Metalworking Fluids Industry Overview

The global metalworking fluids market size was estimated at USD 11.23 billion in 2019 and is anticipated to witness a revenue-based CAGR of 4.4% over the forecast period.

Growing exploration and production activities of oil and gas, especially in the Asia Pacific, followed by North America are anticipated to drive the demand. Metalworking Fluids (MWF) are a range of oils and lubricants used for the smooth functioning of metal pieces in machinery during various industrial operations. These fluids also help extend tool life and improving its performance. Crude oil and base oil are the primary raw materials for the production of MWFs. The raw materials are heated, extracted, and refined for producing different fluids such as motor oils, lubricants, and petrol.

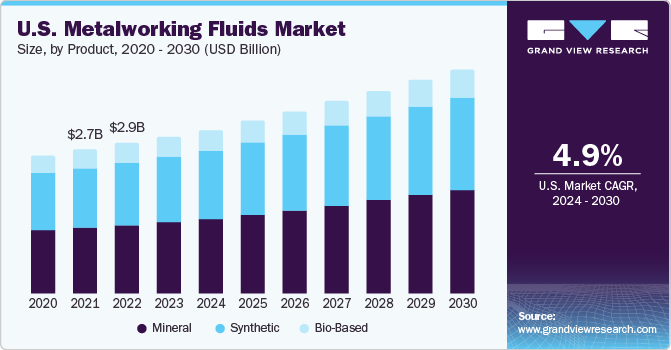

The U.S. metalworking fluids demand witnessed severe fluctuations, until 2014, owing to the economic downturn of 2008 and subsequent recovery. The market is expected to witness moderate growth over the forecast period on account of consolidation in the metal fabrication industry coupled with competition from international markets. Modest growth in the construction and automotive sectors is expected to hamper the MWF industry over the forecast period.

Gather more insights about the market drivers, restraints, and growth of the Global Metalworking Fluids Market

The demand from the U.S. is projected to be driven by the rising consumption of neat cutting oil, which is majorly used for aluminum products. The manufacturing sector in the U.S. is witnessing a shift from steel machinery to aluminum products, due to its easy molding and lightweight properties. The rising usage of aluminum is thus anticipated to generate lucrative opportunities for the consumption of neat cutting oil. This segment is expected to witness a CAGR of 2.7% from 2020 to 2027.

The growth of the heavy machinery industry in the developing economies of Asia Pacific and Central and South America is anticipated to drive the market for metalworking fluids. This industry includes construction equipment, cement, textile, metallurgical and mining machinery, oil field equipment, and material handling equipment. These machines have a high demand for synthetic and semi-synthetic-based fluids which offer better machining performance, corrosion resistance, and increased tool life. The growth in the heavy machinery industry is thus predicted to increase the penetration of semi-synthetic- and synthetic-based MWF over the forecast period.

Emerging markets of China, India, and Brazil are projected to witness huge investments in different sectors such as transportation, infrastructure, and power. These sectors, in turn, result in the demand for devices such as construction equipment parts, compressors, engines, and generators, further propelling the need for lubricants that enhance operational efficiency. The increasing competition among manufacturers also drives the demand for metalworking fluids as they offer efficiency.

However, the penetration of plastic components in the automobile industry has increased considerably over the past few years owing to their lightweight, robust performance, high resistance to corrosion, and durability and efficiency. Plastic components have largely replaced metal parts in various sectors, hindering the market growth. Also, plastics offer durability, improve navigation ability, improve fuel economy, and help in extending the flight range. This has driven plastic use in military and defense aircraft and carriers, which is expected to have a negative impact on the global demand for MWF.

Browse through Grand View Research's Petrochemicals Industry Research Reports.

Lubricants Market - The global lubricants market size was valued at USD 125.81 billion in 2020 and is expected to grow at a compound annual growth rate (CAGR) of 3.7% from 2021 to 2028. The industry dynamics are changing, in terms of raw material, owing to the rising demand for bio-based lubricants.

Noble Gas Market - The global noble gas market size was valued at USD 2.47 billion in 2021 and is projected to expand at a compound annual growth rate (CAGR) of 5.6% from 2022 to 2030. Increasing application areas for noble gases in the healthcare and industrial sectors and supportive government policies are expected to boost the market growth.

Market Share Insights

June 2017 - ExxonMobil said it is transforming its business structure to be organised along three lines effective April 1 - ExxonMobil Upstream Company, ExxonMobil Product Solutions and ExxonMobil Low Carbon solutions. ExxonMobil said it is on track to save more than USD 6 billion in structural costs by 2023 by combining chemical and downstream business and centralising technology and engineering services.

Feb 2022 - Chevron U.S.A. Inc., a subsidiary of Chevron Corporation (NYSE: CVX), and Bunge North America, Inc., a subsidiary of Bunge Limited (NYSE: BG), today announced the signing of definitive transaction agreements to create their previously announced joint venture. The new venture will create renewable feedstocks leveraging Bunge’s expertise in oilseed processing and farmer relationships and Chevron’s expertise in fuels manufacturing and marketing.

Key Companies profiled:

Some prominent players in the global Metalworking Fluids market include

- British Petroleum plc

- Exxon Mobil Corporation

- Chevron Corporation

- Total SA

- PratapTex-Chem Pvt. Ltd.

- Texxol Global

- Swisslube AG

Order a free sample PDF of the Metalworking Fluids Market Intelligence Study, published by Grand View Research.

No comments:

Post a Comment