Third-party Logistics Industry Overview

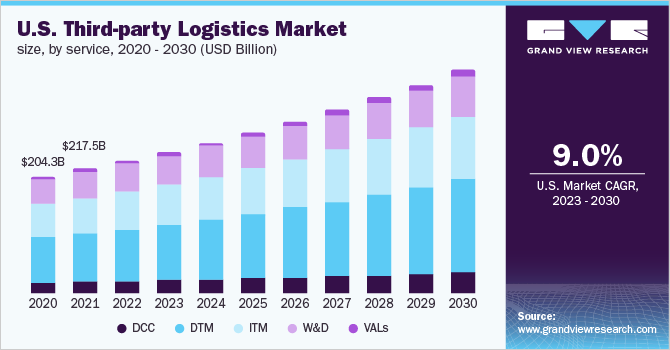

The global third-party logistics market size was valued at USD 956.80 billion in 2021 and is expected to expand at a compound annual growth rate (CAGR) of 8.6% from 2022 to 2030.

The development of logistics infrastructure in the Asia and Middle East regions, the rapid growth of the e-commerce sector, and the development of new technologies are expected to significantly contribute to the market growth. Shippers are focusing on outsourcing the logistics activity to enhance their operations and cost-effectiveness. The increased working capital and globalization lead to the demand for efficient inventory management services. Moreover, the restructuring of the brick-and-mortar business model continues to provide dynamic growth to the industry.

Gather more insights about the market drivers, restrains and growth of the Global Third-party Logistics Market

The changing global supply chain to become more customer-centric enables the companies to outsource their supply chain activities to focus on adaptability and responsiveness. Moreover, the volatile international documentation procedure and customs rules & regulations need the expertise to handle the complex supply chain activity. As a result, small- and medium-sized businesses are also leveraging 3PL services.The rise of e-commerce and digital phenomenon also called “The Amazon Effect”, has changed consumer expectations and buying behavior. End-users are seeking unparalleled expectations, in terms of convenience, cost, control, and choice.

Omni-channel operation demands reliable, fast, and free shipping services, which has resulted in companies adopting a new business model to provide low-cost and on-demand delivery services. 3PL companies embrace various modifications in supply chain management to address the notable transformations and challenges that e-commerce presents. The 3PL companies are shifting their focus from long-haul delivery to just-in-time delivery. The suppliers are also transitioning from multiple storage facilities to a single warehouse location. To accommodate an increase in last-mile delivery, companies invest in smaller trucks and vans, which can support shorter and more frequent deliveries.

In the coming years, last-mile delivery is presumed to be one of the key areas of focus for logistics companies. Fourth-Party Logistics (4PL) is the step ahead that can manage resources, infrastructure, technology, and even external 3PL to provide a holistic supply chain solution. The 4PL companies offer comprehensive consulting services in addition to logistics operations. The service includes logistics strategy, inbound and outbound logistics, inventory planning and management, business planning, and analytics. Deloitte, Accenture Plc, BDP International, and DB Schenker Logistics are some of the companies that are offering 4PL services. 4PL is a relatively new concept, but it is expected to gain momentum in the coming years as medium- and large-scale businesses are seeking a complete logistics solution.

Browse through Grand View Research's Automotive & Transportation Industry Related Reports

- Biopharmaceutical Third Party Logistics Market - The global biopharmaceutical third party logistics market size was estimated at USD 94.4 billion in 2020 and is expected to expand at a compound annual growth rate (CAGR) of 5.6% from 2021 to 2028. The rising trend of outsourcing logistics, the focus of pharmaceutical players on their distribution network owing to its strong sales numbers, and the rise in the number of biosimilar launches are some of the key factors driving the market.

- Transportation Management Systems Market - The global transportation management systems market size was valued at USD 9.22 billion in 2021 and is expected to expand at a compound annual growth rate (CAGR) of 14.6% from 2022 to 2030. The unabated growth of the retail and e-commerce industries.

Market Share Insights

November 2019: Universal Logistics Holdings, Inc. announced the acquisition of Roadrunner Intermodal Services, LLC stretching its logistics capabilities across North America.

August 2019: DSV acquired PanalpinaWelttransport Holding AG, a Switzerland-based logistics group. The company is leveraging Panalpina’s proficiency in the freight forwarding and brokerage service and giving fierce competition to the leading logistics companies.

Key Companies profiled:

Some prominent players in the global Third-party Logistics market include

- BDP International

- Burris Logistics

- H. Robinson Worldwide, Inc.

- Deutsche Post AG (DHL Group)

- CEVA Logistics

- DSV

- DB Schenker Logistics

- FedEx

- B. Hunt Transport, Inc.

- Kuehne + Nagel

- Nippon Express

- United Parcel Service of America, Inc.

- XPO Logistics, Inc.

- Yusen Logistics Co. Ltd.

Order a free sample PDF of the Third-party Logistics Market Intelligence Study, published by Grand View Research.

No comments:

Post a Comment