institutional care. For instance, remote patient monitoring in-home care services enable doctors to review real-time data and consult patients, reducing the number of home visits & appointments and helping in reducing emergency hospital admissions

According to the American Association of Long-Term Care Insurance, more than 8 million U.S. citizens have long-term care insurance. Employers are taking initiative to provide long-term care services to their employees. For instance, Medtronic sponsors a group LTC insurance plan for its employees. This plan is aimed at protecting employees from high costs associated with long-term care services at home, in community care, and in assisted living facilities.

Browse through Grand View Research's Medical Devices Industry Related Reports

- Long Term Care Market - The global long term care market size was valued at USD 983.3 billion in 2020 and is expected to expand at a CAGR of 7.1% from 2021 to 2028. The market is expected to boom owing to the aging baby boomers, increasing disabilities among the geriatric population, the dearth of skilled nursing staff, government funding, and increased collaborations of private insurers with various governments.

- Wheelchair Market - The global wheelchair market size was valued at USD 4.7 billion in 2020 and is expected to grow at a compound annual growth rate (CAGR) of 6.6% from 2021 to 2028. Rising population of geriatrics and the rise in number of disorders such as spinal cord injuries requiring mobility assistance are some of the key factors driving the market.

U.S. Long Term Care Market Segmentation

Grand View Research has segmented the U.S. long term care market based on service:

- U.S. Long Term Care Service Outlook (Revenue, USD Billion, 2017 - 2030)

- Skilled Nursing Facility

- Home Healthcare

- Assisted Living Facility

- Hospice & Palliative Care

- Others

Market Share Insights

October 2021: Amedisys announced the expansion of its home healthcare services with the opening of new centers in Charlotte and Raleigh, North Carolina

August 2021: Humana acquired Kindred at Home, which includes services such as personal care, hospice, and home health

July 2021: Brookdale Senior Living, Inc. sold a significant stake in its outpatient therapy, hospice, and home health business to HCA Healthcare.

Key Companies profiled:

Some prominent players in the U.S. Long Term Care market include

- Brookdale Senior Living, Inc

- Sunrise Senior Living, LLC

- Kindred Healthcare

- Amedisys, Inc

- Genesis Healthcare, Inc

- Capital Senior Living Corporation

- Diversicare Healthcare Services, Inc

- Home Instead, Inc

- Senior Care Center

- Atria’s Senior Living

Order a free sample PDF of the U.S. Long Term Care Market Intelligence Study, published by Grand View Research.

No comments:

Post a Comment