Material Handling Equipment Industry Overview

The global material handling equipment market size was valued at USD 26.3 billion in 2020 and is expected to expand at a compound annual growth rate (CAGR) of 7.4% from 2021 to 2028.

Over 50.0% of factory owners estimate that new projects will either be delayed or put on hold because of the coronavirus pandemic. In comparison, close to 30.0% of owners expect to adjust the sales revenue with the ongoing projects. The mentioned statistics do not bode well for the growth of the market unless OEMs aim to transform digitally. Investments in power and battery technology are expected to create avenues for market growth.

Gather more insights about the market drivers, restrains and growth of the Global Material Handling Equipment Market

Apart from the uncertainties created by the coronavirus pandemic, favorable government initiatives support new infrastructure development worldwide, creating growth opportunities in the market for material handling equipment over the forecast period. Economies such as India, China, and Southeast Asia are attracting foreign investments promoting infrastructure and industrial development, subsequently creating avenues for growth. The development of public infrastructure includes airports, rail networks, seaports and power plants, and others. All these activities may favor the adoption of material handling equipment over the forecast period.

Although the demand in industrial applications witnessed a minor setback in 2020, unprecedented growth in the e-commerce sector helped upkeep market growth through the pandemic. Healthy demand for delivery and distribution of grocery items amidst the lockdown came as a respite for market growth. In addition to the OEMs, the pandemic has driven several supply chain firms to explore tools that aid in making informed decisions with AI implementation to analyze large amounts of data they generate periodically. A combination of data-driven insights and hindsight will help build a resilient supply chain supported by advances in equipment technology.

The development of the One Belt One Route (OBOR) initiative by China, also known as the Belt and Road Initiative (BRI), is also expected to be lucrative for the materials handling equipment industry. The initiative to connect a network of rail and road routes from China to Europe via the Middle East will provide growth opportunities. Similar other initiatives will bode well for the material handling equipment industry over the next few years.

The 2021 Automation Solutions Survey Study stated that the COVID-19 pandemic triggered the demand for a fully automated solution in the manufacturing sector, with companies increasing investments in automated solutions over the next few years. Further, companies project to upgrade their conveyor and sortation system in the next two years. However, due to the pandemic, several medium-sized businesses have altered plans to purchase or modernize new equipment.

Browse through Grand View Research's Advanced Interior Materials Industry Related Reports

- Automated Guided Vehicle Market - The global automated guided vehicle market size was valued at USD 3.81 billion in 2021 and is expected to expand at a compound annual growth rate (CAGR) of 10.2% from 2022 to 2030. Automated guided vehicle (AGV) systems assist to move and transport items in manufacturing facilities, warehouses, and distribution centers without any permanent conveying system or manual intervention.

- Material Handling Equipment Telematics Market - The global material handling equipment telematics market size was valued at USD 3.18 billion in 2017. It is expected to expand at a CAGR of 11.7% during the forecast period. The industry has witnessed significant developments in the past few years.

Material Handling Equipment Market Segmentation

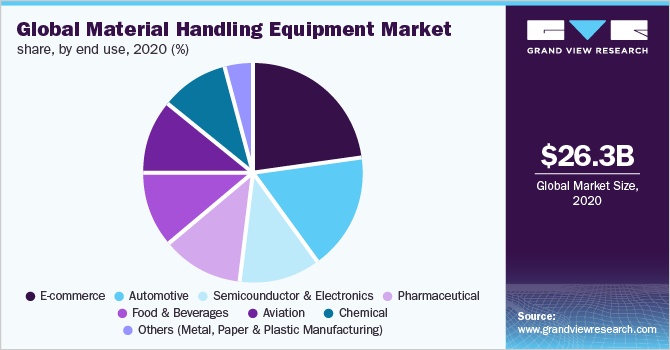

Grand View Research has segmented the global material handling equipment market based on product, end use, and region:

- Material Handling Equipment Product Outlook (Revenue, USD Billion, 2017 - 2028)

- Storage and Handling Equipment

- Automated Storage and Retrieval System

- Industrial Trucks

- Bulk Material Handling Equipment

- Others

- Material Handling Equipment End use Outlook (Revenue, USD Billion, 2017 - 2028)

- Automotive

- Food & Beverages

- Chemical

- Semiconductor & Electronics

- E-commerce

- Aviation

- Pharmaceutical

- Others

- Material Handling Equipment Regional Outlook (Revenue, USD Million, 2017 - 2030)

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

Market Share Insights

- April 2021: Toyota Material Handling, one of the subsidiaries of Toyota Industries Corporation, launched Mole and Mouse Automated Guided Carts (AGCs). The product is expected to allow customers to automate repetitive operational tasks suitable for assembly lines, distribution centers, warehouses, and manufacturing plants.

- July 2020: Vanderlande Industries B.V, one of the logistics process automation providers, introduced HOMEPICK, a goods-to-person (GtP) picking solution. The product complements its automated storage and retrieval system (AS/RS) and facilitates online grocery orders.

Key Companies profiled:

Some prominent players in the global Material Handling Equipment market include

- BEUMER Group

- Daifuku Co., Ltd.

- Honeywell International Inc.

- Kion Group AG

- Mecalux, S.A

- Murata Machinery Ltd.

- SSI Schaefer AG

- Swisslog Holding AG

- Toyota Material Handling Group

- Vanderlande Industries B.V

Order a free sample PDF of the Material Handling Equipment Market Intelligence Study, published by Grand View Research.

No comments:

Post a Comment