U.S. Contraceptive Industry Overview

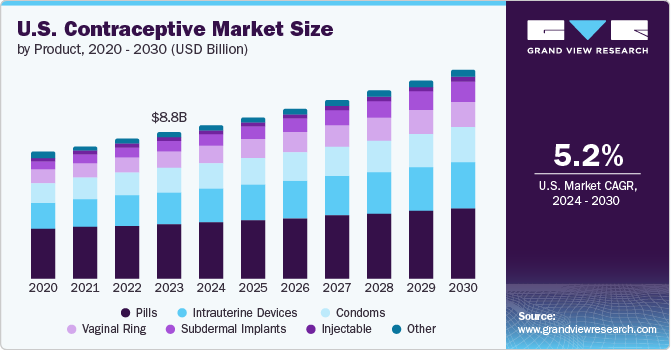

The U.S. contraceptive market size was valued at around USD 8.0 billion in 2021 and is projected to expand at a compound annual growth rate (CAGR) of around 4.70% in the forecast period.

Increase in the use of modern contraceptives and rise in awareness among adolescents and the young population about sexual health and family planning are key factors that driving the U.S. market growth. Moreover, government programs have led to an increase in access to contraceptives that help prevent unwanted pregnancies in teenagers.

Gather more insights about the market drivers, restrains and growth of the U.S. Contraceptive Market

Development, approval, and commercialization of new, more effective, and long-acting reversible contraceptive methods are expected to drive the industry scale during the forecast period. For instance, Agile Therapeutics developed a hormonal patch, Twirla, which was introduced in the U.S. in the fourth quarter of 2020. The launch of generic and low-cost drugs and devices has led to an increase in the demand for contraceptives by teenagers as well. Furthermore, the demand for nonhormonal contraceptives in the U.S. is increasing since they eliminate the risk of adverse effects associated with hormonal imbalance in the body.

Improving access to Family Planning and Reproductive Health (FP/RH) services can have a positive impact on the economy as the number of unintended pregnancies and maternal deaths would be limited. The U.S. government supports global FP/RH efforts which is one of the largest distributors and purchasers of contraceptives.

In 29 U.S. states, insurers are required to provide a full range of coverage for FDA-approved contraceptive methods for women. In 12 states, over-the-counter contraceptives are covered; however, insurers may require a prescription from the beneficiary. In 20 states and the District of Columbia, insurers are required to cover an extended supply of contraceptives at one time.

Browse through Grand View Research's Healthcare Industry Related Reports

- Telehealth Market - The global telehealth market size was valued at USD 62.4 billion in 2021 and is projected to expand at a CAGR of 36.5% from 2022 to 2028. The rising penetration of internet networks and innovation in the smartphone space to enhance global connectivity has enabled addressing gaps in care delivery and availing telehealth services more conveniently.

- Subdermal Contraceptive Implants Market - The global subdermal contraceptive implants market size was estimated at USD 744.9 million in 2018. An increase in use of modern contraceptive methods, rising awareness about sexual health and family planning, and increase in government initiatives are likely to drive the market during the forecast period.

Market Share Insights

July 2020: TherapeuticsMD, Inc. entered into an agreement with Nurx—an online company for women’s health-for increasing its access to Annovera.

February 2020: Afaxys, Inc. and TherapeuticsMD, Inc. signed an agreement to increase access to Annovera in the U.S. public healthcare system.

Key Companies profiled:

Some prominent players in the U.S. Contraceptive market include

- Church & Dwight Co., Inc.

- Reckitt Benckiser Group Plc

- Veru, Inc.

- Organon Group Of Companies

- Pfizer, Inc.

- Teva Pharmaceutical Industries Ltd.

- The Cooper Companies, Inc.

- Mayer Laboratories, Inc.

- Agile Therapeutics

- TherapeuticsmMD, Inc.

- Bayer Ag

- Afaxys, Inc.

- Mithra Pharmaceuticals

- Abbvie

Order a free sample PDF of the U.S. Contraceptive Market Intelligence Study, published by Grand View Research.

No comments:

Post a Comment