Computer Numerical Control Machines Industry Overview

The global computer numerical control machines market size was valued at USD 56.40 billion in 2021 and is expected to expand a compound annual growth rate (CAGR) of 10.2% from 2022 to 2030.

The demand for computer numerical control (CNC) machines is estimated to reach over 2800 thousand units by 2030. The increasing demand for semiconductor production equipment, medical devices and Electric Vehicles (EV), and telecom communication devices is the primary factor expected to drive the market growth over the forecast period. Also, the growing demand for five-axis mill machines and ultra-precision machines required to address the needs for EV productions are anticipated to drive the growth.

Gather more insights about the market drivers, restrains and growth of the Global Computer Numerical Control Machines Market

The CNC machine market recovered well in 2021 due to increased machine orders across the industries, notably from Europe, Asia Pacific, and North America. In 2021, the market recorded positive growth owing to the pent-up demand and backlog orders resulting from the pandemic. This trend will continue over the short term to meet backlogs from 2020. However, the worldwide shortage of semiconductors and rising steel prices & logistics costs are expected to hinder the sales revenues of OEMs, a trend that is expected to continue till 2023.

Automated CNC systems integrated with industrial robots featuring simulation software to increase production is expected to favor the growth of the Computer Numerical Control (CNC) machines market over the forecast period. One of the primary reasons for adopting automated CNC machines is to address the lack of skilled laborers challenges that most industries are currently facing. This enables manufacturing industries to increase their efficiency and maximize the production output. To address this demand, incumbents in this space, such as Fanuc Corporation and OKAMA America Corporation, emphasize integrating new technologies with the existing product portfolio.

For instance, in March 2021, Fanuc America Corporation, a subsidiary of Fanuc Corporation, upgraded its CNC product portfolio by integrating the Quick and Simple Startup of Robotization (QSSR) G-code feature with ss. The company provides enhanced CNC machines that machine operators and tool builders to program the robots more efficiently through this integration. Similarly, in August 2021, Made4CNC ApS, one of the CNC manufacturers based in Denmark, launched a new Safedoor SD100, an automated door opener for CNC machines. The product integrates easily with collaborative robots and offers greater convenience for tending machine operations.

Rising raw material prices and a looming shortage of semiconductors used in CNC machines are expected to pose challenges for the market. In such market conditions, the demand for used CNC machines is expected to increase, hampering the market growth of new CNC machines. The trend is likely to continue over the forecast period. In the long term, the average unit prices of CNC machines are expected to increase with fluctuations in raw material prices.

Browse through Grand View Research's Advanced Interior Materials Related Reports

- Milling Machine Market - The global milling machine market size was valued at USD 63,156.5 million in 2018 and is expected to register a CAGR of 7.0% from 2019 to 2025. Milling machines are some of the most important machines used in metal cutting applications across several industries.

- Welding Equipment Market - The global welding equipment market size was valued at USD 11.53 billion in 2018 and is expected to register a CAGR of 6.9% from 2019 to 2025. The market has witnessed considerable growth over the past years owing to the growing demand for welding equipment across applications such as shipbuilding, offshore exploration, oil & gas, aerospace, automotive, construction, and energy.

Computer Numerical Control Machines Market Segmentation

Grand View Research has segmented the global computer numerical control machines market based on type, end-use, and region:

- CNC Machines Type Outlook (Volume, Thousand Units; Revenue, USD Billion, 2018 - 2030)

- Lathe Machines

- Milling Machines

- Laser Machines

- Grinding Machines

- Welding Machines

- Winding Machines

- Others

- CNC Machines End-use Outlook (Revenue, USD Billion, 2018 - 2030)

- Automotive

- Aerospace & Defense

- Construction Equipment

- Power & Energy

- Industrial

- Others

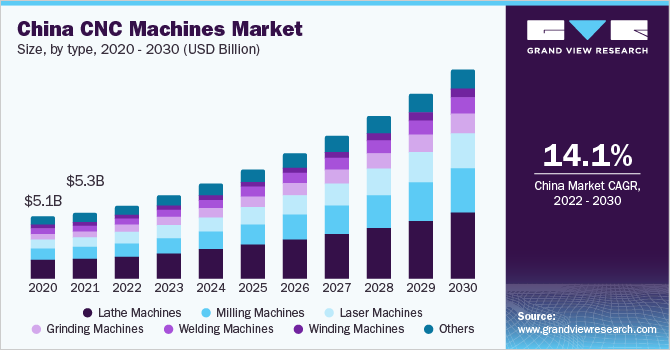

- CNC Machines Regional Outlook (Revenue, USD Million, 2017 - 2030)

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

Market Share Insights

August 2021: Made4CNC ApS, one of the CNC manufacturers based in Denmark, launched a new Safedoor SD100, an automated door opener for CNC machines. The product integrates easily with collaborative robots and offers greater convenience for tending machine operations.

February 2021: Citizen Machinery Co., Ltd launched Cincom L32 XII, a Sliding Headstock Type Automatic CNC Lathe machine that features an automatic tool changer. The features enable to perform complex shapes machining such as implants used in medical treatment and perform multiple functions simultaneously.

Key Companies profiled:

Some prominent players in the global Computer Numerical Control Machines market include

- Amada Co., Ltd.

- Amera Seiki

- Fanuc Corporation

- Datron AG

- DMG Mori

- Dalian Machine Tool Group (DMTG) Corporation

- Haas Automation, Inc.

- Okuma Corporation

- Shenyang Machine Tool Co., Ltd. (SMTCL)

- Hurco Companies, Inc.

- Yamazaki Mazak Corporation

Order a free sample PDF of the Computer Numerical Control Machines Market Intelligence Study, published by Grand View Research.

No comments:

Post a Comment